Key takeways

- Due to its potential to automate repetitive tasks and provide an interactive service, RPA has enabled banks to streamline operations, enhance efficiency, minimize errors, and enhance customer experiences.

- With RPA and other automation technologies, banking and finance institutions can expand their reach to the remotest customers and offer them the most needed banking products and services.

- Well by leveraging RPA, banks, and financial institutions can enhance productivity, streamline operations and deliver better services to their customers.

- Banks and financial institutions that embrace RPA and leverage its evolving capabilities will gain a competitive edge in the industry.

The Banking industry is one popular among the other sectors which have entirely changed due to technological innovations. Waiting for hours and queuing at banks is a matter of the past, these days, consumers are enjoying several facilities at the doorstep of the banks and at their own locations.

Owing to many advantages, Robotics and Artificial Intelligence in banking have gained significant traction. Due to its potential to automate repetitive tasks and provide an interactive service, RPA has enabled banks to streamline operations, enhance efficiency, minimize errors, and enhance customer experiences.

According to Gartner’s report, about 80% of financial institutions are planning to implement RPA in their processes. ‘(Source: Gartner.ca)

With RPA and other automation technologies, banking and finance institutions can expand their reach to the remotest customers and offer them the most needed banking products and services.

In a highly regulated financial environment, more advanced bank processes and less repetitive tasks will be seen in the near future.

Challenges in the Banking sector

Due to increasing consumer demands, the banking industry is facing high-profile challenges and difficulties. Most executives believe that banks do not have the essential data science, machine learning, and AI skills to process automation in the industry.

According to the Deloitte Global RPA Survey, RPA implementation in banking involves working alongside a third-party vendor due to a lack of in-house specialist skills. (Source: www2.Deloitte.com)

- The low-interest rates in recent years have also affected the profitability of banks. This has been a challenge for the banking industry that has led to many banks cutting back on their lending activities in order to save capital.

- The integration of new technologies in the industry in the banking sector has brought competition for traditional banks. This is known as technology disruption that has made traditional institutions lose markers compared to the new competitors.

- Subject to increasing regulations, the banking industry is experiencing higher compliance costs. Such regulations were designed to stabilize the banking processes, however, this has increased the overall costs of doing business.

What is RPA?

Robotic Process Automation is a technological salvation for the banking sector and it has proved to significantly increase the productivity and efficiency of industries. Now RPA is evolving into intelligent automation by incorporating technologies like Machine Learning, Artificial Intelligence, and Natural Language Processing.

The technology holds its potential to perform more complex tasks, handle unstructured data, make decisions, and even engage in human-like conversations. Such capabilities of RPA systems allow them to handle a greater range of banking processes.

Importance of RPA in the Financial Sector

The global Robotic Process Automation is expected to reach $13.74 billion by the end of 2024. (Source: Gitnux.com) Well by leveraging RPA, banks, and financial institutions can enhance productivity, streamline operations and deliver better services to their customers. In terms of cost reduction, accuracy, scalability, data analytics, and functionality, RPA holds a big part in the financial sector.

Data Analytics and Insights

RPA can be leveraged to process good amounts of data from different sources. Integrating RPA with data analytics tools can help financial institutions gain valuable insights into customer behavior, identify trends and make data-driven decisions. Analytics can further help organizations in fraud detection, risk assessment, customer segmentation, and personalized marketing.

Better Customer Experience

RPA implementation in financial institutions can enhance the overall customer experience in banking. The technology can handle customer complaints, provide real-time support and assist in account management tasks. In fact, intelligent automation can enable the industry to offer customized services with quick response times along with 24/7 availability.

Blockchain Integration

Intelligent automation can be integrated into the financial sector to automate different processes such as transaction verification, smart contract execution, and reconciliation. This further enhances transparency and efficiency in banking operations.

Enhanced accuracy and compliance

Following predefined rules and performing tasks consistently, RPA ensures greater accuracy in financial processes with minimized risk of human errors. By automating compliance checks, data validation, and reporting, the technology helps the industry adhere to regulatory requirements and minimizes the risk of non-compliance.

RPA Use Cases in BFSI

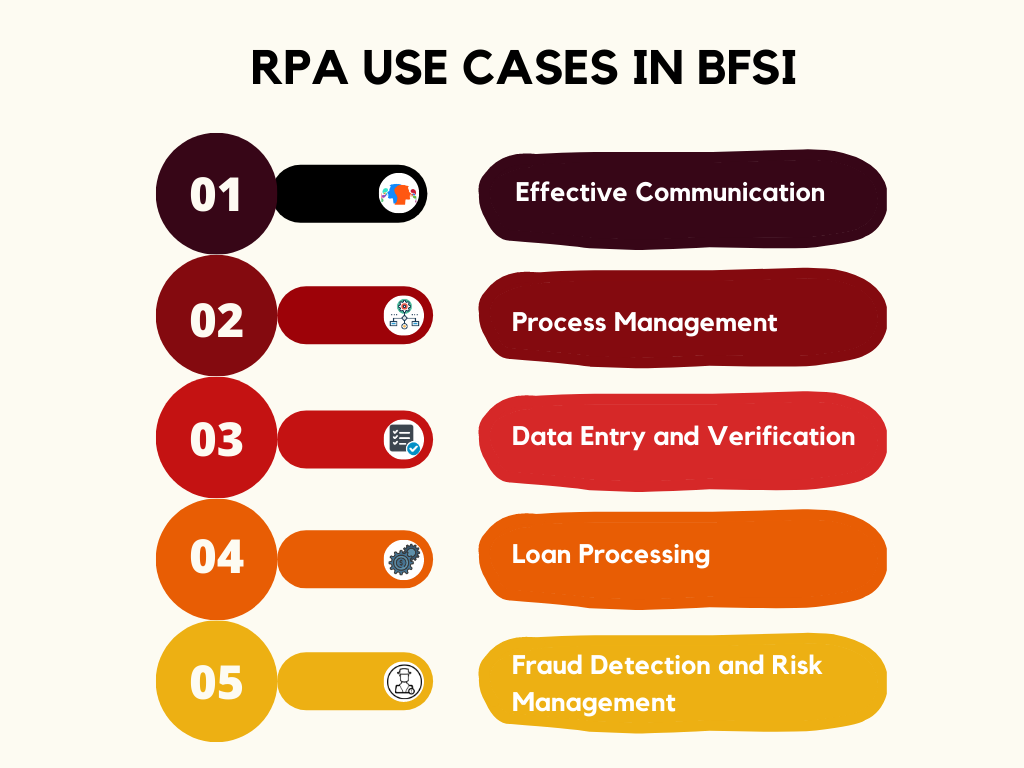

Communication

RPA integration in the sector can automate common tasks like service activation, troubleshooting, and bill inquiries. Not only bots can enhance customer service but also address customers’ queries, perform system checks and escalate complex issues to human agents. As a consequence, organizations can experience quicker response times, better customer satisfaction, and minimized overall costs.

Process Management

Inventory management, order processing, and tracking are some of the essential chain processes that can be streamlined with RPA. The technology can extract data from different systems, generate purchase orders, update inventory levels, and track orders.

Data Entry and Verification

RPA implementation can be used to automate different entry tasks including transaction details, customer basic information, and account balances for multiple systems. Also, the technology validates data for accuracy and precision, thereby reducing errors.

Loan Processing

Processing loan payments is a tedious task for employees, however, RPA can streamline the process. The accurate integration can automate the collection and verification of customer data, credit checks, risk assessments, and document generation. Furthermore, the process also expedites loan approval and disbursal which enhances customer satisfaction.

Fraud Detection and Risk Management

RPA can assist organizations in fraud detection by analyzing their transactions in real time. The integration can apply predefined rules and algorithms to figure out fraudulent activities, and suspicious patterns, and trigger alerts for further investigation. The technology also helps with risk management by conducting risk assessments, generating reports, and monitoring compliance.

RPA Implementation Challenges in Banking

Customer Experience and Expectations

Before implementing RPA, banks need to standardize and streamline their processes. In many cases, existing processes are fragmented or vary across different departments or branches. Achieving process standardization can be time-consuming and require significant effort.

Process Complexity

Some common bank processes involve complex decision-making that is a hard task for RPA to automate. Handling such complex processes may require intelligent automation that covers artificial intelligence or human intervention.

Scalability and Flexibility

It is difficult to maintain and update RPA infrastructure, including monitoring performance, managing bot schedules, and handling exceptions. The industry requires that RPA implementation should be scalable to handle volumes of transactions and increase business requirements.

Data Security and Privacy

Implementation of RPA does not cover data security and compliance standards. To protect sensitive consumer data, the technology lacks additional security measures and controls.

Recent research by Flobotics reveals that around 40% of organizations won’t prefer switching to RPA because of a lack of clarity in the processes. (Source: Flobotics)

To overcome such challenges, organizations need to carefully plan the collaboration and optimization of RPA processes. In order to ensure successful RPA implementation in the industry, it is significant to address these challenges.

Key Considerations for Successful RPA Implementation in Banking

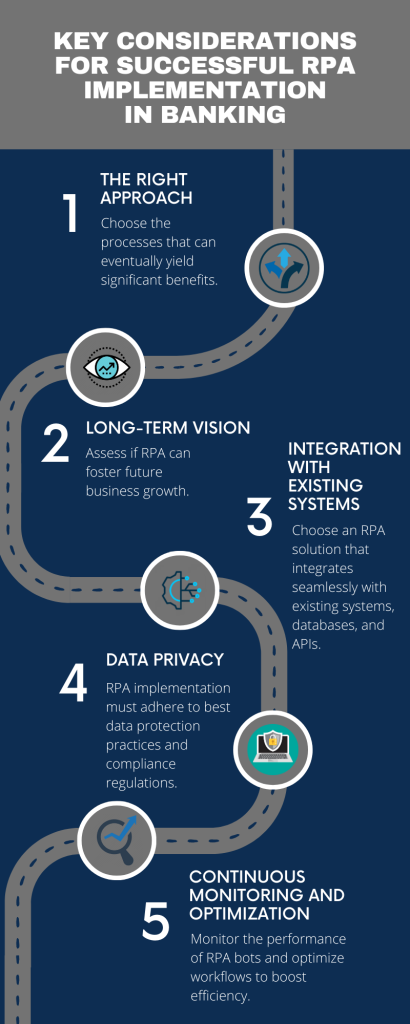

The Right Approach

It is essential to follow the right processes for automation. Taking into consideration the impact on cost reduction, efficiency improvement, and customer experience, choose the processes that can eventually yield significant benefits. In terms of system compatibility, data availability, and regulatory compliance, make sure to follow the ideal path well-suited for RPA.

Long-term Vision

Determine your long-term plans with RPA implementation and consider how it aligns with the organization’s overall strategy and goals. Also, consider the scalability of the RPA solution and find out whether it can manage increased volumes of transactions or accommodate future business growth.

Integration with Existing Systems

Assess the integration requirements of RPA and applications within the financial sector. Make sure to choose an RPA solution that can seamlessly interact with different systems, databases, and APIs.

Data Privacy

Security and Privacy of the information are critical considerations for banks and financial institutions that deal with sensitive information. Ensure that RPA implementation adheres to best data protection practices and compliance regulations.

Continuous Monitoring and Optimization

Monitor the performance of RPA bots and track key performance indicators such as efficiency, accuracy, and error rates. Also, optimize the RPA workflows as required to enhance efficiency and address any issues. Try to seek feedback from users and stakeholders for further optimization.

Future Outlook for the Banking Industry

The future of RPA in banking holds great potential for increased automation and enhanced customer experience. Banks and financial institutions that embrace RPA and leverage its evolving capabilities will gain a competitive edge in the industry.

RPA will continue to enhance its capabilities in document processing, such as extracting data from unstructured documents, performing advanced document classification, and automating document workflows. This will streamline document-centric processes like loan processing, compliance, and customer onboarding.

If combined with Artificial intelligence (AI), Machine learning (ML), and Natural Language Processing (NLP), the technology will enable RPA bots to handle complex tasks, make data-driven decisions, and interact with humans in a more natural and intelligent manner.

It is a good idea to take the expert advice of a professional for implementing RPA for your banking services. Auxiliobits has an experienced team of professionals who can help you select the best automation solutions for your bank. We facilitate seamless implementation of automation for your enterprise.

Call us Now to enhance your services with RPA!

July 19, 2024

July 19, 2024