Key takeways

- Robotic Process Automation (RPA) is revolutionizing the financial services industry by automating manual & repetitive tasks, streamlining processes, and enhancing efficiency. It overcomes challenges such as human errors, data silos, compliance issues, and inefficiencies in customer service.

- RPA works by utilizing software robots or "bots" to mimic human actions on computer systems, interacting with applications, systems, and user interfaces to perform tasks accurately and efficiently.

- The benefits of RPA in financial services include streamlined processes, improved accuracy, reduced errors, cost savings & a high return on investment.

- AI-powered RPA brings cognitive capabilities for intelligent automation, while blockchain-enabled RPA enhances security, transparency, and trust in financial processes. The fusion of AI, blockchain, and RPA opens up new possibilities for advanced applications and smart contracts.

Imagine a world where financial transactions are seamlessly executed with precision, compliance is effortless, and customer experiences are unparalleled. Is such an idealistic vision possible?

Enter Robotic Process Automation (RPA), the technological marvel that is revolutionizing the financial services industry. In this era of digital transformation, where manual tasks and bottlenecks have stifled progress for far too long, RPA emerges as the superhero, empowering financial institutions to break free from the chains of inefficiency.

Let’s explore the dynamic landscape of RPA and witness the transformation it brings to traditional financial methods. Brace yourself for a world where efficiency, productivity & customer satisfaction reign supreme in the field of financial services.

Traditional Methods Used In Finance

Manual Data Entry And Processing

Manual data entry has been a fundamental aspect of financial processes for decades. Employees manually input customer information, transaction details, and other relevant data into various systems and spreadsheets. But, this manual process is time-consuming, tedious & highly susceptible to errors. Human error rates tend to remain around 1% as a general guideline. However, a particular study conducted with laboratory tests reveals that “an error rate of nearly 4%, wherein more than 14% of these errors consisted of notable and potentially hazardous financial discrepancies.” (Source: ConnectPointz).

Complex Reconciliation Processes

Reconciliation is a crucial aspect of financial management, involving the comparison & verification of different sets of data to ensure accuracy and consistency. In traditional methods, reconciling financial records often requires extensive manual effort. This includes matching bank statements with internal transaction records, identifying discrepancies, and resolving them. According to a report by Deloitte, organizations spend a lot of late nights and restless hours per month on manual reconciliation processes. (Source: Delloite).

Paper-Based Documentation And Workflows

Traditionally, financial processes have relied heavily on paper-based documentation. From invoices and receipts to contracts and agreements, a significant amount of paperwork is involved. These physical documents need to be stored, organized, and retrieved when required. Managing paper-based workflows can be cumbersome, leading to delays, inefficiencies, and increased administrative costs. Research has shown that “the average office worker spends up to 40% of their time managing paper files/documents.” (Source: FormStack ).

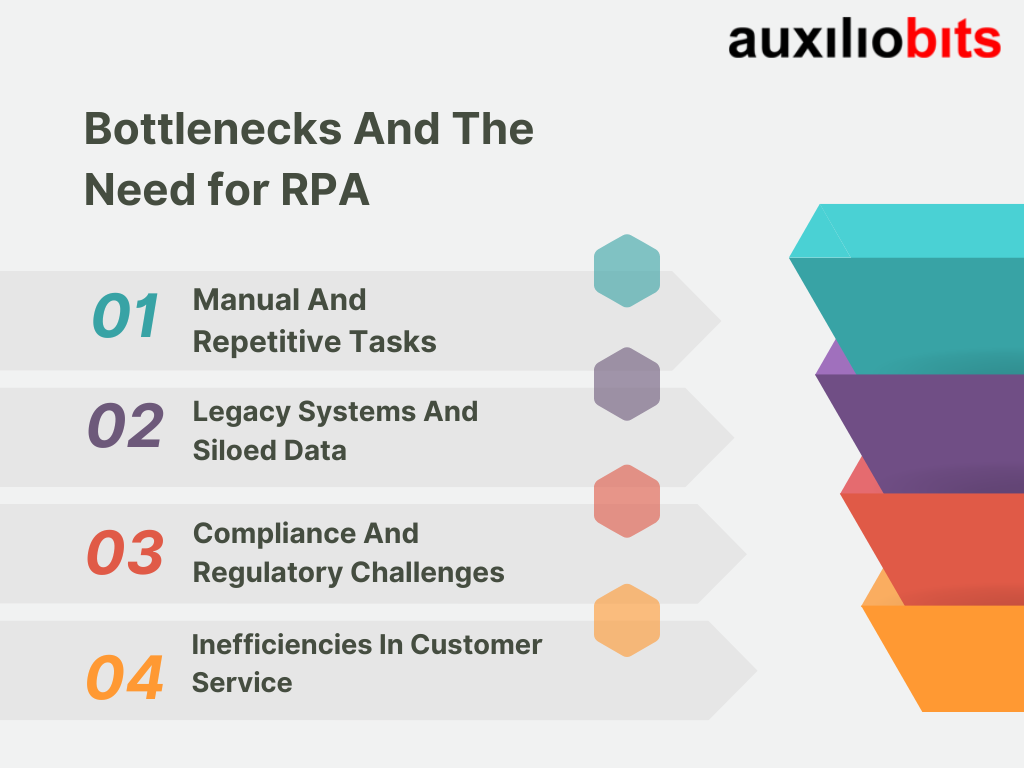

Bottlenecks And The Need for RPA

Manual And Repetitive Tasks

Financial institutions often find themselves burdened with a plethora of manual and repetitive tasks that consume valuable time and resources. According to the survey, “over 40% of workers dedicate a minimum of 25% of their workweek to performing manual & repetitive tasks.” (Source: SmartSheet). These tasks include data entry, document processing, report generation, and transaction processing.

Legacy Systems And Siloed Data

Legacy systems, with their rigid structures and limited interoperability, pose a major bottleneck in the financial services industry. These systems often lack the ability to seamlessly integrate with other applications, leading to data silos and fragmented information. According to a report by MuleSoft, “89% of IT leaders and financial institutions struggle with data silos.” (Source: MuleSoft ).

Compliance And Regulatory Challenges

Compliance with ever-evolving regulatory requirements is a constant challenge for financial institutions. Meeting compliance obligations involves extensive data gathering, verification, and reporting. Financial organizations have to navigate complex regulations, such as AML, KYC, and GDPR, which require stringent due diligence processes. Failure to comply can result in hefty fines & reputational damage.

Inefficiencies In Customer Service

Providing exceptional customer service is necessary for financial institutions to maintain a competitive edge. However, traditional methods often lead to inefficiencies and delays in customer service processes. Customers face long wait times, repetitive information requests & limited access to real-time information. A study by Deloitte indicated that “customers want real-time, personalized data. Still, fewer than a quarter (24%) of Leaders and 15% of Laggards are able to conduct real-time analysis on customers. “(Source: DelloiteDigital).

What Is RPA (Robotic Process Automation)?

In the field of financial services, Robotic Process Automation (RPA) has emerged as a groundbreaking technology that is transforming traditional methods. RPA is an innovative solution that utilizes software robots or “bots” to automate rule-based, repetitive tasks, mimicking human actions on computer systems. These bots interact with various applications, systems, and user interfaces, performing tasks with speed, accuracy, and efficiency.

How RPA Works?

RPA operates by replicating the actions of a human operator. It can navigate through different applications, extract and input data, perform calculations, generate reports, and even communicate with other bots or users. RPA bots are programmed to follow predefined rules and workflows, making them ideal for automating repetitive and standardized tasks in financial processes.

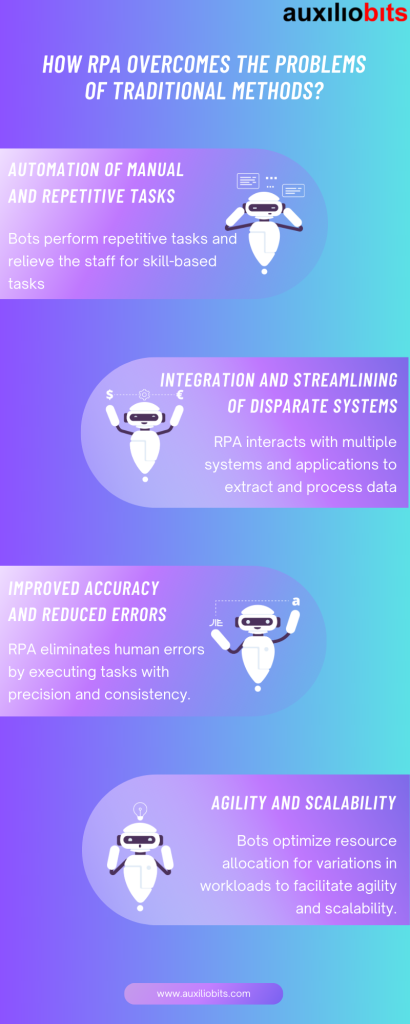

How RPA Overcomes The Problems Of Traditional Methods?

Automation Of Manual And Repetitive Tasks

One of the primary challenges of traditional methods was the reliance on manual data entry and repetitive tasks. RPA eliminates this burden by automating these tasks through software robots. A case study showcased that “organizations are able to reduce manual work by 90% in the bank reconciliation process with RPA solutions.” (Source: RPATech).

Integration And Streamlining Of Disparate Systems

Traditional methods often suffer from the limitations of legacy systems and data silos, hindering seamless integration and data flow. RPA bridges these gaps by interacting with multiple systems and applications, extracting and processing data, and performing cross-system validations. This integration capability of RPA allows for smooth and streamlined processes.

Improved Accuracy And Reduced Errors

Manual processes are prone to human errors, leading to financial discrepancies and compliance risks. RPA eliminates these errors by executing tasks with precision and consistency. A study by KPMG revealed that “implementing RPA can cut costs for financial services firms by up to 75%.” (Source: KMPG). By automating calculations, data entry, and reconciliation, RPA ensures data accuracy, mitigates compliance risks, and enhances financial reporting.

Agility And Scalability

Traditional methods often struggle with scalability and adapting to changing business needs. RPA offers agility by allowing organizations to rapidly scale their operations. Additional bots can be deployed to handle increased workloads, ensuring efficient resource allocation. A study has shown that “RPA in the banking sector reduces processing costs by 30 percent to 70 percent by reducing turnaround time.” (Source: Claysys).

Benefits Of RPA In Financial Services

Streamlining Processes And Enhancing Efficiency

RPA automates manual and repetitive tasks, eliminating the need for human intervention and reducing processing times. By streamlining processes, financial institutions can achieve significant efficiency gains. A case study revealed that “RPA implementation streamlines the time-consuming verification process in mortgage processing, retrieving information from various data sources, resulting in an 80% reduction in processing time.” (Source: Otakoyi).

Improving Accuracy And Reducing Errors

Manual processes are prone to human errors. Such errors can have severe consequences in financial services and impact the outcomes. RPA eliminates these errors by executing tasks with precision and consistency. A study conducted by Gartner says, “Robotic Process Automation can save finance departments 25,000 hours of avoidable work annually and reduce error rates.” (Source: Gartner). By automating data entry, reconciliation, and compliance checks, RPA ensures data accuracy, mitigates compliance risks, and enhances financial reporting.

Cost Savings And Return On Investment (ROI)

Implementing RPA in financial services can result in substantial cost savings. By automating manual tasks, organizations can reduce labor costs & minimize the risk of errors that can lead to financial losses. According to a report by McKinsey & Company, “by automating manual and repetitive tasks, successful operations centers are reducing costs by 30 to 60 percent while increasing delivery quality.” (Source: McKinsey).

The Role Of AI And Blockchain In RPA

AI-Powered RPA For Intelligent Automation

Artificial Intelligence (AI) brings cognitive capabilities to RPA, enabling intelligent automation in financial services. By integrating AI technologies such as machine learning, natural language processing & computer vision, RPA bots can analyze unstructured data, make data-driven decisions, and perform complex tasks. This combination of RPA and AI, often referred to as Intelligent Automation, enhances process efficiency, accuracy, and decision-making capabilities.

For example, AI-powered RPA bots can extract information from documents like invoices, contracts, and statements, intelligently interpret the data, and perform automated validations. As per the research, “with its ability to reduce loan-processing time by up to 80%, RPA is poised to transform the digital lending space.” (Source: BirlaSoft).

Blockchain-Enabled RPA For Enhanced Security And Transparency

Blockchain technology offers a decentralized and immutable ledger that enhances security, transparency, and trust in financial processes. By combining RPA with Blockchain, financial institutions can achieve secure and auditable transactions, streamlined reconciliation processes, and enhanced data integrity.

Blockchain-enabled RPA can be particularly beneficial in areas such as payments, Know Your Customer (KYC) processes, and supply chain finance. For instance, RPA bots integrated with Blockchain can automatically verify transactions, validate digital identities, and ensure compliance with regulatory requirements. A study found that “combining RPA with Blockchain can reduce the time needed to perform specific tasks by up to 90%.” (Source: HackerNoon).

Conclusion

The revolution of Robotic Process Automation (RPA) in the financial services industry is transforming the way operations are conducted, customer experiences are delivered, and risks are managed. The future of RPA in financial services is undeniably exciting. The fusion of AI, Blockchain, and RPA will pave the way for advanced applications, smart contracts, and the exploration of new possibilities. Financial institutions that embrace these technological advancements will gain a competitive edge, deliver exceptional services, and stay ahead in the rapidly evolving landscape of the industry.

Remember, the revolution is not merely about machines replacing humans; it’s about empowering humans to focus on tasks that require creativity, critical thinking & human touch. It’s about reshaping the way we work, delivering superior experiences, and driving the financial services industry forward.

Connect with the professional team at Auxiliobits for the best RPA tools for your business!