Key takeways

- The insurance industry faces several challenges that impact its operations, profitability, and customer satisfaction.

- Embracing innovative technologies like RPA allows insurers to improve customer experiences, enhance risk management, increase operational efficiency, and unlock new growth opportunities.

- Robotic Process Automation exists in two formats: Assisted RPA and Unassisted RPA.

- By leveraging the power of RPA, insurers can focus on strategic initiatives, innovation, and delivering value-added services to their policyholders.

- RPA trends indicate a future where insurance becomes more customer-centric, data-driven, and digitally enabled.

It all started with COVID-19 which did bring certain challenges around the globe, and in various sectors including insurance. There was a major upheaval in the ways of investing money and the decline of human activity. In fact, this was the period when technology like RPA redefined the ways of working in the Insurance Industry.

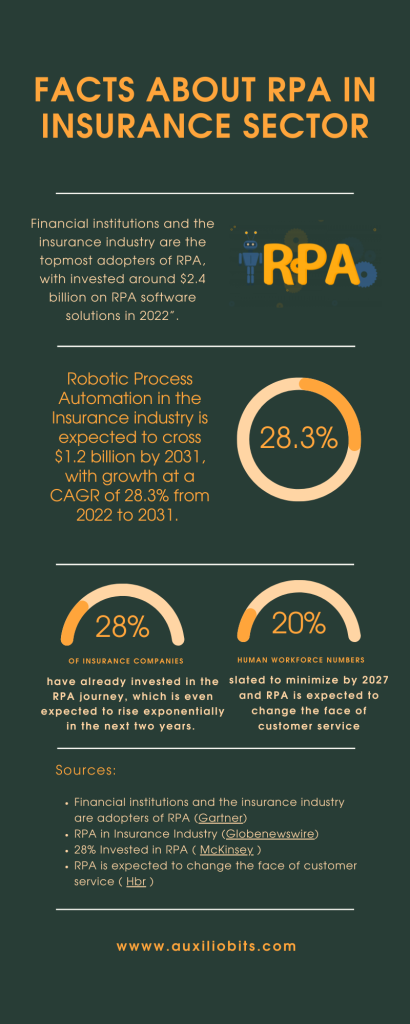

According to a recent report by Gartner, “Financial institutions and the insurance industry are the topmost adopters of RPA, with invested around $2.4 billion on RPA software solutions in 2022”.(Source: Gartner )

However, just like any other industry, insurance has always been tricky and challenging. The insurance industry faces several challenges that impact its operations, profitability, and customer satisfaction.

- Fraudulent claims and activities pose a significant challenge for the insurance industry that results in financial losses.

- Complying with regulatory frameworks, such as data protection laws, anti-money laundering regulations, and consumer protection guidelines, requires significant resources and expertise. Non-compliance can result in fines, penalties, and reputational harm.

- Insurance companies face cost pressures from various sources, including increasing healthcare costs, legal expenses, and natural disasters.

- Demographic changes, such as an aging population and evolving family structures, bring new challenges for insurance companies. It brings the need to adapt its product offerings to cater to changing customer needs, such as long-term care and retirement solutions.

Addressing these challenges requires insurance companies to embrace innovation, invest in technology like RPA, and adapt to changing market dynamics.

Innovation in Insurance Sector

Insurance is not an exception to the innovation and developments in technology. The advancements and possibilities for new ways of service provision can lead to better risk identification and mitigation measures. It is typically regarded as a positive development that delivers convenience and efficiency in the insurance systems.

According to a report by Allied Market Research, Robotic Process Automation in the Insurance industry is expected to cross $1.2 billion by 2031, with growth at a CAGR of 28.3% from 2022 to 2031. (Source: Globenewswire)

Insurance innovation is driven by a combination of technological advancements like RPA and the need to adapt to evolving risks. Embracing these innovations allows insurers to improve customer experiences, enhance risk management, increase operational efficiency, and unlock new growth opportunities. Robotic Process Automation (RPA) plays a significant role in driving innovation in various industries, including insurance.

RPA expedites the launch of innovative insurance products. This enables insurers to respond quickly to market demands, stay ahead of competitors, and capture new business opportunities.

After the pandemic, more and more companies are revealing their interest in the adoption of Robotic Process Automation with the objective to reduce overall costs, enhance efficiency and digital capabilities. Even in the process of decision-making, and launching any new product or service, insurance companies, and advisors prefer asking questions to AI platforms rather than approaching customers.

Is RPA reshaping the Insurance Industry?

Yes, Robotic Process Automation (RPA) is reshaping the insurance industry by transforming how insurance companies operate and deliver services. Here’s how RPA is making an impact:

Greater Client Satisfaction

RPA enables insurers to deliver faster and more accurate service to their customers. Automation of processes such as policy issuance, claims processing, and customer support can lead to quicker response times, improved accuracy, and reduced turnaround times. This, in turn, enhances the overall customer experience and satisfaction.

Fraud detection

The technology can monitor a customer’s spending patterns and bring forward the attempts of malpractices. For manual labor, it is impossible to analyze a large quantity of data within the deadline. RPA because of the automation process can not only detect errors but also gives the required results within the specified time.

Improved operational efficiency

RPA automates repetitive and rule-based tasks, such as data entry, form filling, and document processing, reducing the reliance on manual labor. By automating these tasks, insurers can significantly improve operational efficiency, reduce errors, and accelerate processing times. This allows employees to focus on more complex and value-added activities, enhancing overall productivity.

Data Privacy and Accuracy

RPA can integrate with advanced analytics tools, enabling insurers to gain valuable insights from large volumes of structured and unstructured data. By automating data extraction and analysis, insurers can generate real-time reports, identify trends, and make data-driven decisions. These insights can support risk assessment, fraud detection, and pricing optimization.

Increased accuracy and Compliance

RPA bots perform tasks with high precision and consistency and thus minimize errors and data discrepancies. This helps insurers maintain data accuracy and quality, ensuring compliance with regulatory requirements. RPA also provides an audit trail of activities, facilitating easier tracking and compliance reporting.

RPA can help insurers ensure compliance with industry regulations and guidelines. By automating processes, RPA bots can follow predefined rules and workflows, reducing the risk of non-compliance. Additionally, RPA can assist in data privacy and security by implementing access controls, encryption, and audit trails.

Cost savings

RPA can lead to substantial cost savings for insurance companies. By automating manual processes, insurers can reduce labor costs associated with repetitive tasks and minimize the need for additional staffing. Additionally, RPA can help eliminate errors and rework, reducing the costs associated with claims processing and underwriting.

Overall, RPA empowers insurance companies to streamline operations, reduce costs, enhance customer experiences, and achieve greater efficiency and compliance. By leveraging the power of RPA, insurers can focus on strategic initiatives, innovation, and delivering value-added services to their policyholders.

RPA use Cases in Insurance

According to McKinsey & Company, around 28% of insurance companies have already invested in the RPA journey, which is even expected to rise exponentially in the next two years. (Source: McKinsey)

Well, Robotic Process Automation exists in two formats: Assisted RPA and Unassisted RPA.

In the first kind, the process requires a level of human intervention to complete the process, whereas, in the fully automated kind, RPA handles the entire process end to end with no manual help required.

Both types have their own merits and demerits. Assisted RPA is considered more suitable for situations where human intervention is required. On the other side, Unassisted RPA provides a fully automated process, making it ideal for reducing the need for human involvement.

More commonly, insurance companies prefer a mix of both approaches based on the requirement of human expertise. The decision depends on the specific needs and objectives of the project.

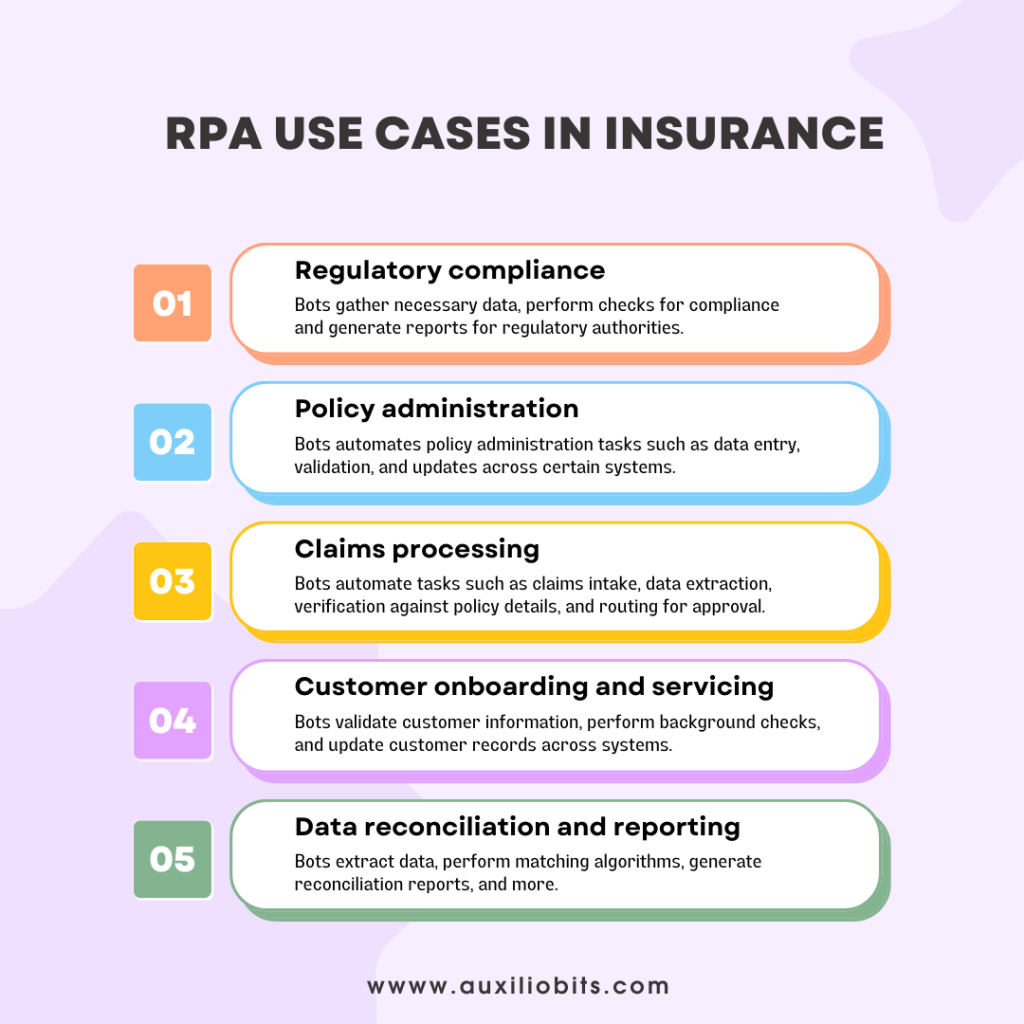

Regulatory compliance

The powerful technology can do wonders for insurance companies by helping them maintain compliance with regulations. This includes data validation, document management, report analysis, and regulatory reporting. In fact, bots can gather necessary data, perform checks for compliance adherence, and generate reports for regulatory authorities. Automation improves accuracy, reduces human errors, and ensures consistency in compliance processes.

Policy administration

RPA can automate policy administration tasks such as data entry, validation, and updates across certain systems. This includes capturing customer information, policy creation, issuing endorsements, and maintaining policy records. RPA improves accuracy, reduces processing time, and minimizes errors in policy administration.

Claims processing

RPA can streamline claims processing by automating tasks such as claims intake, data extraction from claim forms, verification against policy details, and routing for approval. RPA bots can gather relevant data from internal and external systems, perform calculations, and generate claim settlement letters. Automation in claims processing leads to faster turnaround times, improved accuracy, and enhanced customer satisfaction.

Finance and Accounting

The technology can automate certain processes in insurance including accounts payable, accounts receivable, premium collection, and even calculations. The bots can be used to extract data from invoices, reconcile payments, update financial records, and generate reports. Such kind of automation in investment processes can lead to enhanced precision, minimize processing time, and eventually improves financial visibility.

Customer onboarding and servicing

RPA can automate customer onboarding processes, including data entry, document verification, and Know Your Customer (KYC) checks. RPA bots can validate customer information, perform background checks, and update customer records across systems. In addition, RPA can assist with routine customer service inquiries, providing quick responses and resolving simple queries.

Data reconciliation and reporting

RPA can automate data reconciliation tasks by comparing data across different systems and identifying discrepancies. This includes reconciling premium payments, claims data, commission statements, and financial reports. RPA bots can extract data, perform matching algorithms, and generate reconciliation reports, reducing manual effort and improving accuracy.

These are just a few examples of how RPA can be applied in the insurance industry. The versatility of RPA allows insurers to automate a wide range of processes, resulting in improved operational efficiency, cost savings, and better customer experiences. RPA also makes a business agile and resilient so that it can adapt easily to the changing environment and customer demands.

Future of RPA in the Insurance Sector

According to Industry experts, powerful technology like RPA is expected to change the customer face of customer service which may answer customer queries, guide them across different processes, and is slated to minimize human workforce numbers by 20 percent in 2027. (Source: HBR )

The coming years will see more AI applications in many ways as never before. For instance, it will be automated technology managing more queries in the insurance industry. From fraud detection to document verification, RPA will help evaluate new investment opportunities, create investment portfolios, and minimize cybersecurity risks involved in adapting new technologies.

RPA trends indicate a future where insurance becomes more customer-centric, data-driven, and digitally enabled. Insurers that embrace and leverage the power of RPA will have the opportunity to stay competitive, create new revenue streams, and deliver enhanced value to policyholders.

Streamline the processes in your insurance workflow with the best RPA tools. Connect with the experts at Auxiliobits to help you select the best RPA software for your business. Our professional team has several years of experience in the automation sector. We help our clients implement cost-effective automation solutions tailored to the specific needs of their business.

Call us Now!