Key Takeaways

- Eligibility verification is essential across industries. It helps ensure people qualify for services or benefits and avoids delays, errors, or revenue loss caused by outdated manual or fragmented systems.

- Traditional verification processes are slow, error-prone, and expensive. They involve manual data handling, long waiting periods, and limited scalability, making them unsuitable for today’s high-demand digital environments.

- RPA automates structured, repetitive tasks like data entry, navigating systems, and submitting verification requests, reducing manual work while increasing speed, consistency, and efficiency in operational workflows.

- AI enhances verification by interpreting unstructured data, detecting inconsistencies, and learning from past outcomes using technologies like OCR, NLP, and machine learning. Thus, AI makes decisions more intelligent and more adaptive.

- When combined, RPA and AI deliver real-time, end-to-end automation, enabling instant insurance verification, reducing operational costs, minimizing errors, and vastly improving customer or patient experience across all service industries.

Your mother suddenly fell ill, and you rushed to a healthcare facility seeking urgent treatment. The doctor examined the patient and suggested suitable treatment. However, the treatment would be costly, which is why the first thought that arises is insurance. This moment, where eligibility must be confirmed, is not just a healthcare concern—it also happens in finance, government programs, and education. The process, often behind the scenes, makes a big difference in how quickly and effectively someone gets service. What if this verification could happen instantly? You could avoid waiting time and paperwork if this is possible due to artificial intelligence and robotic process automation. When combined, these technologies can automate eligibility checks without any further ado.

Let’s dive into what this looks like, why it matters, and how industries are already transforming using this powerful combination.

Also explore: How can you safely train your AI chat agent on domain-specific knowledge?

What Is Eligibility Verification, and Why Does It Matter?

At its core, eligibility verification determines whether an individual qualifies for a specific service, benefit, or program based on predefined criteria. This process is essential across many industries. In healthcare, for instance, it means verifying whether a patient’s insurance plan covers a particular procedure. Education might involve assessing whether a student qualifies for financial aid or a scholarship. In finance, eligibility checks determine whether a borrower meets the conditions for a loan or credit product.

Though often overlooked, eligibility verification is a foundational step in service delivery. Without it, organizations risk providing services to unqualified individuals, leading to lost revenue, compliance issues, or customer dissatisfaction.

The Traditional Approach: Why It Falls Short

Historically, eligibility checks have been handled through manual and fragmented methods. Staff must sift through forms, call insurance providers or financial institutions, send emails, and often wait hours—or even days—for responses. This slows down the process and introduces multiple points of failure.

Here are the core challenges of traditional eligibility verification:

It’s slow.

Manual processes take time. Verifying data from multiple systems or stakeholders can significantly delay service delivery, especially when using paper-based documents or outdated software.

It’s error-prone

Human errors are common in data entry, interpretation of policy terms, or transcription of information. These mistakes can result in wrongful denials, delayed reimbursements, or customer frustration.

It’s costly.

Dedicated staff are required to handle routine verifications. More people are needed as volumes increase, making the process expensive and operationally inefficient.

It doesn’t scale.

Manual processes can’t keep up with high volumes. A spike in patient visits, loan applications, or benefit claims overwhelms the system, causing backlogs and delays.

Why It Matters Today?

In the digital age, customers expect speed, accuracy, and transparency. Whether they’re patients seeking care, students applying for aid, or consumers buying insurance, no one wants to wait days for an answer that could—and should—be immediate.

Moreover, organizations are pressured to cut costs, improve user experience, and maintain compliance. Legacy verification methods simply can’t meet these modern demands.

That’s why eligibility verification—once an operational afterthought—is now a strategic priority. Automating and modernizing it with technologies like AI and RPA can transform it from a bottleneck into a competitive advantage.

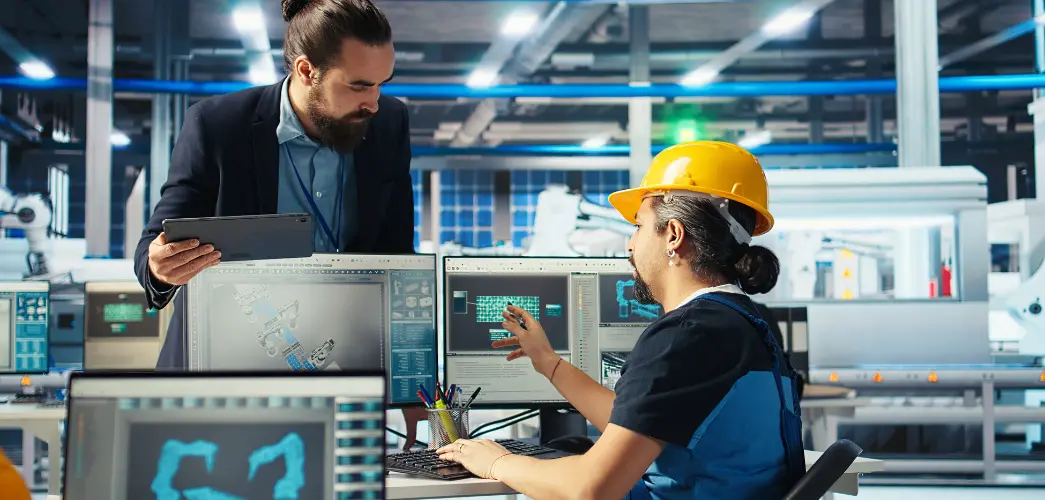

Enter RPA and AI: The Power Couple of Modern Automation

Regarding transforming outdated, manual processes like eligibility verification, two technologies have emerged as a powerful team: Robotic Process Automation (RPA) and Artificial Intelligence (AI). Each has its strengths, but when combined, they deliver automation solutions that are fast, accurate, intelligent, and adaptable.

What is RPA?

Robotic Process Automation (RPA) is a technology that uses software robots—or “bots”—to mimic human actions. These bots can log into applications, extract information, fill out forms, copy and paste data between systems, and even send emails. RPA excels at handling structured, repetitive, rule-based tasks, and it does so with incredible speed and consistency.

Imagine an RPA bot as a tireless digital assistant. It doesn’t get distracted or make typos. It can follow predefined instructions across multiple systems and perform high-volume tasks 24/7. For example, in eligibility verification, RPA bots can pull data from electronic health records (EHRs), enter that data into payer portals, download the response, and feed it back into internal systems—all without human intervention.

However, RPA has its limits. It’s designed to work with structured data, such as spreadsheets, databases, and web forms. When it encounters unstructured or ambiguous information, AI steps in.

What is AI?

Artificial Intelligence (AI) is the cognitive counterpart to RPA. While RPA automates doing, AI automates thinking and understanding. It uses advanced technologies like machine learning (ML), natural language processing (NLP), and computer vision to interpret complex or unstructured data.

In eligibility verification, AI can:

- Read and interpret scanned documents, PDFs, or images using optical character recognition (OCR).

- Understand the context of an insurance response using NLP, even in free-text format.

- Detect inconsistencies or anomalies in coverage details.

- Learn from past verification outcomes to improve decision-making over time.

Why They’re Better Together?

Individually, RPA and AI are powerful, but they’re transformative together. RPA does the heavy lifting of accessing, collecting, and transferring data across systems. AI complements this by interpreting that data, handling exceptions, and enabling decisions where logic alone isn’t enough.

This synergy allows organizations to fully automate complex processes end-to-end, making real-time eligibility verification possible, scalable, reliable, and innovative.

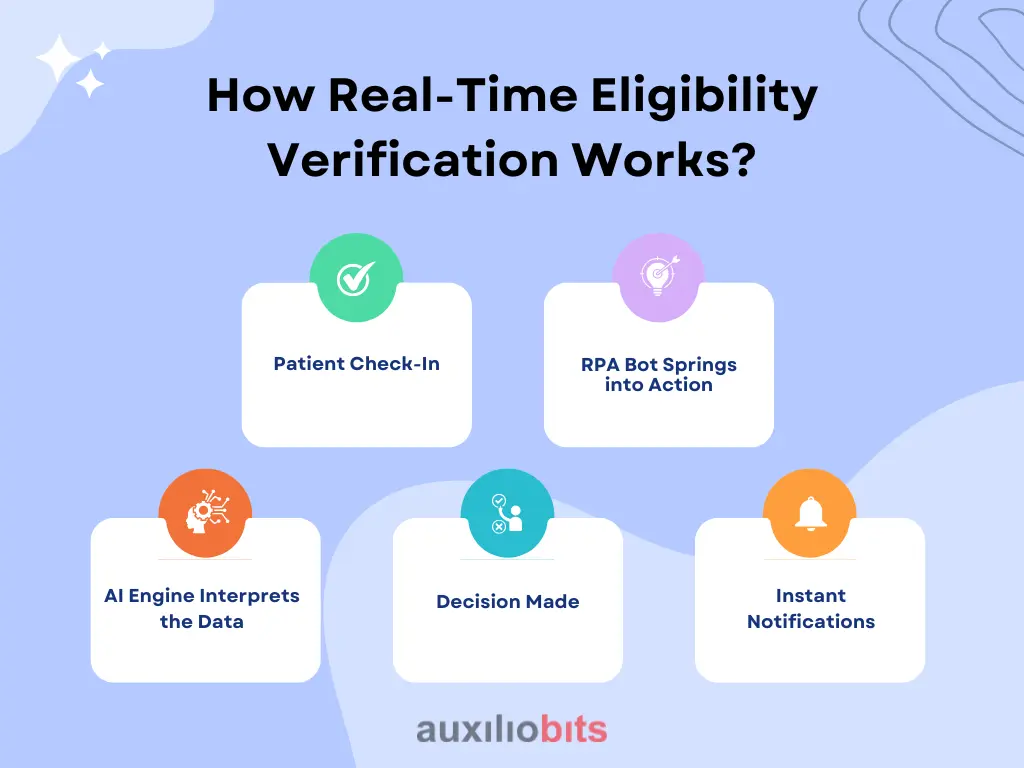

How Real-Time Eligibility Verification Works?

Real-time eligibility verification transforms what was once a tedious and error-prone task into a fast, seamless process. Powered by robotic process automation and artificial intelligence, this system enables healthcare providers to verify patient insurance coverage almost instantly, saving time, reducing costs, and improving patient experience.

Let’s walk through how this works in a typical healthcare setting:

1. Patient Check-In

The process begins at the front desk or via a patient self-service portal. A patient arrives for an appointment and provides key information, such as name, date of birth, insurance provider, and policy number. This data is entered into the provider’s electronic health record (EHR) or practice management system.

2. RPA Bot Springs into Action

When the information is entered, an RPA bot is triggered automatically. It accesses integrated systems like the EHR and billing software to gather all necessary data, including patient demographics, insurance policy details, provider credentials, and service codes for the scheduled treatment.

Then, the bot logs into the payer portal (or uses an API if available) to begin the verification process. It mimics a human user but works much faster—navigating systems, inputting information, and requesting real-time eligibility data.

3. AI Engine Interprets the Data

Once the insurer’s response is received, the AI engine takes over. Natural Language Processing (NLP) deciphers complex or unstructured text from the response, such as coverage notes, co-pay amounts, exclusions, or pre-authorization requirements.

If anomalies are detected, such as conflicting coverage information, policy expiration, or missing data, the AI flags the issue for further review. In a more advanced setting, based on historical data, machine learning models predict the likelihood of a claim denial.

4. Decision Made

Within seconds, the system determines whether the service is covered, partially covered, or requires prior authorization. If pre-authorization is needed, another RPA bot may initiate that workflow automatically.

5. Instant Notifications

The results are sent instantly to the front desk, billing team, and the patient’s mobile app or email. Patients can make informed decisions before receiving care, while staff can address coverage issues proactively.

In Summary

What once took hours, filled with phone calls, faxes, and manual portal logins, can now be completed in real time. This drastically improves operational efficiency and patient satisfaction, reducing costly errors and delays in revenue cycles.