Key Takeaways

- Autonomous agents complement, not replace, human underwriters, providing real-time, high-frequency risk insights while allowing experts to focus on nuanced decision-making.

- Traditional risk assessments struggle due to delays, human subjectivity, and static models, making them less effective in today’s fast-moving credit environment.

- Autonomous agents leverage multiple data streams, including structured, unstructured, and alternative data sources, to provide adaptive scoring, document analysis, and fraud detection in real time.

- Integration and orchestration are critical: agents must seamlessly connect with banking systems, document repositories, and compliance engines to function effectively without creating operational friction.

- Continuous monitoring and human oversight remain essential, ensuring that agents adapt to evolving markets, maintain explainability for regulators, and achieve measurable improvements in approval speed, risk mitigation, and portfolio flexibility.

The loan origination process, especially in commercial and retail banking, has always been a delicate balancing act between speed and risk. Lenders want to approve qualified applicants quickly, yet the consequences of ignoring subtle risk signals can be destructive. Traditional risk evaluation structure depends on rigorous scoring systems, manual underwriting reviews, and post-functioning investigations, but these approaches are showing their limitations in today’s rapidly growing credit scenario. Delays, discrepancies, and left patterns are not only inconvenient—they are expensive. Therefore, the autonomous risk assessment agent comes in handy: self-guided software units that are capable of evaluating, interpreting, and processing complex data streams without human intervention.

This is not about changing underwriters completely, although this is often the fear when new automation technologies come out. Rather, it is about complementing human decisions with high-loyal, frequent-learning agents that provide the first and most reliable signal than traditional systems. The implications are both operational and strategic.

Also read: Autonomous route‑planning agents using NVIDIA mapping and Azure Maps

Why Traditional Risk Assessment Struggles

Many banks still work with hybrid workflows: part automated, part manual. An application arrives, receiving an original credit score, and the underwriters cross-check documents. Even in a digitized setup, most of the risk assessment is sequential and silent. Consider these recurring pain points:

- Delayed data aggregation: Financial documents, employment verification, and tax records—the initial application may lose speed until all the pieces come.

- Human subjectivity: Two underwriters can identify a similar cash flow discrepancy utilizing several methods. One underwriter identifies the potential risk, but the other ones ignore it.

- Static models: Traditional scoring mechanisms are rarely updated in real time, which slows them down to respond to emerging trends such as sudden changes in interest rates or sectoral shocks.

It is not that these systems are naturally flawed; They are not just designed for a world where applications are high, the customer’s expectations are instantaneous, and the risk factors are faster.

How Autonomous Agents Step In

Autonomous risk assessment agents work differently. Instead of waiting for a batch of applications and processing them gradually, they continuously ignore structured and unstructured data in many channels: financial details, alternative data sources, social media signals, real-time market indexes, and more. They evaluate the risk and normalize and evaluate the risk in parallel, producing actionable insights in real time.

Some practical capabilities include:

- Adaptive scoring models: Agents do not apply only stable thresholds. They accommodate continuous weight based on portfolio performance, macroeconomic trends, and historical repayment patterns.

- Document Analysis: Agents use a combination of semantic parsing and optical character recognition, and at times even handwritten notes, to extract detailed information from a plethora of sources.

- Fraud detection signs: discrepancies in the submission process—such as abnormal IP addresses or mismatched metadata—immediately launch flags. Some agents also correlate several applications in platforms to detect synthetic identity.

- Landscape simulation: Agents can also find out weaknesses, including credit deficits. This happens by testing several models across numerous hypothetical situations.

An interesting case emerged in a mid-sized bank, where an autonomous agent system reduced the average loan approval time by five days. Initially, the underwriter suspected and thought that the system might have an issue and had ignored minor discrepancies. Instead, the agent accurately identified microscopic cash flow discrepancies in high-risk applicants, which were first missed by human reviewers.

Designing Agents for the Loan Pipeline

Creating effective autonomous agents is no trivial task. Loan origination involves several steps, each with unique data and decision-making requirements:

- Application intake: Agents can pre-verify documentation, check for completeness, and also guide applicants in real time to minimize errors.

- Credit scoring: Beyond traditional credit bureau scores, agents can include transactional data, recurring payment behavior, and regional risk indicators.

- Underwriting enhancements: Agents highlight unusual patterns and provide relevant reasoning for recommendations, effectively acting as a decision-support layer rather than a replacement.

- Approval and monitoring: Once the approval is obtained, the agents can keep an eye on portfolio risk continuously. Apart from this, agents also check the borrower’s behavior, ensuring that the human managers are alert.

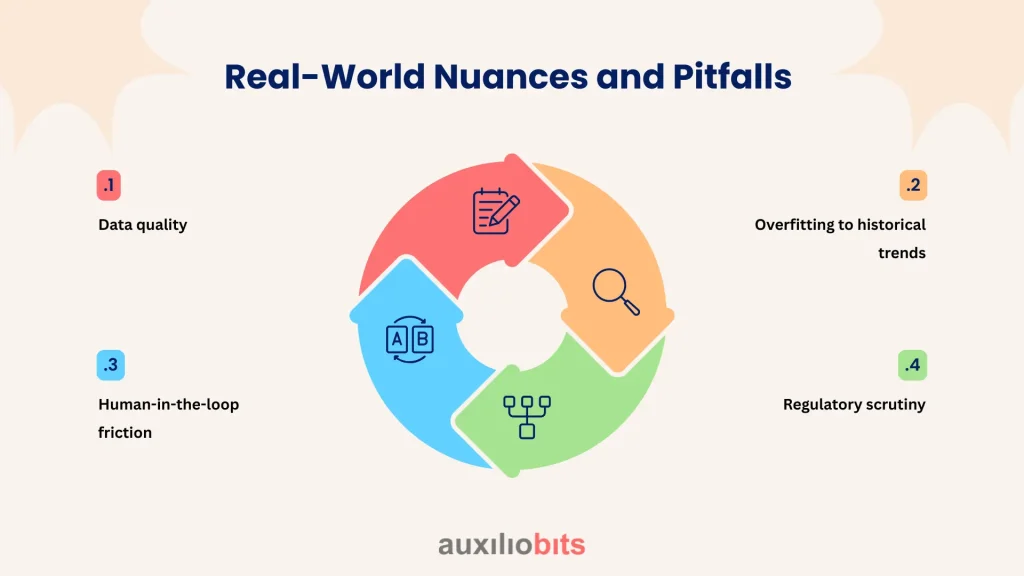

Real-World Nuances and Pitfalls

Even the most sophisticated agents aren’t magic. Certain challenges come along the way:

- Data quality: Agents leave no stone unturned to strive for high-resolution data, which is up to the mark. Nothing can compensate for financial records that go missing and inconsistent reporting standards.

- Overfitting to historical trends: Agents that are overly tuned to past defaults may misinterpret emerging market conditions. A sudden spike in sectoral insolvency can blind a model trained solely on stable historical data.

- Human-in-the-loop friction: Some underwriters resist agent recommendations, especially if the reasoning is opaque. Trust-building requires transparency dashboards and gradual adoption strategies.

- Regulatory scrutiny: Credit risk regulations often mandate explainable decisions. Agents must produce interpretable rationales, not just numerical scores.

Measuring Agent Effectiveness

Banks often default to traditional KPIs such as loan approval rates or default frequency. Autonomous agents invite a rich set of metrics:

- Decision from time to time: How fast can an agent screen and score an application?

- False positive/negative rates: Are agents rejecting low-risk borrowers or missing risk profiles?

- Portfolio diversification effect: Do agents inadvertently focus the risk in some areas or demographics?

- Reduction in operational cost: How much offset is human effort without compromising risk monitoring?

Integrating Agents With Broader Systems

Autonomous agents are not present in zero. Their effectiveness depends on the smooth integration into the debt origin ecosystem:

- Core banking systems: Uninterrupted API integration allows agents to obtain account history, transaction records, and repayment data in real time.

- Document reserves: Agents require access to a mixture of structured and unstructured input, from PDF to Excel sheet to scanned contracts.

- Regulatory compliance engine: Automatic KYC/AML verification and reporting must be embedded to avoid audit failures.

- Monitoring of dashboard: Risk authorities and shapes require the agent’s argument, discrepancies, and visibility of emerging risk scores

Interestingly, some institutions have many agents, each specializing in a separate section of the pipeline. One agent can focus on the perfect detection of fraud, the other can focus on cash flow discrepancies, and the third on sector-specific stress tests. The coordination of these agents requires the same orchestration argument, similar to the conductor leading a symphony: very aggressive, and the system is overflagged; very generous, and the risk is averted.

The Human Factor

Despite their autonomy, these agents are most effective when paired with expert human oversight. Underwriters remain important for:

- Validating edge cases and unusual applications.

- Providing judgment in areas that defy quantification, such as reputational risks or strategic lending decisions.

- Acting as a feedback loop to refine agent algorithms and assumptions.

In fact, the most successful implementations are rarely “set and forget.” Banks continuously monitor agent recommendations, conduct periodic audits, and retrain models as portfolios evolve. There’s a subtle irony here: while agents reduce human effort, they also demand more nuanced human oversight.

A Glimpse Into the Next Wave

Autonomous agents are evolving beyond simple risk scoring:

- Inter-agent collaboration: Some banks are experimenting with multiple agents communicating internally to resolve conflicting signals, essentially debating the risk before making a decision.

- Predictive portfolio management: Agents not only evaluate individual applications but also forecast regional or geographic credit stress.

- Ethical risk considerations: Incorporating ESG and reputational factors into automated risk assessments is gaining attention.

Consider a pilot project where agents evaluated loan applications for small retailers. Beyond traditional credit metrics, they integrated sales velocity, social commerce data, and local supply chain volatility. The result: faster decisions, lower default rates, and improved portfolio flexibility.

Closing Thoughts

Autonomous risk evaluation agents are not a panacea. They require careful design, continuous inspection, and intensive integration with existing workflows. Nevertheless, when implemented thoughtfully, they convert the debt origination process into an active, data-rich decision engine from a reactive, sequential pipeline. Banks that mastered this balance—taking advantage of autonomy without leaving human decision-making—can get rapid approval, a low default rate, and a more flexible portfolio. The change is subtle but deep. Applications are no longer processed; They are constantly understood, made relevant, and monitored. In a world where speed and precision are defined as rapidly competitive advantages, autonomous agents are no longer a luxury—they are increasingly becoming a requirement.