Key Takeaways

- Unlike traditional bots, Agentic AI agents can perceive, plan, decide, and act autonomously, making them ideal for high-complexity, exception-prone financial workflows, such as vendor invoice reconciliation.

- In real-world deployments, Agentic AI reduced reconciliation time from 5 days to 5 hours, cut error rates below 1%, and minimized human involvement by over 70%.

- These agents continuously learn from outcomes, vendor patterns, and past resolutions, enabling them to scale across various use cases, including credit scoring, cash application, and expense auditing.

- Agentic AI can integrate securely with ERPs, procurement tools, and email systems, while maintaining clear audit trails, facilitating contextual communication, and ensuring human-in-the-loop governance.

- Finance teams adopting Agentic AI early will unlock compounding returns in agility, operational efficiency, and intelligent decision-making, positioning them ahead of the curve.

The pressure on finance teams is intensifying in today’s dynamic business landscape. With fluctuating markets, increasing regulatory oversight, and growing data volumes, CFOs and their teams are expected to be more strategic, efficient, and agile in their approach to financial management. Traditional tools—Excel models, shared drives, and ERP-based workflows—can no longer keep up.

Automation through RPA and scripting brought relief for routine tasks, but critical finance workflows involving decision-making, judgment, and collaboration remain manual or semi-automated. These gaps lead to high operational costs, compliance risks, and strained relationships with vendors and stakeholders.

This is where Agentic AI enters the picture—not as a tool, but as a paradigm shift. This blog demonstrates how Agentic AI facilitates the autonomous optimization of financial processes, with a particular focus on a high-friction use case: vendor invoice reconciliation.

Also read: How RPA Helps Finance Departments Achieve SOX and IFRS Compliance?

The Limitations of Traditional Financial Automation

Finance departments widely adopted Robotic Process Automation (RPA) over the last decade. It excelled at tasks such as invoice data entry and bank reconciliation. However, RPA’s rule-based nature means it can only handle predefined, linear functions with little to no variability.

Challenges arise when exceptions occur, such as line-item mismatches, dynamic discount terms, currency fluctuations, or new vendor formats. In these cases, bots either fail silently or escalate the issue, pushing the work back to humans. Over time, this leads to bot sprawl, brittle automations, and a false sense of efficiency.

Moreover, these systems lack self-learning capabilities. Once deployed, they don’t adapt. They don’t “ask questions,” “resolve ambiguity,” or “make context-aware decisions.” Finance needs more than automation—it requires intelligence.

What Is Agentic AI?

Agentic AI refers to autonomous software agents that independently execute tasks across systems, learn from context, make decisions, and collaborate with humans or other agents.

Unlike traditional bots that execute scripted instructions, Agentic AI agents are built on large language models (LLMs) and multi-agent frameworks. These agents operate with a sense of agency, meaning they proactively plan and act based on outcomes, rather than just following steps.

Core capabilities include:

- Perception: Understanding documents, emails, APIs, and dashboards.

- Planning: Breaking goals into sub-tasks dynamically.

- Execution: Taking autonomous action—writing emails, updating ERP, querying systems.

- Learning: Adapting from feedback and refining future actions.

- Collaboration: Communicating with stakeholders or other agents.

This makes Agentic AI ideal for finance functions with high variability, recurring exceptions, and cross-team dependencies.

Financial Process Chosen: Vendor Invoice Reconciliation

Vendor invoice reconciliation is a crucial yet cumbersome function. It involves matching supplier invoices against purchase orders (POs), verifying goods receipt notes (GRNs), resolving discrepancies, and coordinating with procurement or vendors for clarification as needed.

Challenges include:

- Inconsistent invoice formats

- Currency conversion errors

- Pricing or quantity mismatches

- Missing or late GRNs

- Payment term variations

Finance teams often spend hours deciphering mismatches, emailing vendors for corrections, or looping in procurement for resolution. All this adds to payment delays, supplier dissatisfaction, and potential overpayments or duplicate entries.

While some ERP systems offer basic matching tools, they fall short when data is unstructured or misaligned. Agentic AI provides a novel approach to autonomously interpret, compare, resolve, and communicate—often without human intervention.

Manual vs. Rule-Based Automation vs. Agentic AI

Let’s compare how this process looks under different approaches:

| Aspect | Manual | RPA | Agentic AI |

| Speed | Low | Medium | High |

| Scalability | Poor | Moderate | Excellent |

| Learning | No | No | Continuous |

| Adaptability | High (human) | None | High |

| Collaboration | Email chains | None | Dynamic |

| Auditability | Manual logs | Static | Transparent trace logs |

| Cost-efficiency | Low | Moderate | High (over time) |

Agentic AI combines the best of human adaptability with machine consistency. It interprets exceptions, learns from past outcomes, and seamlessly integrates with systems and people, making it superior for volatile, high-volume processes such as reconciliation.

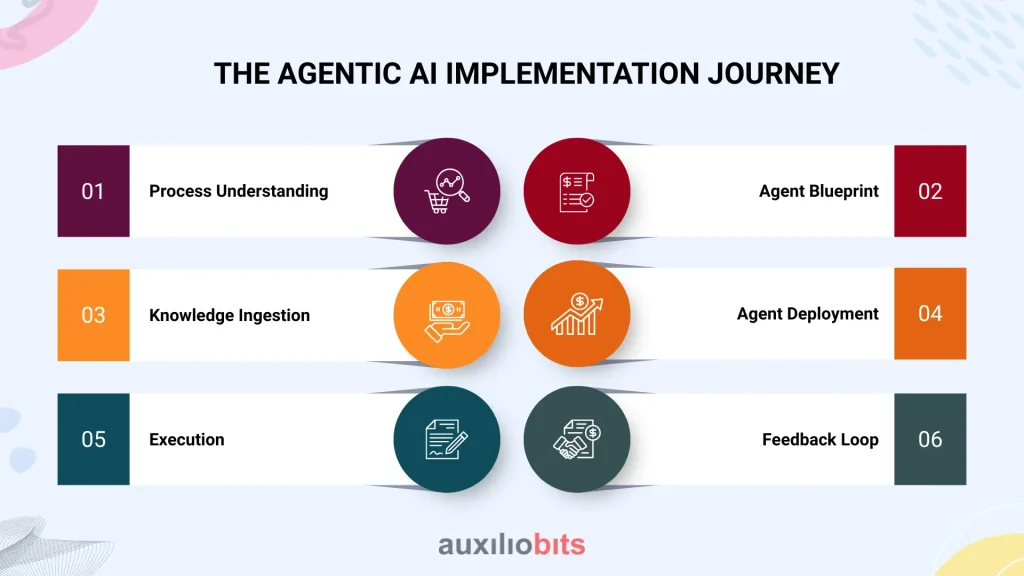

The Agentic AI Implementation Journey

A leading electronics manufacturer partnered with an Agentic AI provider to automate their invoice reconciliation process. The steps followed were:

a. Process Understanding

Mapped invoice-to-PO matching logic, exception patterns, and vendor communication paths across SAP ERP, Ariba, and shared inboxes.

b. Agent Blueprint

Defined capabilities: document parsing, PO retrieval, mismatch analysis, communication drafting, and ERP updates.

c. Knowledge Ingestion

Trained agents on historical invoices, vendor behaviors, contract clauses, and exceptions using embeddings and retrieval-augmented generation (RAG).

d. Agent Deployment

Connected agents to:

- ERP (SAP) via APIs and IDocs

- Procurement platforms (Ariba)

- Shared mailboxes for outbound/inbound messaging

- Policy documents for real-time referencing

e. Execution

Upon receipt of the invoice, the agent parsed the data, matched it with POs/GRNs, identified any mismatches, fetched the contract terms, drafted vendor clarifications, and updated the ERP after resolution.

f. Feedback Loop

The agent logged each decision and outcome. Over time, it began pre-empting common vendor issues, reducing the need for clarifications.

This deployment took eight weeks from design to go-live.

Behind the Scenes: How the AI Agent Works

Multi-Modal Perception

Using OCR and LLMs, the agent reads PDFs, Excel files, emails, and structured ERP data. It maps vendor line items with PO data, identifies mismatches like overbilling, and flags missing data.

Task Planning

It employs frameworks like LangGraph or ReAct to break a goal—“reconcile invoice INV-328”—into steps:

- Extract invoice metadata

- Retrieve related POs and GRNs

- Validate unit prices and quantities.s

- Apply any dynamic discount.s

- Flag issues and fetch supporting policies

- Communicate with vendor (if needed)

- Close the loop and push to ERP

Communication Layer

“Hi [Vendor], the quantity billed (200 units) doesn’t align with the received quantity (150 units). Could you verify and resend the invoice?”

Memory and Learning

ach action is logged in an agent memory store. Over time, the agent identifies recurring vendor issues, learns preferred responses, and autonomously adapts to new formats or policies.

Quantifying the Impact of

| KPI | Before (Manual/RPA) | After (Agentic AI) |

| Avg.. Resolution Time | 4.8 days | 5 hours |

| Vendor Follow-ups | 2-4 per case | 0.5 per case |

| FTE Requirement | 12 analysts | 3 analysts |

| Error Rate | 6.3% | 0.7% |

| Payment Delays | Frequent | Rare |

| Duplicate Payments | 11/year | 0 |

The company reconciled over 3000 invoices daily, with 80% fully automated. Human intervention was only needed in edge cases. Supplier satisfaction rose due to faster clarifications, and early payment discounts increased by 25%. Additionally, agents documented every decision with a clear rationale, improving auditability and regulatory confidence.

Broader Benefits Across Finance

Agentic AI agents aren’t confined to invoice workflows. Their architecture enables use across diverse finance areas:

- Cash Application: Match bank statements with open receivables using fuzzy logic and conversation history.

- Audit Readiness: Proactively check transactions against policies, flag anomalies, and prepare audit trails.

- Credit Scoring: Pull data from credit bureaus, past transactions, and payment trends to assess creditworthiness dynamically.

- Expense Management: Parse expense reports, validate against policies, and approve or flag unusual claims.

- Month-End Close: Collate data from departments, track missing entries, send reminders, and ensure completeness.

The modularity of agent design enables organizations to start with one use case and expand horizontally, creating a mesh of intelligent finance agents that coordinate autonomously.

Challenges and Considerations

Some of the common challenges and considerations were:

Security & Access

Agents often require access to sensitive data—banking info, contracts, PII. Ensuring secure API tokens, audit logs, and least-privilege access is critical.

System Compatibility

Legacy ERPs or siloed systems without APIs can hinder real-time agent actions. Middleware or RPA fallback may be needed initially.

Trust & Explainability

Finance teams are hesitant to trust “black-box” decisions. Ensuring transparent reasoning, logs, and override options are key.

Governance

Without guardrails, agents may perform undesired actions. Define thresholds, escalation paths, and approval checkpoints to ensure effective management and control.

These challenges are surmountable with proper design, change management, and human-agent collaboration frameworks.

Future Outlook

The future of finance lies in autonomous, collaborative AI ecosystems. Soon, we’ll see:

- Multi-agent orchestration: One agent handles cash application triggers, which in turn trigger another for credit risk reassessment.

- Predictive finance: Agents forecast liquidity or alert for supplier risk using real-time market feeds.

- Conversational finance: Ask your agent, “Why did our Q2 DPO spike?” —and get an actionable answer.

- Embedded compliance: Agents will enforce policies during transactions, not after the fact.

Ultimately, finance will shift from post-facto control to real-time intelligent governance, powered by Agentic AI.

Final Thoughts

Agentic AI is transforming finance—not by replacing people, but by removing friction from workflows that humans were never meant to handle alone. The vendor invoice reconciliation use case proves that agents can interpret, decide, act, and learn—freeing up analysts for strategic work.

As finance becomes more real-time, data-driven, and distributed, autonomous agents will become foundational infrastructure. They’ll unlock speed, accuracy, compliance, and insight at scale.

Organizations that invest early will reap compounding returns on their investment, not just in operational savings, but also in increased agility and foresight. Agentic AI is not a tool—it’s a capability. And the future of finance is already arriving, one intelligent agent at a time.