Key Takeaways

- Supply chain resilience now depends on reasoning, not just reporting. Traditional dashboards and predictive analytics fail to interpret meaning; agentic systems bridge that gap by reasoning through complex dependencies.

- Shock prediction agents act autonomously across data silos. These agents sense disruptions from both structured and unstructured data, simulate outcomes, and collaborate across procurement, logistics, and finance.

- Real-world use cases show measurable ROI. Early adopters report reduced disruption-response times and millions saved annually in emergency logistics through better foresight and adaptive planning.

- Adoption requires cultural and architectural shifts. The transition from control-based to adaptive systems demands unified data visibility, governance models, and human-AI collaboration frameworks.

- The future supply chain will be agentic and resilient by design. Within five years, autonomous predictive agents will become standard, enabling organizations to anticipate shocks before they escalate—turning uncertainty into a strategic advantage.

You can almost feel it when a supply chain trembles. It’s not the tremor of trucks or factory floors, but the sudden silence in dashboards, the email marked “urgent” from procurement, or the call from a supplier halfway across the world. These moments—micro or macro disruptions—have always haunted manufacturing. The difference now is that prediction, not reaction, is becoming the battleground.

But “prediction” today means something far more sophisticated than running a demand forecast model. It’s shifting toward agentic intelligence—autonomous systems that interpret, reason, and act across fragmented, unpredictable supply chain environments. They don’t just alert; they negotiate, simulate, and sometimes even adapt the plan on their own.

The New Reality of Shock Sensitivity

Manufacturers have always designed supply chains for efficiency, not adaptability. Lean inventories, just-in-time operations, globalized sourcing—it all worked perfectly until the world stopped being predictable. COVID-19 merely exposed what industry insiders already knew: our supply chains are brittle by design.

A single missed shipment of semiconductors can idle an entire automotive assembly line. A delay in critical APIs (active pharmaceutical ingredients) can hold up drug production for months. Even minor disruptions—a storm at a port, a political protest, a customs software glitch—can ripple downstream for weeks.And yet, despite all the AI dashboards, predictive analytics tools, and IoT feeds we’ve added, many organizations still react after the damage is visible. Because traditional analytics, no matter how advanced, still depend on predefined models and static thresholds. They can see anomalies—but they can’t reason about them.

That’s where supply chain shock prediction agents come in.

From Predictive Analytics to Predictive Reasoning

Most predictive tools can answer what might happen. Very few can reason through why it’s happening or what should be done about it.

Supply chain shock prediction agents bridge that gap. They’re not just algorithms sitting behind dashboards—they’re autonomous, conversational, and contextual. They interpret data streams from multiple systems (ERP, MES, logistics APIs, weather data, social signals), detect weak signals, and then simulate potential outcomes in real time.

Here’s how they differ from traditional predictive models:

- Context-Aware Reasoning: Instead of only tracking KPIs, they understand dependencies—how a port delay in Singapore affects your assembly line in Detroit three weeks later.

- Continuous Learning: They adapt to new variables automatically. A change in supplier reliability doesn’t require a manual model retraining cycle.

- Decision Simulation: Before recommending mitigation actions, they run scenario simulations. What if we airlift? What if we shift the order to supplier B? What if we delay production by two days?

- Multi-Agent Collaboration: Several agents—procurement, logistics, and finance—can coordinate to agree on trade-offs (cost vs. lead time vs. sustainability).

This is not the future tense—it’s already being prototyped by advanced manufacturers and logistics integrators.

Why Traditional Systems Keep Failing at Shock Detection

A typical ERP system, say SAP or Infor, can track supplier orders and inventory levels perfectly. But it can’t interpret the intent or impact of an upstream anomaly. For example:

- A supplier reports a “temporary delay.” The ERP logs it.

- The demand forecast tool shows no change because it’s running on last quarter’s data.

- Procurement waits for an update.

By the time the next update arrives, it’s too late.

The core issue is semantic understanding. Supply chain systems are great at structure (quantities, dates, SKUs) but poor at meaning. They don’t know that “temporary delay” in one supplier’s language often translates to a 15-day lead time increase. They can’t reconcile how local labor unrest might intersect with raw material scarcity two tiers upstream.

Agents, on the other hand, live in that ambiguity. They read supplier emails, scrape local news feeds, interpret human-language updates, and triangulate meaning. That’s a seismic shift from data analytics to cognitive sensing.

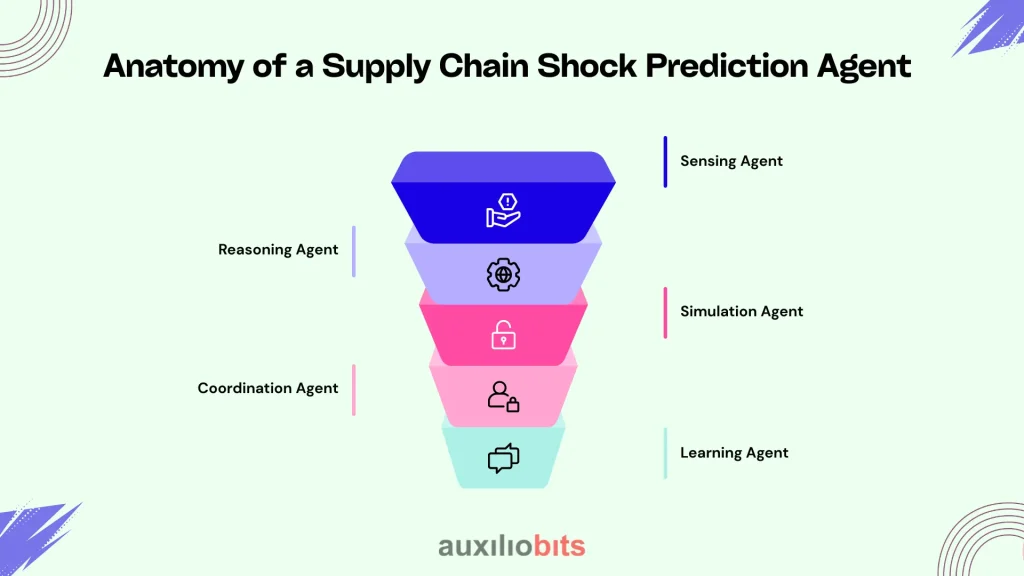

Anatomy of a Supply Chain Shock Prediction Agent

Picture it less like a monolithic AI model and more like an ensemble of specialized workers—digital colleagues, if you will. Each with a distinct role, but all collaborating around a shared goal: anticipating disruptions.

1. Sensing Agent:

- Continuously ingests structured (IoT, ERP) and unstructured (news, social media, weather alerts) data.

- Uses NLP to identify disruption-related language patterns (“port congestion,” “labor strike,” “export restriction”).

2. Reasoning Agent:

- Assesses the severity and relevance of detected signals.

- Uses causal reasoning models to determine potential impact chains (if port delay → then shipment delay → then production shortfall).

3. Simulation Agent:

- Runs probabilistic scenarios using current logistics constraints, supplier histories, and buffer capacities.

- Evaluates options: reschedule production, reroute shipments, switch suppliers.

4. Coordination Agent:

- Communicates with other domain agents (finance, procurement, operations).

- Aligns mitigation actions with business objectives—cost efficiency, service level, and sustainability compliance.

5. Learning Agent:

- Captures outcomes of past decisions.

- Adjusts confidence thresholds, supplier trust scores, and event weighting for future predictions.

It’s almost like having a “digital control tower,” except this tower isn’t staffed by humans watching dashboards—it’s staffed by intelligent agents talking to each other.

Case in Point: The Microchip Shortage

When the semiconductor shortage hit, automotive OEMs scrambled. Most didn’t lack data—they lacked interpretive capacity. Their ERP systems showed supplier delivery dates. Their planning systems showed forecasts. But no one connected the dots between COVID-related plant closures in Taiwan and the impending production gap.

An automaker that had experimented with autonomous supply chain agents noticed early pattern shifts—news reports of wafer delays, freight bottlenecks, and social chatter from supplier communities. Its agents flagged the risk weeks before official supplier notices came through.

The company adjusted orders, secured alternative chipsets, and avoided line shutdowns. Meanwhile, competitors lost billions in idle capacity.

It wasn’t prescience—it was architecture.

Why Agentic Prediction Works Where Dashboards Don’t

Dashboards are retrospective. Even predictive ones. They depend on what data has been collected, cleaned, and formatted. Agents are opportunistic—they consume whatever data is available, structured or not, and reason through uncertainty.

A few design principles make this possible:

- Multi-Source Fusion: Combining quantitative feeds (inventory levels, shipment tracking) with qualitative signals (supplier communication, economic news).

- Causal Reasoning over Correlation: Understanding why something is happening, not just that it correlates.

- Autonomous Hypothesis Testing: Agents can propose and test hypotheses—“If this supplier fails, can Tier-2 supplier X compensate?” —without human initiation.

- Dynamic Confidence Scoring: Every prediction carries a confidence level that changes as new data arrives.

Of course, that doesn’t mean agents are infallible. They make mistakes—false positives, misinterpretations, and overreactions. But in complex supply networks, even imperfect foresight is vastly better than surprise.

Implementation: Easier Said Than Done

It’s tempting to imagine a plug-and-play solution, but deploying agentic systems in manufacturing supply chains is not trivial. The complexity lies in data silos, legacy IT, and cultural resistance.

Common hurdles include:

- Fragmented data ownership: Procurement, logistics, and finance often maintain separate data universes. Agents need unified visibility.

- Inconsistent data quality: Garbage in, garbage out still applies—though agents can mitigate some of it through reasoning.

- Integration fatigue: Manufacturers are already buried in integration projects; adding another AI layer feels risky.

- Change management: People trust dashboards more than autonomous recommendations—at least initially.

Still, the path forward doesn’t require a full overhaul. Many companies start by embedding reasoning agents around existing ERP or SCM systems—essentially, a cognitive overlay that listens, interprets, and recommends without touching the core system.

The Economic Logic Behind Predictive Agents

If we strip away the technical jargon, this all comes down to time and money.

A typical mid-sized manufacturer spends millions annually on expedited freight and emergency procurement. The majority of that spending comes from reacting too late. Even a 10% improvement in shock anticipation can cut those costs dramatically.

Then there’s resilience ROI: being able to maintain delivery commitments when competitors can’t. That reliability translates directly to long-term contracts and premium positioning.

One automotive supplier estimated that deploying supply chain prediction agents reduced disruption-response time by 60% and saved roughly $8 million in annual emergency logistics. Not a moonshot—just better timing, powered by better interpretation.

The Human Element

For all the automation, humans remain crucial. Agents are only as strategic as the humans who set their boundaries. Overreliance on automated decisioning can backfire—especially when the system overestimates its confidence.

The healthiest architectures are hybrid. Agents manage the sensing, reasoning, and simulation, while human experts arbitrate context and emotion. In high-stakes decisions—like reallocating scarce materials between customers—humans should still close the loop.

A Quiet Revolution in Risk Culture

The real shift isn’t technical—it’s philosophical. Traditional supply chain management was about control: locking down variables, enforcing compliance, and minimizing variance. Agentic supply chains embrace uncertainty. They assume the world will fluctuate and build systems that learn to ride those fluctuations instead of resisting them.

This mindset aligns with what some call resilient intelligence—systems that don’t just survive shocks but grow smarter from them. In a sense, every disruption becomes a data point for the next prediction cycle.

Where It’s Headed

In the next five years, expect supply chain prediction agents to move from niche experiments to standard capability. They’ll be embedded not just in manufacturing but across logistics providers, raw material traders, and even finance teams (credit agents assessing supplier risk in real time).

- Cloud hyperscalers are already developing “agent frameworks” for industry-specific reasoning (Azure AI Agents, AWS Bedrock).

- Platforms like LangChain and CrewAI are being used to orchestrate multi-agent supply chain workflows—connecting reasoning agents to data warehouses, ERP APIs, and even conversational interfaces.

- Some forward-looking manufacturers are piloting collaborative agent networks that communicate across enterprise boundaries—supplier agents negotiating delivery windows directly with buyer agents.

If that sounds a bit futuristic, remember: five years ago, “AI forecasting” sounded futuristic too.

What Could Go Wrong?

Agents can amplify noise. They can chase phantom risks or over-prioritize short-term signals. They can misread sentiment, fail to capture on-the-ground nuance, or cause alert fatigue. Worse, they can make suppliers feel surveilled if not implemented transparently. Then there’s the question of accountability. If an agent recommends rerouting materials and the shipment fails—who owns that decision? The operations team? The data science unit? The AI vendor? Manufacturers will need governance models that track decision lineage and confidence justification. Otherwise, they risk replacing one kind of opacity (human intuition) with another (machine reasoning).

A Final Reflection

Predictive agents won’t eliminate uncertainty. They’ll redefine the relationship we have with it. Manufacturing supply chains will always face shocks—from weather to war to unexpected surges in demand. What changes is the response rhythm.

Instead of waking up to an emergency, organizations start to anticipate the tremor before it becomes a quake. And that’s not just automation—it’s foresight embedded into the fabric of operations.

Not every manufacturer is ready for that shift. But the ones who are—those who view agents not as tools but as collaborators—are already shaping a supply chain culture where intelligence is distributed, adaptive, and deeply human-aware.

Because ultimately, prediction isn’t the goal. Resilience is.