Key Takeaways

- Loan origination automation is no longer optional—it’s a necessity for banks, credit unions, and fintechs competing in a digital-first lending market.

- Workflow bots streamline back-end tasks like application screening, document verification, credit scoring, underwriting, and compliance, cutting turnaround time from days to hours.

- Voice agents enhance customer experience by offering conversational support for loan applications, real-time status updates, scheduling, and payment reminders.

- Automation delivers measurable benefits such as lower operational costs, scalability during demand spikes, reduced errors, and stronger compliance management.

- Successful adoption requires a phased roadmap—starting with process discovery and pilots, followed by scaling, workforce training, and continuous optimization.

Banking is expanding at a very high rate, and the loan origination process, which is subject to manual interventions, also follows suit. The faster processing, better customer satisfaction, and business efficiency requirements are compelling financial institutions towards automation using workflow bots and voice agents. The debt origin automation enhances the application-to-disposal cycle, reduces human intervention errors and regulatory risks, and provides an awesome customer experience.

Now, this is the top importance for banks, credit unions, fintech firms, and hostage lenders. With more customers seeking digital-first lending, institutions can no longer survive on legacy infrastructure alone. Manually created roadblocks not only result in hold-ups but also damage customer loyalty.

In this blog post, we are going to discuss how voice assistants and AI-based workflow automation bots change the loan origination process. We will touch upon major benefits, real scenarios, and success strategies for implementation.

Also read: AI Agents for Regulatory Compliance Monitoring in Banking

What is the Origin of the Loan

“Origin of the loan” refers to the entire process, as the applicant borrows the loan at the time when the loan is made available. The following are commonly included in it:

- Submission of loan request

- Collection of information and document validation

- Credit assessment

- Underwriting

- Approval or rejection of the loan

- Disbursal of funds

All these steps can be susceptible to slippages unless mechanized. Additionally, in high-volume operations, delays in underwriter backlog or document verification can have significant effects on commercial effectiveness. In addition, customers expect an immediate response, and if they do not receive it, they switch to a rival.

Heritage systems have more touchpoints, repetition, and manual information processes in the process, and they are reducing turnaround time and increasing the cost of operation.

Loan Generation Demand

Today, the market is calling for speed, precision, and flexibility. Manual loan is plagued by processing:

- Processed high versions of applications

- Compliance Rules

- Anti-fraud protection

- Distribute a comfortable customer experience.

Since customer acquisition becomes rapidly expensive, it has become mandatory for existing customers to maintain uninterrupted onboarding and personal engagement. Early automation organizations are more capable of market disturbance, regulatory changes, and transfer of consumer patterns.

Debt origin automation solutions solve problems by adopting smart technologies that automate each step and provide a better user experience. The solutions not only ensure speed of process but also ensure uniform quality of service across geographies and branches.

How to Streamline the Workflow Bots Loan Origin Process

Workflow bots are rule-based, artificial intelligence-powered software that executes human action on computer systems automatically. Workflow bot process is a type of automation (RPA) and can execute automatic processes in batches. They operate round the clock, 24/7, and can be scaled instantly to deal with demand spikes without compromising output quality.

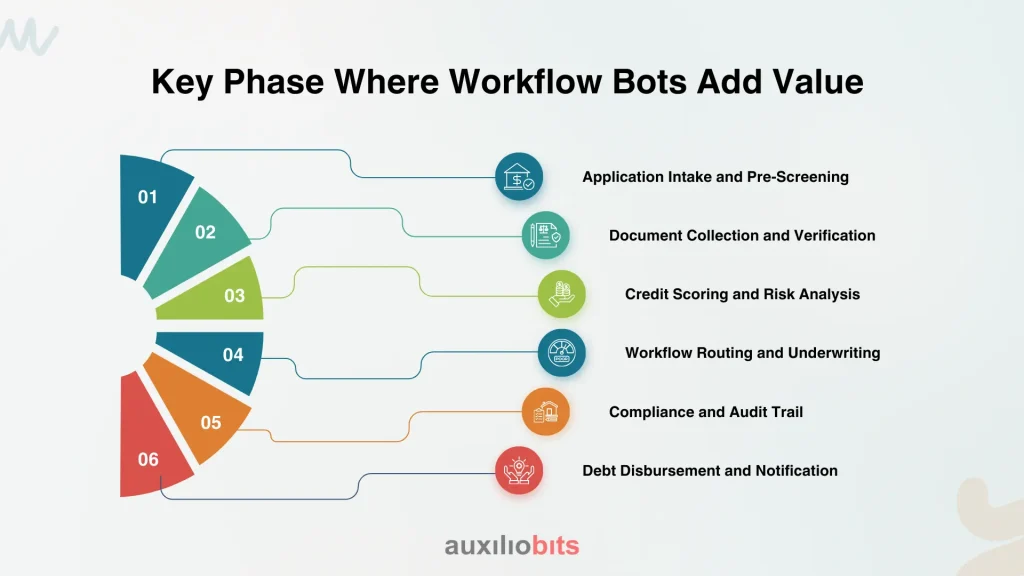

Key Phase Where Workflow Bots Add Value

1. Application Intake and Pre-Screening

Bots automatically retrieve data from:

- Third-party Aggregators

- Mobile apps

They compare data against internal systems, say CRM or core banking, and outsiders, say the Credit Bureau, to facilitate real-time pre-uses. Through APIs and background checks, bots filter out only qualified applications, reducing manual screening load.

2. Document Collection and Verification

Can workflow bots:

- Automatically ask for documents from applicants

- Collect information using OCR (optical character recognition)

- Verify document data against the application entry.

- Hence, highlight differences for the exam.

This automated layer does away with manual back-office clerical workflows. Further, integration with financial and government databases allows bots to perform eKYC checks in real-time and safely.

3. Credit Scoring and Risk Analysis

Bots can pick up credit scores and risk factor scores from pre-demagogued algorithms. Bots can:

- Process automatic credit policy verification

- Match credit and employment history.

- Provide returns to allow underwriters to make decisions

This automation allows lenders to weigh risk against profitability in a manner that objectively and equally gauges in terms of previous records and current market patterns.

4. Workflow Routing and Underwriting

Bots can route applications for the appropriate underwriter or decision engine by complexity, loan product, or applicant type. Bot machines can also indicate approval, rejection, or approval with conditions through learning. Bots can become intelligent over time through predictive models to enhance routing performance and minimize turnaround.

5. Compliance and Audit Trail

Workflow automation provides accurate documentation of all activity. Botts:

- Regulatory Compliance (KYC/AML) verify

- Maintain an end-to-end electronic audit trail.

- Notify users of missing or incomplete information.

This traceability improves internal governance, simplifies auditing, and helps legal departments stay in compliance with international and domestic lending rules.

6. Debt Disbursement and Notification

When bot-approved, they can:

- Tiger disbursement through the networked banking network

- Notify the borrower through status messages.

- Update internal database

By automatically closing the loop, institutions can reduce post-approval errors and increase borrower satisfaction with instant notifications and easy access to funds.

Voice Agent for Loan Origination: Customer Speaks in Conversation

Whereas back-end functions are serviced by workflow bots, voice agents refine front-end experience. You can communicate with customers via the convenience of natural language processing (NLP), via voice agent, Alexa, and Google auxiliary calls, chats, or smart speakers.

Voice agents not only relieve contact centers but also improve user experience with instant, natural-sounding assistance. Customers don’t waste minutes in lengthy IVR queues.

1. Loan Application Support

Voice agents can:

- Guide user phase rate

- Answer the most frequently asked interest rate questions, conditions, and qualifications.ns

- Collect user information through a slender interface.

This dramatically reduces drop-offs across the loan application process and enhances the sense of personalization.

2. Remissive and Status Update

Instead of browsing the web or making customer service calls, customers merely ask a voice agent:

“What is the status of my debt?”

“Do you need any more documents from me?”

This preserves transparency and proactive communication with the borrowers.

3. Scheduling Appointment

Voice agents can schedule calls or meetings with loan officers on behalf of hard cases. Agents avoid any manual calendar coordination that leads to saving staff and borrowers’ time through automated appointment management.

4. Payment Notifications and Reminders

Phone calls or voice notifications automatically remind the borrowers of due payments or paperwork. The occurrence of missed payments is reduced, and collection efficiency is improved while keeping a good relationship with the customers.

To Automate the Source of Loans Using Workflow Bots and Voice Agents

1. Low processing time

Day one or even weeks’ debt approvals, but now in minutes. Institutions can give same-day disbursals with a guarantee of accuracy and compliance.

2. Saving costs

Fewer human hours translate to lower labor costs and fewer errors. Automation eliminates the need for huge manual exercises, reducing fixed overheads.

3. Scalability

With automation, banks can determine the loan amount during peak hours without having to hire additional staff. It could be festive loan drives or packaged economic deals; the system can adapt dynamically.

4. Lower error rate

Bots do not tire and make mistakes, resulting in cleaner data and smarter decisions. Inconsistencies are automatically identified and flagged, uncovering risks.

5. Better Customer Experience

Voice agents offer real-time service and a personalized debt experience 24/7, all of which are essential for retaining customers. Satisfaction is translated into brand loyalty and referral generation.

6. Compliance Monitoring

Compliance institutions are automatically screened based on the changing rules, reducing the risk of fines or cases. Regulator auditing is simpler and less intrusive.

Real-World Implementation Example

Imagine a medium-sized bank had an RPA-driven loan origination forum backed by a voice bot.

Pre-Automation:

- Average 4–5 days in debt processing

- 20% application dropout rate due to slow communication

- Compliance issues identified by internal audit

Post-Automation:

- Processed loan approval within less than 24 hours

- The dropout rate was reduced to 5%

- Full KYC/AML compliance with audit-proof audit trails

- Voice agents handled 70% of debt status requests, releasing human agents for higher-order tasks.

This resulted in enhanced operational efficiency, higher NPS (Net Promoter Score), and improved internal audit scores across branches.

Implementation Roadmap: Where to Start

If you are wondering how to get started, here are some of the steps to follow:

Process Search

Utilize process mining or manual analysis to uncover hindrances in your debt origination process. Map out each step of your workflow and identify redundancy.

Set Automation Targets

Set a standard KPI such as reducing turnaround time, increasing customer satisfaction scores, or reducing human touch points.

Select the Appropriate Equipment

Use an interactive AI platform for bots everywhere, like UiPath or Automation Anywhere as automation platforms, and Voiceflow or Google Dialogflow as voice agents.

Pilot and Design

Start with a pilot for a loan type, e.g., consumer loans, and execute the entire automated process. Scale incrementally on success measures.

Train Teams and Scale

Underwriter, agent, and support staff training. Rollout in phases to include auto loan, mortgage loan, etc. Building internal champions to promote the adoption of change.

Monitor and Optimize

Monitor performance based on the dashboard and finance automation rules, and performance on voice scripts. Constantly refined and improved.

Challenges and Ideas

Several benefits, but beware when deploying.

- Data Privacy: Treat everything as money and personal data under GDPR, CCPA, or a law enacted. Be transparent to gain trust.

- Transformation Management: Make employees robust to coexist and work with bots and voice agents. Equip them with education.

- Customer Trust: Automate by default and inform customers about using bots. Be transparent when they are communicating with a bot and when a human will step in.

Conclusion

Debt origination through workflow bots and voice agents is revolutionizing automation, borrowing institutions’ business, and customer engagement. Banks can leverage the speed of decision, accelerate lower costs, ensure compliance, and provide smart automation to create a more human-like digital lending experience.

You could be a bank that can look to automate functions or see fintech soon. Automation is not an option; it’s a necessity. Have it on board today to stay ahead.