Key Takeaways

- RPA ROI looks neat on slides, but often softens in reality—hours saved are not the same as dollars saved.

- Scaling RPA exposes maintenance costs, governance gaps, and diminishing returns.

- Agentic AI shifts ROI from tactical savings to strategic protection and growth.

- ROI models must segment hard savings, productivity, resilience, and revenue separately.

Finance should be part of the ROI design conversation early, not after deployment.

Executives smile politely when someone pitches automation. The first slide—fewer errors, faster cycles—always gets nods. But the second slide, the one with numbers, is where the room tightens. “Show me the ROI,” someone from finance says. And that’s when the easy talk about digital transformation collides with reality.

Measuring return on automation is messy. RPA promised quick wins with keystroke bots. Now, agentic AI agents claim to redesign workflows, make decisions, and even negotiate across systems. The value is real—but harder to trap inside a spreadsheet. This post lays out where ROI models work, where they break, and how companies should adapt their measurement from tactical RPA to autonomous AI.

Also read: ROI of HyperAutomation in Finance and Supply Chain Operations

Why Automation ROI Refuses to Behave

A machine on the factory floor has a clean ROI model: capital cost, maintenance, and output per hour. Automation? Much less so. A few reasons:

- Partial coverage. Automating 70% of a claims process doesn’t cut costs by 70%. People still handle exceptions, and exceptions often take the most time.

- Bad baselines. Many firms don’t actually know how long manual processes take. “It’s about 10 minutes” is not data. Without time-and-motion studies, ROI is shaky.

- Soft value. Faster loan approvals might raise customer satisfaction. That matters—but try assigning a hard dollar figure and you’ll get blank stares.

- Invisible drag. Bots break when layouts change. Maintenance hours, license fees, and babysitting eat into savings.

This is why so many automation programs look dazzling in pilots but flatten out when scaled.

The RPA Years

RPA was sold as the quick ROI story. Find repetitive work, calculate labor hours, replace them with bots, subtract license fees—done. On paper, it worked.

Take a payroll team at a mid-sized insurer. Ten staff spent half their time reconciling timesheets against policy rules. An RPA bot did it at night, error-free. Savings looked like five full-time equivalents. ROI pitch: $400,000 per year saved.

Except the team didn’t shrink by five people. Headcount stayed, but their work shifted. Real benefits were less tangible: fewer overtime hours, faster payroll runs, lower error penalties. Good outcomes, yes—but not the neat $400K that the ROI slide showed.

This is the first trap: equating hours saved with money saved. Unless roles are reduced, redeployed, or hiring is prevented, savings stay theoretical.

Scaling RPA

RPA pilots deliver strong numbers. Scaling turns into a grind.

- Bot sprawl. Every department builds its own automations, often undocumented. Maintenance costs creep up.

- Change fatigue. Each system upgrade breaks scripts. IT spends time patching instead of innovating.

- Lower-yield processes. The obvious, high-volume tasks get automated first. The next 50 processes produce smaller returns but require the same overhead.

One manufacturer automated purchase-order matching in three regions. Forecasted ROI: 40% savings. Realized ROI: closer to 18%. Why? Exceptions piled up, regional rules varied, and governance overhead grew. The savings were real—but half what was pitched

Lesson: RPA ROI drops as programs mature unless companies invest in process standardization and governance.

Agentic AI Arrives: Different Value Equation

Now, the conversation shifts. Agentic AI agents don’t just push keystrokes—they reason, act, and sometimes collaborate with other agents. That means ROI looks different.

Imagine a logistics provider. A storm shuts down a key port. In a rules-based world, humans scramble: rerouting shipments, updating customers, and recalculating demand. With agentic AI, autonomous agents negotiate alternatives, adjust routes, and notify clients before anyone picks up the phone.

The value here isn’t just reduced labor. It’s avoided losses:

- Missed deliveries that never happened.

- Penalties were dodged because customers were updated proactively.

- Retained business that would have gone to a competitor.

That’s strategic ROI. And it’s harder to prove on a quarterly financial report.

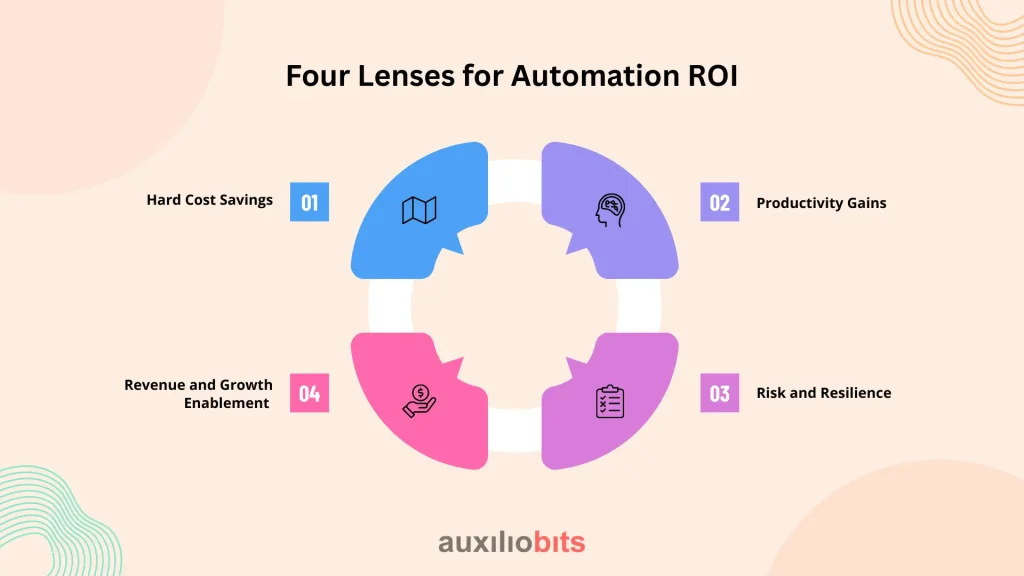

Four Lenses for Automation ROI

To move from RPA to agentic AI, you need a multi-lens ROI model. Different benefits require different yardsticks.

1. Hard Cost Savings

- Labor hours have actually been eliminated.

- Lower compliance fines.

- Reduced overtime or contractor spend.

2. Productivity Gains

- More work is handled with the same staff.

- Faster throughput, shorter cycle times.

- Better accuracy, less rework.

3. Risk and Resilience

- Downtime avoided.

- Fraud was caught earlier.

- Faster response to disruptions.

4. Revenue and Growth Enablement

- Faster quote-to-cash, improving cash flow.

- Personalized customer service is driving retention.

- Market responsiveness enables faster pivots.

Mature automation portfolios report across all four. Early-stage programs usually only report the first.

Insurance Example: RPA vs. Agentic ROI

Consider claims processing.

- RPA Phase: Bots enter claim data, validate fields, and send files downstream. ROI is measured as hours saved per claim, error reduction, and fewer compliance penalties. Maybe $2M annually.

- Agentic Phase: AI agents triage claims, flag suspicious activity, recommend settlements, and escalate tricky cases. ROI shifts: fraud losses reduced by $10M, litigation avoided, payout times cut—boosting customer retention worth $50M in lifetime value.

Notice the difference? RPA gives back labor efficiency. Agentic AI protects revenue and reputation. Both matter, but one is tactical, the other strategic.

ROI Is Political, Too

Here’s a less comfortable truth: ROI isn’t just math. It’s politics.

- IT wants numbers that show platform success.

- Ops wants efficiency metrics.

- Finance wants hard-dollar savings.

- Executives want transformation stories.

If those groups don’t align, the project looks weak—even if the tech works. There have been bots save 10,000 hours but get dismissed because finance wouldn’t classify the hours as savings. Also, there have been AI agents delivering resilience during supply shocks, but leadership waved it off as “lucky timing.”

The lesson? Bring finance in early. Agree on what counts as ROI before the project launches. Otherwise, you’ll be fighting over definitions after the fact.

Practical Ways to Measure ROI

Some practices I’ve seen work across industries:

- Time studies, not estimates. Put a stopwatch on tasks before automation. Managers are often wrong about how long work takes.

- Benefit segmentation. Report savings, productivity, and strategic impact separately. Don’t mix them—it dilutes credibility.

- Scenario modeling. For agentic AI, build “what-if” cases: downtime avoided, fraud prevented, churn reduced. Imperfect, but persuasive.

- Track support drag. Don’t forget license fees, bot monitoring, and model drift checks. These quietly kill ROI.

- Evolve metrics. Early programs measure hours saved. Mature ones track cycle time, risk mitigation, and revenue enablement.

A Useful ROI Table

This table helps keep ROI conversations structured. Each benefit has a different logic and requires different evidence.

| ROI Lens | RPA Example | Agentic AI Example | Measurement Approach |

| Cost Savings | Fewer payroll staff are needed | Fewer auditors required for compliance | Direct salary & vendor cost reduction |

| Productivity | More invoices processed per FTE | Faster contract review & routing | Volume per cycle time |

| Risk/Resilience | Reduced re-entry errors | Supply chain reroute, avoiding downtime | Losses avoided |

| Growth Enablement | Faster onboarding speeds collections | Personalized upsell agents in CRM | Revenue realized / churn reduced |

The Contradiction We Can’t Escape

Here’s the paradox: ROI must be quantified to win budget, yet the most meaningful benefits of advanced automation—resilience, agility, and competitiveness—don’t always neatly reduce to dollar amounts. Ignore them and you miss the strategic story. Focus only on them, and finance may roll their eyes.

The best automation leaders hold both truths. They track the hard numbers but also tell the broader story:“Yes, we saved $3M. More importantly, we avoided a $20M loss when our AI agents rerouted supply chains in a crisis.”

That’s ROI, too—just not the kind you can prove on a balance sheet every quarter.

Conclusion

Quantifying automation ROI has always been a balancing act. RPA showed us that simple math—hours saved times wages—can be compelling but often incomplete. Agentic AI now pushes the conversation into territory where resilience, customer trust, and competitive agility carry as much weight as labor savings. The organizations that succeed won’t be the ones with the prettiest ROI slides. They’ll be the ones honest about costs, disciplined about measurement, and bold enough to count value in ways that aren’t always easy to fit into a ledger. In the end, ROI isn’t just a finance metric—it’s the story a company tells itself about why automation matters.