Key Takeaways

- In manufacturing M&A, speed protects value more reliably than long-term system elegance. Integration delays don’t look dramatic—but they quietly erode margins, working capital, and trust.

- Data unification works best as interpretation, not standardization. Waiting for a perfect single source of truth slows decisions; automation can align meaning even when systems differ.

- Process harmonization fails when it becomes a cultural contest. Automating mechanical steps first reduces resistance and buys time for real alignment later.

- Financial close timelines are an early warning signal for integration health. When close drags, decision latency rises—and automation is often the fastest way to surface issues sooner.

- Automation accelerates truth, which makes leadership readiness just as important as technology. Used well, it removes noise. Used poorly, it exposes problems faster than the organization is prepared to handle.

Most manufacturing M&A deals don’t fail because the strategy was wrong. They stumble because integration drags. Initially, it happens quietly, but eventually, it becomes evident in the numbers.

Revenue synergies slip a quarter. Working capital balloons. Plant managers keep running “their way” because nobody has time to fight it. And six months in, someone in finance asks a question that sounds innocent but isn’t: “Why do we still not have a consolidated view of inventory?”

By the time that question surfaces, the problem is no longer technical. It’s structural.

Automation—done correctly—has become one of the few levers that can compress integration timelines without tearing the organization apart. Not the shiny kind. Not transformation theatre. This approach aims to eliminate mundane tasks, allowing leadership to concentrate on making decisions rather than resolving conflicts.

This is not about digitizing for its own sake. It’s about speed, control, and reducing the entropy that M&A introduces into manufacturing operations.

Also read: Autonomous quality control: using computer vision agents in manufacturing lines

Why Integration Speed Is the Real Value Driver

In manufacturing acquisitions, value leakage rarely shows up as a single failure. It shows up as friction.

- Duplicate planning cycles running in parallel

- Procurement teams negotiating separately with the same suppliers

- Two versions of “truth” in cost of goods

- Manual workarounds that become permanent habits

Every month, these persist, synergies decay.

Faster integration is not about rushing people. It’s about removing the structural delays that force people to slow down. And those delays are usually buried in data and process mismatches, not culture decks.

A mid-sized automotive components group acquired a regional supplier with three plants and a different ERP. Leadership assumed ERP consolidation would take 18–24 months, so they postponed most operational integration decisions. Instead, they automated cross-system data reconciliation—production volumes, scrap rates, supplier invoices—within eight weeks. No ERP replacement. No big bang.

The result wasn’t elegance. It was clarity. And clarity moved faster than any system migration plan.

Data Unification: The First Integration Battle You Win

Every integration team says data is the problem. Few acknowledge why.

It’s not just that systems are different. It’s that data means different things in different plants.

A “completed order” in one business might mean goods issued. In another, it means invoiced. Try consolidating KPIs on top of that and watch meetings derail.

Automation helps here not by standardizing data immediately, but by creating a translation layer.

Think less “single source of truth” and more “single interpretation of reality”.

What works in practice:

- Automated data extraction from ERPs, MES, WMS, and planning tools—without waiting for IT harmonization

- Normalization logic that maps local definitions to enterprise-level metrics

- Exception handling, not perfection. Flag inconsistencies instead of blocking integration

This is where integration efforts often fail philosophically. Teams chase correctness instead of usability. Automation allows you to accept messy inputs while producing usable outputs.

In one chemical acquisition, procurement data across entities couldn’t be merged cleanly due to supplier master inconsistencies. Automation created a cohesive view of spending by utilising pattern matching and analysing transactional behaviour, rather than relying on master data alignment. Was it a textbook? No. Was it actionable? Absolutely.

And once leaders could see combined spend, supplier consolidation followed naturally.

Harmonizing Processes: Navigating Change Without Cultural Conflict

Process harmonization is where integration teams lose credibility.

Everyone agrees processes should align. Nobody agrees on whose process wins.

Automation changes the conversation. It shifts focus from whose process is right to which steps actually need a human.

That distinction matters.

Rather than forcing immediate standardization, successful integrations identify:

- Steps that are purely mechanical

- Steps that require judgment

- Steps that exist only because systems don’t talk

Automate the first and third aggressively. Leave the second alone—for now.

Examples that consistently accelerate integration:

- Automated sales order ingestion across disparate order entry formats

- Invoice matching across different tolerance rules

- Production reporting consolidation without touching shop-floor workflows

- Vendor onboarding workflows that sit around ERPs, not inside them

Notice what’s missing: wholesale process redesign. That comes later, when emotions cool and facts are clearer.

One heavy equipment manufacturer tried to impose a global planning process on an acquired business within 90 days. It failed. Resistance hardened. Six months later, they automated demand and supply signal aggregation instead—letting each plant keep its planning rhythm while leadership gained a unified view. Planning harmonization happened the following year, voluntarily.

Automation didn’t replace leadership. It bought time for leadership to work.

Faster Financial Close: The Hidden Integration Multiplier

If you want to know how well an integration is going, look at close timelines.

Delayed close is a symptom, not the disease.In manufacturing M&A, financial close slows because:

- Intercompany transactions multiply

- Cost structures don’t align

- Inventory valuation logic differs

- Manual adjustments explode

Automation doesn’t fix accounting policy differences. It removes the clerical drag that hides them.

What high-performing integration teams automate early:

- Intercompany reconciliations across entities

- Automated journal preparation for recurring adjustments

- Inventory valuation data feeds from operations to finance

- Exception-based review instead of line-by-line checking

This is not about eliminating finance jobs. It’s about freeing finance leaders to focus on integration decisions instead of spreadsheet hygiene.

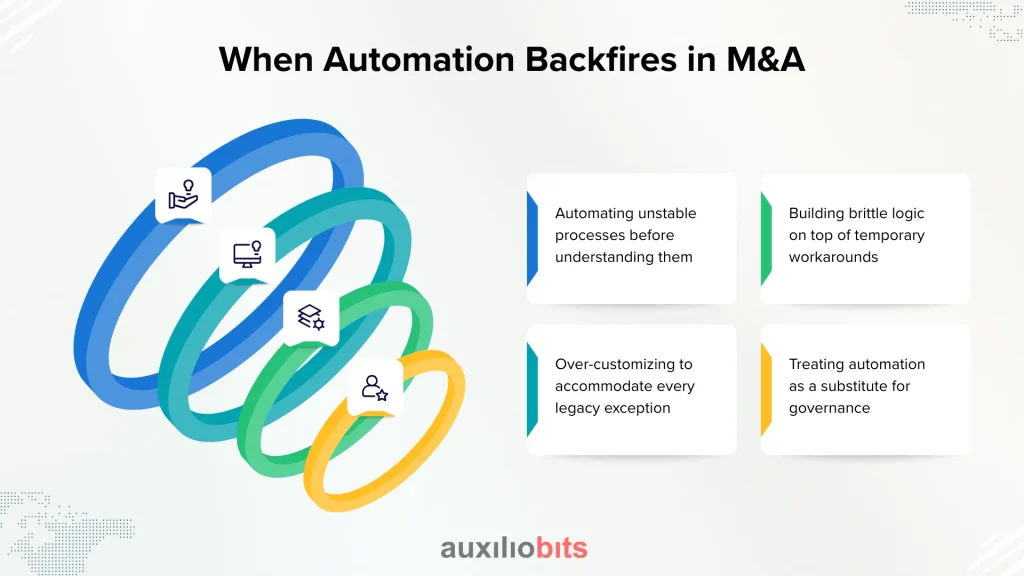

When Automation Backfires in M&A

It’s worth saying this plainly: automation can slow integration if misused.

Common failure modes:

- Automating unstable processes before understanding them

- Building brittle logic on top of temporary workarounds

- Over-customizing to accommodate every legacy exception

- Treating automation as a substitute for governance

There’s also a political failure mode. Automation exposes inconsistencies. Not everyone appreciates that.

In one integration, automated KPI reporting revealed that a “high-performing” plant was benefiting from favorable accounting treatment, not operational excellence. The backlash delayed rollout elsewhere. The tool wasn’t wrong. The timing was.

This is where judgment matters. Automation accelerates truth. Leadership has to be ready for it.

Integration Isn’t Digital Transformation

One of the most damaging assumptions in manufacturing M&A is that integration equals transformation.

It doesn’t.

Integration is about stabilization, visibility, and control. Transformation is optional—and often premature.

Automation sits in between. It allows you to integrate without committing to long-term architectural decisions too early.

Think of it as scaffolding, not the building.

- Temporary by design

- Flexible enough to adapt

- Strong enough to carry operational load

Some automation layers will be retired post-integration. Others will become permanent orchestration fabric. Both outcomes are fine if chosen intentionally.

The mistake is treating integration automation as a prototype. It’s production-grade work, just with a different lifespan.

Why Speed Matters More in Manufacturing Than Other Sectors

Manufacturing M&A has unique constraints that make automation disproportionately valuable:

- Physical inventory doesn’t wait for system alignment

- Production schedules amplify small planning errors

- Supplier relationships are operational, not contractual abstractions

- Quality issues surface in the real world, not dashboards

Delays compound quickly.

A consumer goods company delayed unifying production planning for two acquired plants due to system differences. Automation could have bridged the gap. Instead, stockouts increased, expedited freight costs rose, and the plants were blamed for “underperformance”.

They weren’t underperforming. They were misaligned.

What Accelerates Integration (Beyond Slides)

Based on repeated patterns—not frameworks—faster integrations share a few traits:

- Automation owned by integration leadership, not parked in IT backlogs

- Clear sunset criteria for interim solutions

- Relentless focus on cross-entity visibility, not local optimization

- Willingness to accept imperfect data in exchange for speed

- Respect for plant-level realities, even when standardization is the end goal

Notice how little of this is about tools.

The strategic value of automation in M&A is not the technology. It’s the compression of decision latency.

When leaders see issues sooner, they decide sooner. When they decide sooner, value leaks less.

That’s the game.

A Final Thought

Most manufacturing acquirers overestimate how quickly systems can be unified—and underestimate how quickly people can adapt if friction is removed.

Automation removes friction.

Automation does not replace judgement, but rather it eliminates the surrounding noise.

If M&A is a competition against entropy, automation is not the driving force. It’s the ability to steer without constantly stopping to check the map.

And in manufacturing, that difference shows up faster than most deal models admit.