Key Takeaways

- Manufacturing AI ROI shows up in reduced variability and earlier decisions—not flashy automation or headline KPIs.

- Finance, supply chain, and after-sales deliver the fastest payback because they are exception-heavy and decision-dense.

- AI works best as judgment augmentation first, not as a replacement for human accountability.

- The highest-risk AI initiatives are end-to-end autonomy and politically sensitive processes implemented too early.

- CXOs who win with AI focus on removing operational blindness—where friction silently erodes margin every day.

Most manufacturing leaders are no longer asking whether to invest in AI. That debate ended quietly sometime after the third supply-chain shock and the fifth margin review, where “labor inefficiency” showed up as a bullet point nobody wanted to own.

The real question now is simpler—and harder:

Where does AI actually pay back in a manufacturing enterprise?

Not in slideware. Not in pilot decks. These are the P&L terms that withstand the scrutiny of quarterly reports.

After working across finance, supply chain, and after-sales operations in manufacturing environments—discrete, process, and hybrid—I’ve noticed something consistent: the highest returns rarely come from the flashiest AI use cases. They come from unglamorous parts of the business where human effort is expensive, variability is high, and decision latency quietly erodes value every day.

This article focuses on those places. It also spends time on something vendors rarely talk about: what not to automate first, even if the tech is available and the demo looks impressive.

Also read: Autonomous quality control: using computer vision agents in manufacturing lines

A Quick Reality Check on “AI ROI” in Manufacturing

Before we talk about specifics, it’s worth aligning with how ROI actually shows up for manufacturing CXOs.

It’s usually not:

- A single, headline KPI improvement

- A dramatic headcount reduction

- A fully autonomous factory floor (yet)

It is more often:

- Fewer working capital surprises

- Tighter forecast-to-cash cycles

- Lower cost-to-serve without harming customers

- Better decisions made earlier, not faster decisions made late

AI pays back when it removes friction from decisions that already should be obvious—but aren’t, because data is fragmented, processes are stitched together by email, and tribal knowledge lives in people who are already overloaded.

Where Manufacturing CXOs Actually See ROI

1. Finance: From Reactive Control to Predictive Governance

Finance is often framed as a “back-office” AI candidate. That framing misses the point. In manufacturing, finance sits at the crossroads of operational reality and strategic intent.

Where AI delivers real value here isn’t reporting—it’s anticipation.

Practical ROI zones in manufacturing finance

Working capital optimization

- AI-assisted forecasting of receivables behavior by customer segment

- Early warning on invoice disputes before they age into write-offs

- Dynamic safety stock valuation is based on demand volatility rather than static rules.

There was a mid-sized industrial manufacturer that reduced DSO by nearly two weeks without changing payment terms—simply by using AI models to flag invoices likely to stall and routing them to the right collections path early. No bots calling customers. Just better prioritization.

Cost variance analysis should be conducted in a timely manner.

Traditional variance analysis tells you what went wrong last month. AI-enhanced models surface:

- Which plants are drifting now

- Whether the variance is structural or transient

- Which drivers matter this time (labor mix vs. scrap vs. supplier behavior)

That nuance matters. Otherwise, leadership ends up pushing blanket cost controls that fix nothing and irritate everyone.

Forecast confidence, not just forecast accuracy

Finance leaders don’t need a single number. They need:

- Confidence ranges

- Scenario sensitivity

- A sense of why the forecast might break

AI is useful here not because it’s smarter, but because it’s less emotionally invested than the spreadsheet owner defending last quarter’s assumptions.

Why this works

Finance processes are decision-dense and exception-heavy. Humans are bad at triaging exceptions at scale. AI is adept at narrowing attention to what actually deserves it.

2. Supply Chain: ROI Lives in Variability Reduction, Not Prediction Theater

Supply chain AI is full of exaggerated promises. Perfect forecasts. Autonomous planning. End-to-end visibility that magically fixes everything.

In practice, ROI comes from reducing variability, not pretending it disappears.

High-return AI use cases in manufacturing supply chains

Demand sensing that respects reality

Classic forecasting assumes historical stability. Manufacturing reality says otherwise:

- Promotions distort signals

- Channel inventory lies

- One big customer can ruin your averages

AI models that ingest POS data, order patterns, and external signals (selectively) can improve short-term demand sensing—not to perfection, but enough to:

- Reduce expedite costs

- Improve line scheduling

- Lower finished goods overproduction

The win isn’t forecast accuracy in isolation. It’s fewer downstream firefights.

Inventory segmentation beyond ABC

Static ABC analysis is blunt. AI-driven segmentation accounts for:

- Demand volatility

- Supplier reliability

- Margin contribution

- Substitutability

This leads to differentiated inventory policies that actually make sense. One automotive supplier cut overall inventory by ~12% while increasing service levels for their most volatile SKUs. That’s not magic. That’s nuance applied at scale.

Supplier risk and lead-time intelligence

AI models trained on:

- Historical lead-time variance

- Quality incidents

- Geopolitical and logistics signals

Why this works

Supply chains fail at the edges—handoffs, assumptions, delayed signals. AI shines in pattern recognition across those edges, especially where humans default to “this usually works.”

3. After-Sales & Service: The Most Underrated ROI Engine

If you want to find manufacturing AI ROI hiding in plain sight, look at after-sales.

It’s messy. It’s data-poor. It’s operationally complex. And it directly affects revenue, margins, and brand loyalty.

That combination makes it a prime candidate.

Where AI pays back in after-sales

Service demand prediction

Not “predict every failure.” That’s fantasy.

But:

- Identifying equipment populations with rising failure probability

- Anticipating parts demand regionally

- Flagging customers likely to escalate service complaints

This reduces:

- Emergency dispatches

- Excess field inventory

- Overtime costs

Parts availability optimization

After-sales inventory is notorious for:

- Obsolete stock

- Critical shortages

- Poor visibility across depots

AI helps by:

- Linking installed base data to failure patterns

- Recommending redeployment instead of replenishment

- Prioritizing parts that actually protect uptime contracts

One heavy equipment OEM reduced parts obsolescence write-offs by double digits—not by better planning meetings, but by letting models challenge long-held stocking assumptions.

Case triage and technician enablement

AI doesn’t replace technicians. It:

- Routes cases more intelligently

- Surfaces relevant service history

- Suggests likely root causes

That shortens resolution times and improves first-time fix rates—two metrics executives care about more than chatbot deflection.

Why this works

By nature, after-sales operations are exception-driven. AI thrives in environments where the “happy path” is rare.

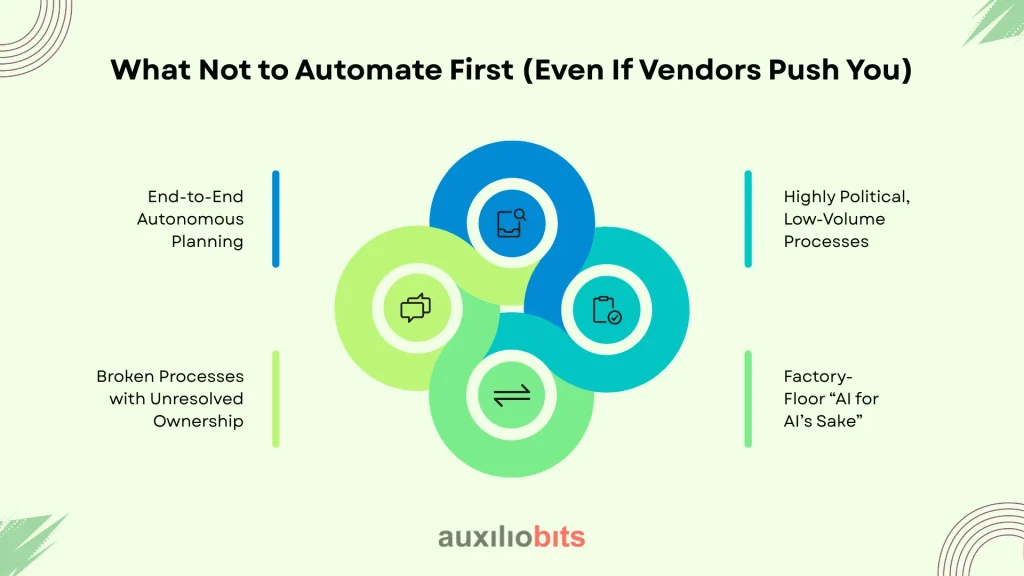

What Not to Automate First (Even If Vendors Push You)

This part matters. A lot.

Some AI initiatives fail not because the tech doesn’t work—but because they attack the wrong problems too early.

1. End-to-End Autonomous Planning

If your planners don’t trust your data, don’t understand the model logic, or routinely override system recommendations, full autonomy will backfire.

You’ll get:

- Silent resistance

- Shadow spreadsheets

- Blame when outcomes disappoint

Start with decision support, not decision replacement.

2. Highly Political, Low-Volume Processes

Executive approvals. Strategic sourcing decisions. One-off CAPEX reviews.

These processes are:

- Infrequent

- Context-heavy

- Politically sensitive

Automating them early creates more friction than value. AI can inform these decisions—but should not own them.

3. Broken Processes with Unresolved Ownership

If no one agrees who owns:

- Master data

- Exception handling

- Policy interpretation

AI will simply scale the confusion.

Automation doesn’t fix governance gaps. It exposes them faster.

4. Factory-Floor “AI for AI’s Sake”

Vision systems without stable lighting. Predictive maintenance without reliable sensor data. Optimization models on equipment that changes configuration weekly.

These can work—but only after foundational discipline is in place. Otherwise, ROI evaporates under maintenance effort and retraining costs.

A Pattern Worth Noticing

Across finance, supply chain, and after-sales, the AI initiatives that succeed tend to share traits:

- They augment judgment before replacing it

- They focus on exceptions, not averages

- They target economic friction, not technical novelty

- They accept that some decisions stay human—and design around that

The failures, by contrast, often chase:

- End-to-end autonomy too early

- Perfect predictions instead of useful ones

- Cost reduction narratives that ignore operational reality

A Subtle but Important Point on Timing

Some executives ask, “Should we wait until AI matures further?”

In manufacturing, waiting is rarely neutral. Variability compounds. Institutional knowledge retires. Manual workarounds harden into culture.

That said, starting small doesn’t mean starting shallow.

Pick problems where:

- ROI is visible within a year

- Data exists but isn’t well-used

- Humans already feel the pain

Finance close cycles. Supply chain variability. After-sales chaos. These aren’t experimental zones. They’re operational pressure points.

Conclusion

AI in manufacturing isn’t about replacing people or building futuristic factories. It’s about making fewer bad decisions at scale—and making the right ones earlier.

CXOs who see ROI aren’t chasing intelligence. They’re removing blindness.

And that, quietly, is where the money shows up.