Key Takeaways

- Automation investment includes software, setup, training, and support—costs CFOs must analyze to align with financial goals and avoid hidden surprises.

- Automation enhances productivity, reduces errors, and frees teams for strategic tasks, making it a critical financial lever for modern CFOs.

- CFOs should measure automation ROI using the formula (Net Benefit / Total Investment) × 100 to assess actual financial value.

- Payback period is vital to compare automation projects—faster returns mean lower financial risk and quicker cost recovery.

- Evaluate automation opportunities by analyzing process fit, current costs, scalability, and total cost of ownership to make informed investment decisions.

Do you know which is the most critical factor that makes or breaks a company’s financial success? Yes, you guessed it right. It is none other than automation. In today’s time, when there is so much competition, CFOs play an essential role in promoting and determining automation investments critical to cost reduction, operational effectiveness, and business expansion. There’s no doubt that due to the perks it offers, automation has gained immense popularity worldwide. Whether you are a small business owner or handling an established firm, automation will always work best for you.

However, with the wide range of automation tools and solutions available—from robotic process automation to AI-powered systems—CFOs must approach these investments with a clear understanding of their financial implications.

Also read: Real-Time Eligibility Verification Using AI + RPA

What Is Automation Investment?

An automation investment is the sum a business spends on adopting and implementing new technologies. These technologies support routine tasks that can be completed without human involvement and traditional corporate procedures and processes that can be automated.

Automation investments come with several tools and systems. We have listed them below:

Robotic Process Automation:

Software bots that mimic human actions to perform rule-based tasks like data entry, invoice processing, or report generation.

AI-based Tools:

Solutions powered by artificial intelligence and machine learning that can make decisions, analyze data, and handle more complex tasks, such as customer service chatbots or fraud detection.

Workflow Automation Software:

Platforms that help streamline business processes by automating task assignments, approvals, and progress tracking across departments.

Document Processing Systems:

Tools that use optical character recognition and AI to read, extract, and process information from physical or digital documents, such as forms, invoices, or contracts.

While automation can bring significant long-term savings and business value, it usually requires an upfront financial investment. This includes the cost of software licenses, integration with existing systems, employee training, and ongoing support or maintenance. Some automation solutions may require infrastructure upgrades or hiring experts to manage and maintain the systems.

Understanding the full scope of an automation investment is crucial for CFOs and financial leaders. It’s not just about the technology—it’s about measuring how much it costs, how quickly it delivers benefits, and how it aligns with the organization’s financial goals. Automation investments can significantly improve productivity, accuracy, and profitability when planned and executed correctly.

Why CFOs Should Care About Automation?

In today’s business environment, the Chief Financial Officer role has expanded beyond managing budgets and reducing costs. CFOs are now expected to be strategic partners who help drive financial performance, improve operational efficiency, and support the company’s long-term growth. One of the most effective ways to achieve these goals is through automation.

Automation technologies — robotic process automation, AI-driven analytics, and intelligent document processing — can significantly streamline financial operations. They take over repetitive and manual tasks like data entry, invoice matching, bank reconciliations, and compliance reporting. This speeds up processes and reduces the risk of human errors that can lead to costly mistakes in financial reporting.

By automating routine tasks, finance teams can shift their focus from transactional work to more strategic, high-value activities such as forecasting, budgeting, financial planning, and analysis. This empowers the finance function to provide deeper insights that support business decisions and improve overall financial strategy.

Automation also plays a key role in improving compliance and risk management. It helps standardize processes, ensures timely reporting, and makes audit trails more transparent. This reduces regulatory risks and increases confidence in financial data — something every CFO should prioritize.

Moreover, automation enables better resource allocation. Reducing manual workloads frees employee time, making teams more productive without increasing headcount. In the long run, this means more output with lower operating costs.

Understanding the cost and value of automation is essential for CFOs. While an upfront investment is involved, the efficiency, accuracy, and agility return can be substantial. CFOs who understand and lead automation initiatives can ensure that technology investments align with business goals and deliver measurable financial outcomes.

Understanding ROI in Automation

Return on Investment is one of the most critical metrics for evaluating the success of any business initiative, and automation is no exception. ROI helps you understand how much value or benefit you gain from an automation project compared to what it costs to implement. For CFOs and finance leaders, calculating ROI is essential to justifying spending, prioritizing projects, and ensuring that automation delivers real financial impact.

The basic formula to calculate automation ROI is: Automation ROI = (Net Benefit / Total Investment) × 100

Let’s break it down with a simple example:

- Suppose your company spends $100,000 on implementing an automation solution. This includes the cost of software, setup, training, and any support services.

- After automation is in place, you start saving around $250,000 annually. These savings come from reduced labor costs, faster processing times, fewer errors, and improved compliance.

Now calculate ROI:

ROI = ($250,000 – $100,000) / $100,000 × 100 = 150%

This means the company earns 1.5 times its original investment in just one year — a strong return.

ROI can vary depending on the automated process, the implementation scale, and the time it takes to realize the benefits. Some automation projects offer quick wins, while others may take longer to show results but provide bigger long-term gains.

It’s also important to consider indirect benefits like improved employee satisfaction, better customer experience, or reduced compliance risks. While these may not appear directly in the ROI calculation, they add significant strategic value.

What Is a Payback Period?

The payback period is a simple but essential financial metric that tells you how long it will take to recover the money you invested in an automation project. In other words, it shows how quickly your automation investment “pays for itself” through cost savings or efficiency gains.

The formula to calculate it is:

Payback Period = Initial Investment / Annual Cash Savings

Let’s look at an example:

- Suppose your company invests $100,000 in an automation solution.

- That automation saves $250,000 in yearly savings from reduced labor costs, faster processing, and fewer errors.

Payback Period = $100,000 / $250,000 = 0.4 years, or approximately 5 months.

This means your company would recover the full cost of the automation project in just 5 months. After that, all savings become pure financial gain.

A short payback period is a good sign. It means lower financial risk and quicker returns, which is especially important when managing limited budgets or justifying investments to stakeholders.

For CFOs, understanding the payback period helps compare multiple automation projects and prioritize those that deliver faster and safer returns, aligning technology choices with financial goals.

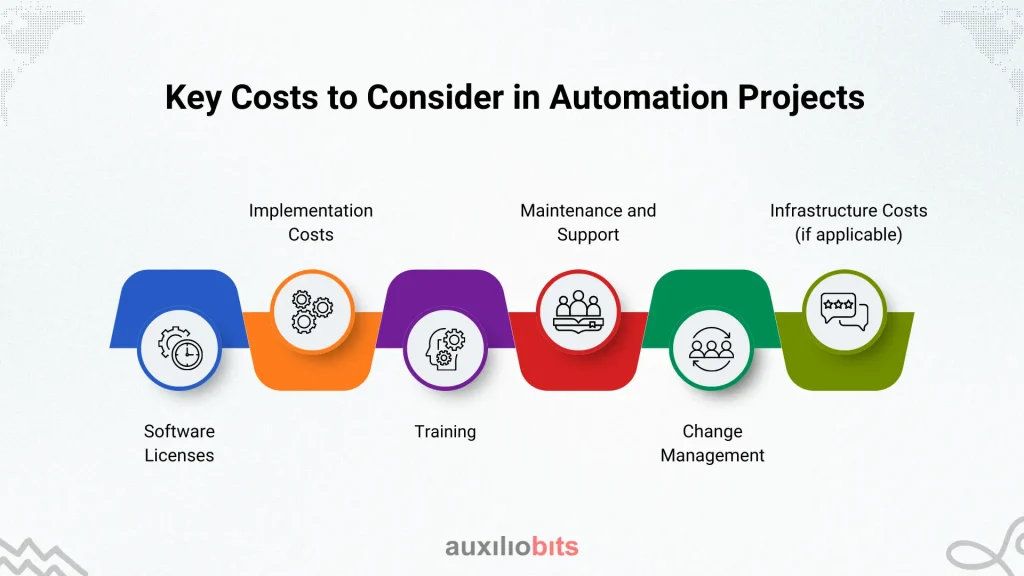

Key Costs to Consider in Automation Projects

When planning an automation project, looking beyond the technology benefits is essential. CFOs must understand all the costs involved in accurately calculating ROI (Return on Investment) and payback period. Ignoring or underestimating these costs can lead to unrealistic expectations and poor financial decisions. Below are the key cost areas you should always include when evaluating an automation initiative.

1. Software Licenses

This is often the most obvious cost. Automation tools like Robotic Process Automation (RPA), AI platforms, or workflow software usually require licenses. These could be priced per user, bot, or based on the number of automated tasks. Depending on the vendor, licensing may be a one-time or recurring subscription. Always check for hidden fees like add-ons or usage limits.

2. Implementation Costs

These are the costs of setting up the automation solution. They include configuring the software, integrating it with existing systems, and customizing workflows. To ensure a smooth rollout, you may need external consultants, technical experts, or vendor support. The more complex the process, the higher the implementation costs can be.

3. Training

Even though automation is meant to simplify work, your employees still need to learn how to use new tools and systems. This involves time and money. You may need to run training sessions, create user manuals, or pay for vendor-led workshops. Training helps ensure employees adopt the new technology effectively and avoid errors.

4. Maintenance and Support

Once automation is live, it still needs regular updates and support. Bugs, software upgrades, and system changes can affect performance. You’ll need technical support to fix issues, maintain performance, and scale automation to other departments or processes. These ongoing costs can be monthly or yearly.

5. Change Management

Automation doesn’t just affect technology — it changes how people work. Employees may resist change, fear job loss, or feel unsure about new roles. Change management includes communication plans, engagement activities, and leadership support to help teams adapt. This cost is often overlooked but plays a significant role in the success of automation projects.

6. Infrastructure Costs (if applicable)

Sometimes automation tools require additional hardware, cloud services, or upgrades to your IT environment. For example, AI-based systems may need more processing power or storage capacity. Be sure to assess whether any infrastructure investments are required.

How to Evaluate an Automation Opportunity?

Before investing in an automation solution, it’s essential to evaluate whether the opportunity is worth it carefully. Not every process is a good candidate for automation, and not every tool will deliver the same value. CFOs and decision-makers should ask key questions to assess the potential benefits, risks, and costs. Here’s how to break it down in simple terms:

1. What process is being automated?

Start by identifying the specific task or process. Is it repetitive, rule-based, and time-consuming? Good candidates for automation are processes that are done the same way every time, don’t require a lot of judgment, and are performed often. Examples include invoice processing, data entry, payroll processing, and report generation. If the process involves many steps but slight variations, it’s likely a strong automation opportunity.

2. What is the current cost of the process?

Next, look at what the process costs you today. This includes more than just labor costs. Consider the time employees spend doing the task, the cost of errors or delays, and the impact on customer experience or compliance. Estimating this baseline helps you compare it with the expected savings after automation.

3. What is the expected benefit?

What improvements do you expect from automating the process? Common benefits include time savings, fewer errors, better compliance, and faster turnaround. You may also see benefits in employee satisfaction by removing tedious or frustrating tasks. Try to estimate the value of these benefits in financial terms so you can calculate ROI later.

4. How scalable is the solution?

Can this automation solution be used in other parts of the business? For example, if you automate invoice processing in one department, can you roll it out to others? A scalable solution provides greater long-term value because it can be reused and expanded, reducing the cost per use over time.

5. What is the Total Cost of Ownership (TCO)?

Finally, look beyond just the upfront price. The TCO includes all the costs over the life of the automation, including software, implementation, training, maintenance, support, and upgrades. Understanding the full cost helps you avoid surprises and make a more accurate ROI or payback calculation.

By asking these questions, CFOs can make smarter, data-driven decisions and invest in automation projects that genuinely add value.

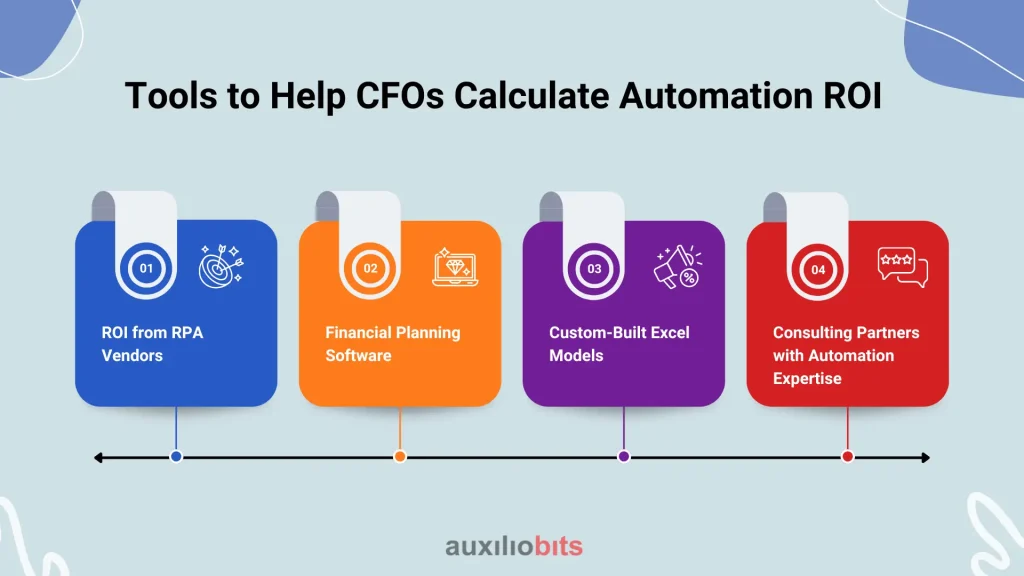

Tools to Help CFOs Calculate Automation ROI

Calculating the Return on Investment (ROI) and payback period for automation projects is essential for making informed financial decisions. Fortunately, there are several helpful tools and resources that CFOs can use to make this process easier, more accurate, and more strategic. Here’s a simple look at the most valuable options:

1. ROI from RPA Vendors

Many robotic process automation vendors, like UiPath, Automation Anywhere, and Blue Prism, offer free or built-in ROI calculators. These tools help organizations estimate potential savings based on their specific use cases. You simply enter details like current process time, labor cost, and expected automation efficiency, and the tool calculates the expected ROI, payback period, and long-term savings. While these calculators are helpful starting points, remember they may highlight best-case scenarios, so always validate the assumptions.

2. Financial Planning Software

Finance teams often use tools like Anaplan, Workday Adaptive Planning, or Oracle Planning Cloud for budgeting and forecasting. These platforms can also be used to model automation investments. They allow you to run scenarios, include automation costs and savings in your financial plans, and track actual performance over time. Using a tool familiar to the finance team ensures better accuracy and integration into overall business planning.

3. Custom-Built Excel Models

Excel remains one of the most flexible and widely used tools for financial analysis. CFOs can create custom ROI calculators using spreadsheets tailored to their organization’s automation plans. Excel models can include inputs for all cost categories (software, training, and support) and forecast expected benefits (like labor savings and error reduction). You can also use formulas to automatically calculate ROI, payback period, and even sensitivity analysis to understand different scenarios.

4. Consulting Partners with Automation Expertise

Sometimes, it’s best to bring in outside experts. Automation consultants can help you evaluate processes, build detailed cost-benefit models, and provide accurate ROI projections. They bring experience from similar projects and can offer industry benchmarks. A trusted partner can help you avoid mistakes and ensure realistic ROI calculations.

Having the right tools helps CFOs make smart decisions about automation investments. Whether you use vendor calculators, planning software, Excel, or expert advice, accurate ROI and payback insights are key to choosing the right projects and achieving long-term value.

Conclusion

For CFOs, automation is more than a tech upgrade—it’s a financial strategy. By understanding how to evaluate automation investments through ROI and payback periods, you can make smarter decisions that improve efficiency and profitability.

Make data your ally and let automation work for your bottom line.