Key Takeaways

- Process mining turns HyperAutomation programs from anecdotal wins into data-driven, self-optimizing fabrics.

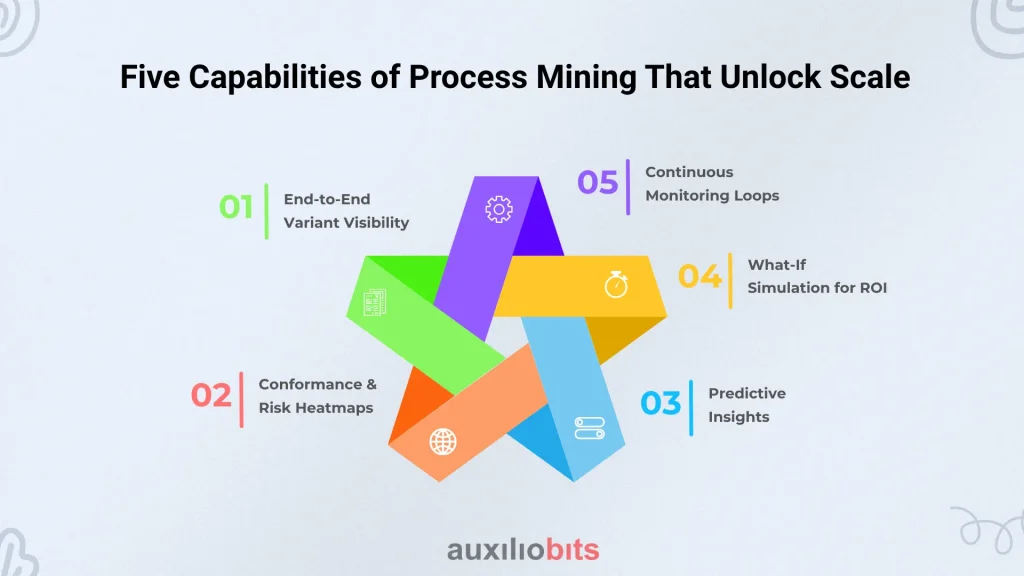

- Five advanced capabilities—variant visibility, conformance, prediction, simulation, and continuous monitoring—unlock sustainable scale.

- Integration with RPA, iPaaS, and Agentic AI enables closed-loop self-healing workflows.

- Market momentum is undeniable: forecasts show a 42 percent CAGR to $42 billion by 2032.

- A staged roadmap and strong governance prevent analysis paralysis and automation sprawl.

HyperAutomation has become the board-level mantra for eliminating latency, cost, and risk across complex value chains. Yet even the most ambitious programs struggle to move beyond scattered task bots. Process mining fills that gap by acting as an enterprise-grade “MRI,” ingesting timestamped event logs from ERP, CRM, MES, and IoT platforms, then reconstructing every path the work can take. In Gartner’s 2024 Magic Quadrant for Process Mining, 18 vendors earned coverage, underlining how strategic the discipline has become for CIOs looking to scale automation rather than dabble in it.

The technology is not simply diagnostic. Modern suites layer simulation, machine learning, and low-code connectors on top of the raw process graph, converting insights into orchestrated actions. That combination—transparent discovery and closed-loop automation—turns HyperAutomation from a patchwork of scripts into a continuously self-optimizing fabric.HyperAutomation has become the board-level mantra for eliminating latency, cost, and risk across complex value chains. Yet even the most ambitious programs struggle to move beyond scattered task bots. Process mining fills that gap by acting as an enterprise-grade “MRI,” ingesting timestamped event logs from ERP, CRM, MES, and IoT platforms, then reconstructing every path the work can take. In Gartner’s 2024 Magic Quadrant for Process Mining, 18 vendors earned coverage, underlining how strategic the discipline has become for CIOs looking to scale automation rather than dabble in it.

The technology is not simply diagnostic. Modern suites layer simulation, machine learning, and low-code connectors on top of the raw process graph, converting insights into orchestrated actions. That combination—transparent discovery and closed-loop automation—turns HyperAutomation from a patchwork of scripts into a continuously self-optimizing fabric.

Also read: HyperAutomation: Beyond RPA to Full-Scale Enterprise Autonomy.

Why HyperAutomation Initiatives Stall After the Pilot Phase?

Many automation programs falter not because the technology under-delivers, but because structural blind spots emerge the moment a pilot confronts real-world scale.

1. Pilot purgatory. A proof-of-concept often runs in a controlled, single-line environment where variables are limited and champions are hyper-engaged. When the same automation is transplanted to another plant, business unit, or geography, dozens of subtle differences—data schemas, exception codes, approval hierarchies—surface. Because these nuances were invisible during the pilot, the original design breaks, benefits shrink, and sponsors lose confidence in further rollouts.

2. Fragmented prioritization. Without holistic visibility into end-to-end value streams, organizations choose automation candidates based on political influence or anecdotal pain points. The result is a patchwork of disconnected bots that solve local bottlenecks while ignoring systemic constraints. Over time, the enterprise accumulates “islands of efficiency” that fail to raise overall throughput or customer experience, eroding executive support.

3. Automation debt. Every bot or script introduces credentials, custom error-handling, and monitoring hooks. When these assets proliferate without a disciplined reuse strategy, each subsequent change—an ERP patch, a policy update, a new compliance rule—requires manual regression testing across an ever-growing inventory. The effort to keep the estate running eventually exceeds the perceived benefit, freezing further investment.

4. Why process mining matters. By reconstructing the whole, timestamped reality of how work flows, process mining exposes hidden variants, quantifies systemic value, and pinpoints precisely where automations should be injected. Armed with empirical insights, leaders can generalize lessons across plants, align roadmaps to the highest ROI areas, and design reusable, governed bot components—turning pilot victories into enterprise-wide momentum.

Process Mining 101—A Quick Primer for Automation Leaders

Process mining sits at the intersection of data science and business process management. Three factors matter most:

| Discipline | Core Question | Typical Output | HyperAutomation Leverage |

| Discovery | “What happens?” | Variant graph | Spots with high-volume manual detours are ripe for RPA |

| Conformance | “Where do we deviate?” | Red/green risk overlay | Flag non-compliant paths for auto-remediation |

| Enhancement | “How could we improve?” | Simulation dashboard | Test automation scenarios before coding |

Five Capabilities of Process Mining That Unlock Scale

To move beyond isolated automations and into enterprise-scale transformation, HyperAutomation programs need more than visibility—they need continuous intelligence. Process mining delivers this through five core capabilities that bridge strategy and execution with precision and speed.

1. End-to-End Variant Visibility

X-ray-level transparency ensures architects see every path, frequency, and elapsed-time delta—critical for designing bots that withstand real-world chaos, not just the “happy path.”

2. Conformance & Risk Heatmaps

European insurers now flag GDPR breaches in real time; one life insurance carrier reduced audit preparation time by 50 percent and avoided penalties by automating compliance checks directly from mining insights.

3. Predictive Insights

Specific platforms embed machine-learning models that forecast SLA breaches hours in advance, giving AI agents time to reroute work or trigger proactive customer outreach.

4. What-If Simulation for ROI

Before writing a single line of bot code, business users can test “what happens if we automate activity A and eliminate approval B?” The simulation outputs cycle-time, cost, and compliance deltas, letting executives fund only the highest-yield sprints.

5. Continuous Monitoring Loops

Always-on connectors stream fresh event data into the mining engine, instantly surfacing new variants caused by ERP patches, regulatory changes, or post-merger data harmonization. Governance teams receive alerts, preventing process drift and “silent” technical debt.

Integration Patterns: Process Mining + RPA + Agentic AI

When process mining insights are integrated with automation tools like RPA, and agentic AI, enterprises unlock self-healing, context-aware workflows that don’t just detect issues—they resolve them autonomously. The following integration patterns illustrate how this synergy creates intelligent, scalable operations.

- Trigger-Based Automation. A conformance rule detects that an invoice has bounced between approvers more than three times. The mining engine pings an RPA queue; a bot extracts missing PO details and automatically resubmits the document.

- Closed-Loop Self-Healing. Predictive monitoring forecasts a likelihood of SLA breach; an LLM-powered agent emails the customer, updates delivery promises, and injects a rush-order flag into SAP—all without human intervention.

- Data-Mesh Federation. Mining-derived KPIs (e.g., “touchless order rate”) are published as real-time streams via an iPaaS broker, allowing BI dashboards, digital twins, and control towers to subscribe without duplicating ETL logic.

These patterns elevate process mining from a reporting utility to a fabric that continuously senses, decides, and acts.

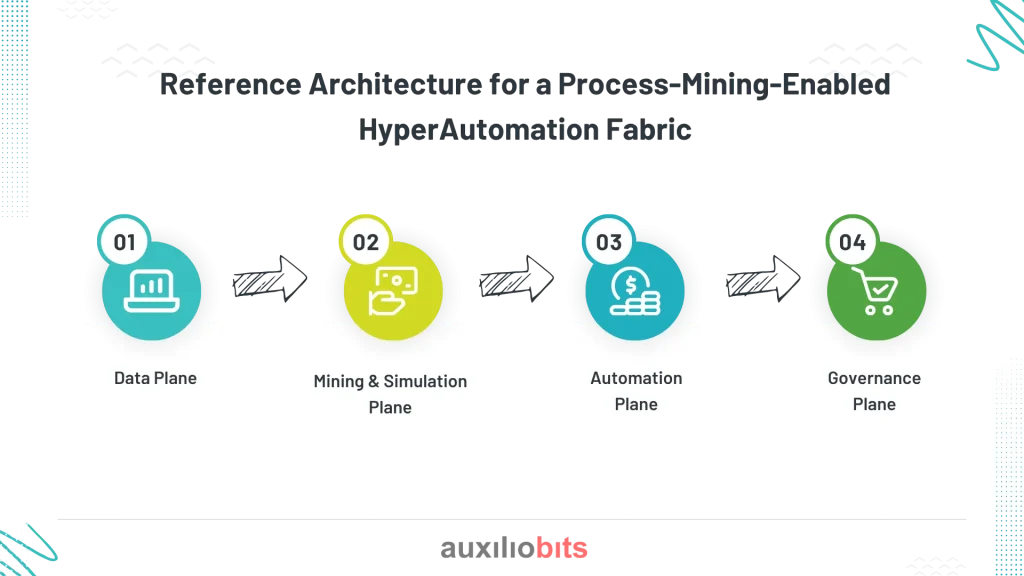

Reference Architecture for a Process-Mining-Enabled HyperAutomation Fabric

To operationalize process mining at scale and avoid automation silos, enterprises need a modular yet tightly integrated architecture. The following four-layer reference model provides a blueprint for embedding mining intelligence into the core of HyperAutomation, ensuring flexibility, scalability, and control.

1. Data Plane. Change-data-capture (CDC) connectors pull logs from SAP, Salesforce, Jira, shop-floor historians, and IoT gateways into a lakehouse built on Delta or Iceberg.

2. Mining & Simulation Plane. Discovery, conformance, predictive, and simulation engines reside here, exposing REST and Kafka endpoints for downstream consumption.

3. Automation Plane. RPA robots, low-code flows, and Agentic AI services subscribe to mining events. BPMN-compatible workflow engines handle orchestration to ensure traceability and transparency.

4. Governance Plane. A metadata catalog maintains lineage; policy engines enforce segregation of duties, role-based access, and automated testing pipelines so that changes propagate safely across hundreds of bots.

By decoupling planes, enterprises avoid vendor lock-in and gain the agility to swap out best-of-breed components without re-platforming.

High-Impact Use Cases Across Enterprise Functions

Process mining’s versatility shines when applied across departments, unlocking deep automation value far beyond finance. From accelerating collections to streamlining procurement and enabling straight-through processing in insurance, these real-world examples illustrate how mining insights drive measurable impact across industries.

Finance—Order-to-Cash (O2C) Acceleration

Baseline: 48-day DSO and 22 percent invoice dispute rate.

Mining Insight: 18 percent of orders detour through Credit after goods ship, delaying billing.

Automation: A Pre-credit-check agent calls a bureau API during order entry; a bot writes limits back to the ERP.

Outcome: DSO falls to 34 days; $18 million in working capital freed.

Manufacturing—Procure-to-Pay (P2P) Cost Leakage

Grand View Research pegs the process-mining software market at $1.43 billion in 2024, with a blistering 59.4 percent CAGR to 2030—manufacturers representing one of the fastest-growing verticals.

Mining Insight: 14 invoice-approval variants; five exceed 10 days.

Automation: Three-way-match bot plus price-deviation AI model.

Outcome: Cycle time cut by 44 percent; early-payment-discount capture up 0.8 percent.

Insurance—Claims Straight-Through Processing

Mining Insight: 62 percent of motor claims stall awaiting police reports.

Automation: Whisper-enabled agent extracts report data and auto-uploads to the core system.

Outcome: Straight-through rate jumps from 28 percent to 71 percent, boosting NPS by 11 points.

These vignettes demonstrate that process mining is not confined to finance; any data-rich workflow can be continuously improved.

ROI Benchmarks and Market Outlook

Fortune Business Insights projects the global process-mining market to soar from $3.66 billion in 2025 to $42.69 billion by 2032—a 42 percent CAGR.

Mordor Intelligence adds that O2C alone accounts for 31.5 percent of 2024 spend, highlighting abundant low-hanging fruit for CFOs.

Customer case studies support the macro view: Celonis reports median cycle-time reductions of 30–60 percent and double-digit EBITDA gains when insights are integrated into RPA and agentic workflows. Combined with shrinking software TCO—thanks to SaaS delivery and auto-generated connectors—the payback period often falls below nine months.

A Pragmatic Four-Stage Implementation Roadmap

| Stage | Objective | Duration | Key Deliverables |

| Discover | Capture logs, map variants | 4–6 weeks | “As-is” process map, latency hotspots |

| Design | Prioritize and simulate | 2–4 weeks | Business case, automation backlog |

| Automate | Build bots & AI agents | 8–12 weeks | Orchestrated workflows, UAT results |

| Monitor & Scale | Continuous optimization | Ongoing | Drift alerts, benefit tracking |

Running these stages in a rolling wave keeps a steady pipeline of high-ROI sprints while avoiding analysis paralysis.

Common Pitfalls and How to Avoid Them

While process mining offers transformative potential, scaling it successfully requires sidestepping common traps that can undermine momentum, inflate costs, or dilute value. Below are four pitfalls that frequently derail enterprise efforts—and proven ways to avoid them.

- Data-Quality Illusions. Missing user IDs or activity codes can splinter a variant graph. Mitigation: Incorporate data-observability tools and run log-completeness checks before discovery.

- Dashboard Decoration. Beautiful but unused dashboards add no value. Pair every KPI with an owner and an automated trigger that launches remediation.

- Governance Overkill. Requiring C-suite signatures for every log extract kills momentum. Use a tiered model: a sandbox for discovery and gated promotion for production artifacts.

- Automation Sprawl. Bots created outside a reuse registry balloon the maintenance cost. Standardize assets in a shared library tied to version control and DevSecOps pipelines.

Final Verdict

Process mining is no longer a back-office diagnostic tool—it is the strategic engine that powers scaled, intelligent HyperAutomation. As enterprises grapple with fragmented workflows, invisible bottlenecks, and automation programs that stall after the pilot, process mining delivers the data-backed clarity and continuous intelligence required to move forward with confidence.

From unearthing hidden variants in the Order-to-Cash cycle to predicting SLA breaches in customer service, its real value lies in enabling closed-loop automation: sensing what’s happening, deciding what to do, and acting autonomously and at scale. When integrated with technologies like RPA, iPaaS, and Agentic AI, process mining elevates automation from isolated bots to a living system that continuously adapts, optimizes, and governs itself.

For organizations seeking more than one-off efficiencies—for those aiming to rewire how their business operates—process mining is not optional. It is foundational. And as market momentum builds and capabilities evolve, the enterprises that embrace this paradigm now will not only scale faster—they’ll lead the future of autonomous operations.

In the age of HyperAutomation, scale is not a function of tools—it’s a function of insight. And process mining is how that insight is made actionable.