Key Takeaways

- HyperAutomation delivers ROI by enabling strategic shifts in finance and supply chain operations, not just efficiency.

- OCR is critical in converting unstructured documents into machine-actionable data, reducing latency and unlocking financial value.

- Non-obvious metrics, such as OCR yield rate, ATV, and document value impact, should replace hours-saved KPIs.

- C-level leaders must architect ROI by planning for auditability, resilience, and model adaptability from day one.

- Enterprises that succeed won’t just automate—they will continuously evolve how work happens.

Global CFO surveys indicate over 47% of organizations are under margin pressure despite revenue growth. Automation, in isolation, hasn’t reversed this. What executives need is operational leverage, not another IT project.

HyperAutomation—done right—delivers not only cost optimization but model fluidity: the ability to adapt operating models in real-time under macroeconomic pressure.

The real ROI lies not in automation per se, but in the ability to restructure effort, risk, and timing in core processes—with OCR playing a critical role in activating unstructured data across enterprise silos.

Also read: HyperAutomation: Beyond RPA to Full-Scale Enterprise Autonomy.

From Task Automation to ROI Architecture

Traditional automation initiatives are typically designed with task-level metrics, including reduced FTEs, improved SLA compliance, and fewer errors. HyperAutomation demands a shift in thinking: ROI is not the sum of microefficiencies—it is the strategic delta between the baseline and new operating archetypes.

What the C-Suite Needs:

- Latency elimination, not just acceleration

- Cost-per-iteration drops with every new transaction.

- Non-linear scaling through modular AI + OCR agents

- Input tolerance: Systems that work with imperfect or variable data

For example, in finance, HyperAutomation isn’t about processing invoices faster—it’s about creating a liquid payable architecture where terms optimization, early payment discounts, and supplier financing are algorithmically surfaced.

OCR: The Forgotten Link in E2E Digitization

Most automation pipelines choke when encountering non-structured inputs, such as PDFs, shipping documents, handwritten notes, and supplier statements. OCR, particularly context-aware, AI-augmented OCR, bridges this gap.

But OCR isn’t just data extraction—it’s semantic reconstruction. Advanced systems now combine OCR with:

- Named entity recognition (NER) to auto-classify supplier names or contract clauses

- Table structure inference for nested invoice line items

- Image segmentation + ML-based form identification, practical in freight or customs documents

For CTOs, this means fewer “exception cases” routed to humans, and a self-healing pipeline that adapts over time.

Finance Ops: Beyond Cost Saving—Toward Margin Fluidity

OCR in Multi-Entity Invoice Intelligence

Enterprises operating across multiple geographies often encounter complex invoice formats, diverse currencies, and varying tax policies. Basic OCR engines fail here. Modern solutions utilize deep learning-based layout parsing and adaptive OCR pipelines that are retrained across various formats.

ROI lever: Automating entity-aware invoice interpretation saves on compliance violations and allows centralized AP operations with local policy adherence.

Cash Forecasting with AI-Augmented AP/AR

CFOs can no longer rely on quarterly cash projections. With AI agents integrated into OCR-RPA workflows, dynamic working capital models can be built. These agents:

- Auto-classify invoice risk scores

- Predict payment delays based on historical supplier behavior.

- Simulate early payment discount scenarios across liquidity positions

The ROI isn’t just faster processing—it’s financial optionality unlocked.

Supply Chain Ops: Real-Time Adaptation as an ROI Lever

Intelligent Document Flow in Procurement

OCR unlocks auto-intelligence across supplier contracts, RFP submissions, and SLA documents. But the strategic leap is enabling:

- Clause-level comparison across vendors

- OCR + NLP to flag pricing anomalies or unapproved modifications

- Automated flagging of expiration triggers tied to procurement workflows

This moves procurement from tactical processing to strategic sourcing intelligence, with a measurable impact on procurement velocity, vendor compliance, and contract leakage.

OCR for Predictive Logistics Visibility

Asynchronous document flows often hinder logistics execution—POs arrive in PDFs, while shipment receipts are typically faxed or emailed. OCR is no longer optional; it enables:

- Pre-ingestion of shipment documents to surface mismatches before goods arrive

- AI agents read scanned customs forms to estimate clearance delays.

- Automated discrepancy resolution between freight invoices and delivery confirmations

For CTOs, this shift focuses on preemptive decision support—a primary driver of ROI.

Quantifying ROI in High-Variance Processes

Unlike static automation (e.g., password resets), finance and supply chain involve highly variable inputs. OCR enables HyperAutomation to function even when:

- Document formats change

- Layouts vary by region or vendor.

- The data is incomplete, poorly scanned, or handwritten.

Thus, ROI here is less about speed, more about automation coverage and adaptability.

Key Metric: Automation Throughput Variability (ATV)

This KPI measures the consistency with which automation performs across varying input conditions. Firms with high ATV can expand automation scope without reengineering pipelines.

Benchmark-Grade Metrics: Beyond Hours Saved

Traditional RPA success is often measured by hours saved—a flawed metric at scale. C-level leaders should focus on:

| Metric | Strategic Insight |

| Digital STP (Straight-Through Processing) Rate | % of transactions processed without human intervention post-OCR |

| Value Unlocked per Document | Early payment discounts, late fees avoided, and SLA rebates |

| OCR Yield Rate | % of documents where usable data was extracted in the first pass |

| Time to Exception Resolution | Measure of AI-agent effectiveness in resolving OCR errors |

Combine these with the net present value (NPV) of automation over a 3–to 5–year period to justify capital expenditures.

Use Cases: Enterprise-Scale ROI Realized

Tier-1 Automotive Supply Chain (Global)

- OCR used to ingest 500K+ customs clearance documents/year

- RPA agents resolved discrepancies with ASN (Advanced Shipping Notices)

- Result: 28% faster border clearances, $3.5M in SLA compliance recovery

- ROI: 320% YoY

Fortune 500 Retail Finance Function

- Deployed OCR + AI agents to manage supplier invoice variability across 13 countries

- Reduced human validations by 82%

- Real-time working capital analytics reduced cash reserve requirement by $9M.

- ROI payback in 7 months

Executive Challenges: Auditability, Failure Modes, Obsolescence

Auditability

OCR-led pipelines must maintain source traceability. For finance workflows, this is critical during internal or external audits.

A significant concern: Is extracted data preserved with an immutable audit trail?

Advanced solutions embed document hashes + AI interpretation logs, enabling explainability.

Failure Modes

When OCR fails (e.g., low-contrast scans), does the pipeline auto-escalate or halt? Intelligent OCR must integrate confidence scoring, allowing agentic rerouting or fallback rules.

Obsolescence

Models trained on 2023 formats will degrade with the introduction of new templates. CTOs must plan for continuous retraining infrastructure using data flywheels, where each processed document improves the next.

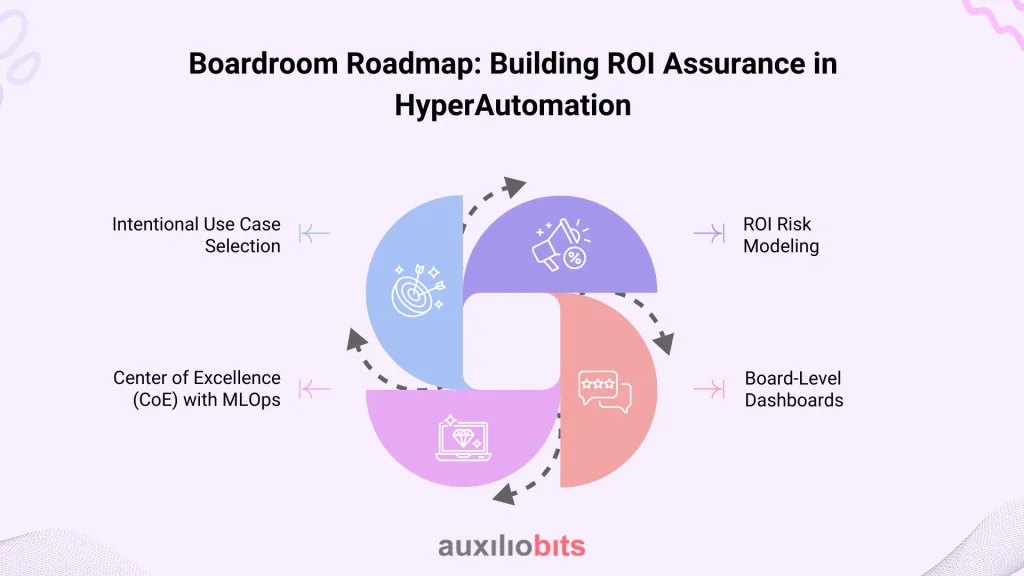

Boardroom Roadmap: Building ROI Assurance in HyperAutomation

For CEOs charting digital transformation, HyperAutomation isn’t a “deploy-and-forget” initiative. It requires:

1. Intentional Use Case Selection

Target volatile, document-intensive, and decision-impacting processes. Not just repetitive ones.

2. ROI Risk Modeling

Account for OCR failure rates, AI hallucination risks, and exception handling delays. Use Monte Carlo simulations for ROI range estimation.

3. Center of Excellence (CoE) with MLOps

Establish cross-functional governance for the OCR and AI model lifecycle. Centralized control, federated execution.

4. Board-Level Dashboards

Go beyond bot utilization. Monitor cost-to-serve, automation variability impact, and document value activation rates.

Conclusion

The ROI of HyperAutomation in finance and supply chain no longer lies in marginal task savings but in transformational process liquidity, strategic timing optimization, and real-time intelligence generation.

OCR, while often overlooked, is the essential catalyst that enables automation to function across unstructured reality. Without it, automation is blind. For CEOs, the opportunity lies in building real-time enterprises that think, adapt, and make decisions near real-time. For CFOs, it’s about unlocking capital trapped in inefficient flows. And for CTOs, it’s about building autonomous infrastructure that learns from data without overhauling core systems.