Key Takeaways

- RPA ROI is harder to model than traditional investments because savings depend on process complexity, exception handling, and how organizations treat freed-up labor.

- Baseline accuracy drives credibility—capturing transaction volumes, AHT, FTE costs, and rework is non-negotiable for a defensible ROI case.

- Spreadsheets remain the default tool, but process mining and sensitivity analysis strengthen models by grounding assumptions in real data.

- Overpromising is the fastest way to lose trust—inflated automation rates, ignored exception costs, or unrealistic headcount reduction projections erode credibility.

- ROI modeling is as much about politics as math—operations, finance, and IT all have different stakes. The best models balance these perspectives and leave room for positive surprises.

Executives nod politely at any automation pitch—until the second slide with numbers shows up. Then the real questions begin. What’s the payback? How fragile are these assumptions? And, importantly, who gets to own the savings? If you’ve ever been on the delivery side of a robotic process automation initiative, you know the technical proof of concept is usually the easy part. The real battle happens when finance asks for a defensible model of returns.

There have been programs stalled because the ROI argument was thin. On the other hand, there have been projects greenlit on shaky math—only to have those numbers come back to haunt the sponsor when benefits were audited a year later. Modeling ROI for RPA is not just about producing a spreadsheet—it’s about establishing credibility with the business, operations, and finance teams.

This article digs into the mechanics of ROI modeling for RPA, the tools people actually use, and some techniques that separate believable numbers from wishful thinking.

Also read: How to Scale RPA from One Bot to an Enterprise-Wide Framework?

Why ROI Modeling for RPA is Uniquely Difficult

Unlike capital expenditures on machinery or real estate, RPA’s value proposition often depends on how people work today—and how much of that work you can realistically automate. A few reasons why ROI calculations are tricky:

- Process variance: Even standardized workflows hide exceptions. Bots handle the 80%, but the 20% of odd cases still require human intervention. That chips away at savings.

- Labor dynamics: Just because a bot saves three hours a day doesn’t mean you actually reduce headcount. Sometimes it just frees capacity. Finance teams will press hard on whether these are “hard” or “soft” savings.

- Bot fragility: Unlike ERP modules, RPA scripts break when the interface changes. The ongoing maintenance cost isn’t always captured in initial ROI models.

- Scaling fallacy: Multiplying savings from one process by ten processes is tempting, but usually wrong. Processes don’t scale linearly, and overhead costs rise.

This is why ROI modeling for RPA is part finance, part operations, and part political negotiation.

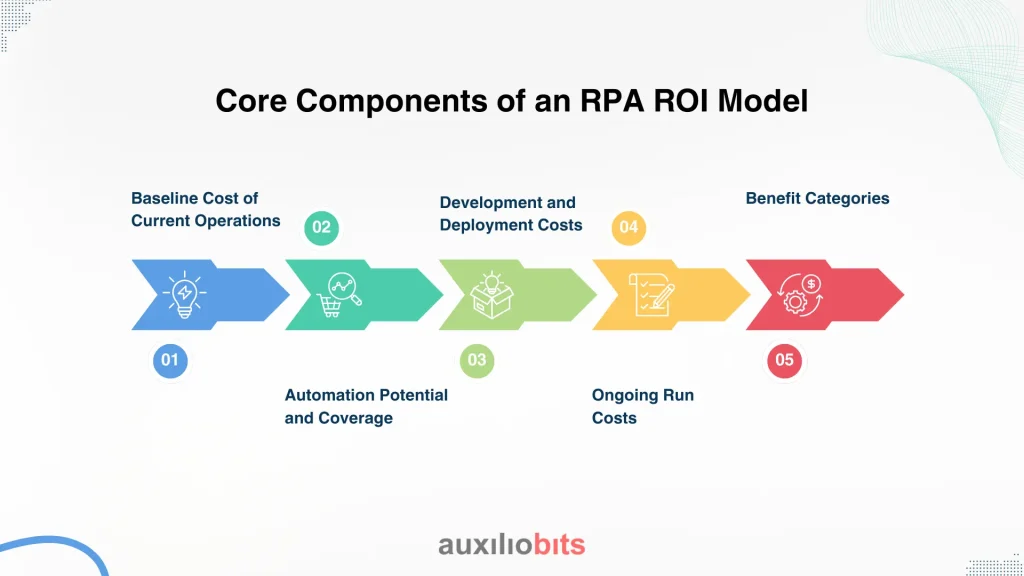

Core Components of an RPA ROI Model

Every credible ROI model I’ve seen for RPA has a few non-negotiable elements. Without them, stakeholders won’t buy in.

1. Baseline Cost of Current Operations

You can’t prove savings without understanding the “as-is” cost. This means documenting:

- Transaction volumes (per week, month, year).

- Average handling time (AHT) per transaction.

- Full-time equivalent (FTE) effort required, including salaries, benefits, and overhead allocations.

- Error rates and rework costs (these are often ignored but can be substantial).

One financial services client discovered that 15% of their loan origination time was spent fixing errors in data entry. That became a hidden ROI driver when automation reduced error-induced rework.

2. Automation Potential and Coverage

Not every part of a process is automatable. A good ROI model breaks the process into segments:

- Fully automatable (straight-through processing).

- Partially automatable (bots handle routine, humans handle exceptions).

- Non-automatable (judgment-heavy work).

Mapping these percentages prevents inflated savings.

3. Development and Deployment Costs

Too many proposals only include licensing fees. The real costs include:

- RPA platform licenses.

- Infrastructure (cloud hosting, virtual machines).

- Development effort (internal or outsourced).

- Change management and training.

- Compliance and audit readiness (often overlooked until year two).

4. Ongoing Run Costs

Bots aren’t “set and forget.” Maintenance, bot monitoring, and upgrades eat into returns. There have been programs where 30% of the expected ROI vanished because they underestimated ongoing costs.

5. Benefit Categories

The model should cover:

- Hard savings: Direct labor cost reduction or avoidance.

- Soft savings: Capacity creation, faster cycle times, and better compliance.

- Risk mitigation: Avoided penalties, reduced fraud, improved auditability.

Finance departments usually discount soft savings unless you can tie them to revenue impact.

Tools for RPA ROI Modeling

Now, onto the actual tools. There isn’t a single “gold standard,” but several categories are common.

1. Excel and Google Sheets (Still the Default)

Most ROI models for RPA still live in spreadsheets. Why? Flexibility. Finance teams trust them because they can see and tweak the formulas themselves. Pros: transparency and customizability. Cons: models get messy, assumptions creep in, and version control becomes a nightmare.

2. Vendor ROI Calculators

Most RPA vendors (UiPath, Automation Anywhere, Blue Prism, etc.) provide ROI calculators. They’re useful for quick estimates, but be careful

- They often assume 100% automation rates.

- They understate maintenance costs.

- They frame everything in ways that make their platform look attractive.

3. Process Mining Tools

Celonis, UiPath Process Mining, and similar platforms now include ROI dashboards. These are more data-driven, since they extract transaction logs from ERPs and CRMs. The advantage is accuracy: you see actual handling times, not self-reported estimates. But they require IT involvement and an upfront integration effort.

4. Dedicated ROI Platforms

Some consulting firms have built proprietary ROI modeling tools for RPA. These usually combine time tracking, financial modeling, and scenario planning. Unless you’re running a large-scale automation program, these may be overkill.

Techniques for Building a Credible ROI Case

Even with the right data and tools, the technique of modeling matters. Numbers don’t speak for themselves—you have to frame them in ways that withstand scrutiny.

1. Be Conservative with Automation Rates

Claiming “90% automation” is a red flag. Real-world processes rarely allow that level. Start with 60–70% unless you have very strong evidence. A conservative assumption builds trust.

2. Distinguish Between FTE Savings and Actual Headcount Reduction

Saying “this saves 5 FTEs” sounds good, but if the company isn’t planning layoffs, those savings aren’t realized. Frame them as capacity gains instead. Be explicit: “This creates capacity equivalent to 5 FTEs, which can be redeployed to higher-value work.”

3. Use Sensitivity Analysis

Executives don’t just want the base case—they want to see how fragile the model is. What if transaction volumes fall 10%? What if bot maintenance costs double? Scenario analysis is critical.

4. Account for Ramp-Up Time

Savings don’t appear on day one. Bots need stabilization. A good model phases in benefits over 6–12 months. I once saw a program promise $1M in year one savings, only to deliver half because the bots kept breaking during the first quarter.

5. Show Non-Financial Metrics Alongside

Cycle time reductions, improved SLA compliance, and error rate drops matter. They don’t replace financial ROI, but they strengthen the case.

Real-World Examples

- Insurance Claims Processing: An insurer’s automated claims intake, expecting $2M annual savings. In reality, only $1.2M materialized. Why? Exception handling was higher than expected, and IT costs for maintaining integrations ballooned. The CFO later remarked that if the ROI model had included sensitivity analysis, they’d have planned differently.

- Banking KYC Checks: A European bank used process mining to baseline its Know Your Customer onboarding. They discovered average handling time was 40 minutes, not the 20 minutes staff estimated. That doubled the savings case and helped secure budget. The automation delivered close to projections because the model was grounded in actual system data.

- Manufacturing Accounts Payable: A manufacturer’s automated invoice matching. They modeled $600K in savings but categorized half as “capacity creation.” This avoided conflict with finance and operations. When volumes grew 20% the following year, the freed-up capacity absorbed the increase without additional hires—an ROI success, though not in the traditional sense.

Common Pitfalls to Avoid

- Overpromising headcount reduction that never materializes.

- Ignoring exception handling, which erodes savings.

- Forgetting IT overheads (VM costs, monitoring tools, upgrades).

- Treating vendor calculators as gospel instead of rough guides.

- Failing to engage finance early leads to skepticism later

Advanced Techniques

For more mature programs, ROI modeling gets sophisticated:

- Monte Carlo Simulation: Instead of single-point assumptions, simulate thousands of scenarios with different volumes, error rates, and costs. This gives a probability distribution of ROI, which finance teams love.

- Total Cost of Ownership (TCO) Models:Include not just RPA but adjacent costs—OCR tools, AI services, and compliance overheads. A holistic view prevents surprises.

- Balanced Scorecard: Some firms track ROI alongside strategic metrics (customer satisfaction, compliance risk reduction) to capture value beyond pure dollars.

An Important Note

Here’s the uncomfortable truth: ROI modeling for RPA is as much politics as math. Operations teams want to show big savings. Finance wants to discount anything that isn’t hard dollar. IT wants costs accounted for. Getting alignment means balancing these perspectives. Sometimes the smartest move is to understate ROI slightly—better to surprise positively than to be accused of inflating numbers.

Final Thoughts

ROI modeling for RPA isn’t about producing the prettiest spreadsheet. It’s about telling a believable story backed by data, with enough nuance to withstand CFO-level scrutiny. If you can show that you’ve considered exceptions, maintenance, and the messy realities of work, your model will stand apart from the “magic 80% savings” claims that give automation a bad name.

The irony is that good ROI modeling requires as much human judgment as it does calculation. Numbers convince, but credibility carries the deal.