Key Takeaways

- Claims adjudication is a critical process bogged down by manual inefficiencies.

From data entry errors to fragmented payer systems and slow communications, traditional methods slow down reimbursements, impact cash flow, and reduce trust. - Autonomous agents offer end-to-end cognitive automation. These agents go beyond traditional RPA by using AI to read, understand, and validate claims, apply dynamic rules, detect fraud, and orchestrate workflows without human intervention.

- They significantly reduce turnaround time and errors. Claims can be processed in minutes instead of weeks, with far fewer denials, reduced manual touchpoints, and faster reimbursements for providers and patients alike.

- The benefits go beyond speed—impacting financial stability, staff satisfaction, and patient trust. By freeing up staff, improving transparency, and enhancing compliance, autonomous agents strengthen the entire healthcare revenue cycle.

Healthcare providers who adopt autonomous agents today will lead the market tomorrow

With better agility, scalability, and decision-making insights, early adopters will gain a sustainable competitive edge in an increasingly data-driven healthcare economy.

How many of you agree that claims adjudication is a critical yet at times cumbersome procedure in the healthcare sector? It is the main engine that brings revenue and makes sure that the patients get their reimbursement on time. Nevertheless, the essential operation has been bogged down due to manual procedures. This as an outcome has given rise to mistakes, financial issues, and delays. Therefore, everyone from doctors to front office executives, stakeholders, and staff suffers through major problems.

Imagine a world where claims are processed not in weeks or even days, but in mere hours, or even minutes, with unparalleled accuracy. This is not a dream. All of it can come true with the help of autonomous AI agents in healthcare claims processing.

Also read: How Autonomous Agents Improve Business Process Resilience?

The Hidden Hurdles of Traditional Claims Adjudication: The True Costs

Before we delve into the groundbreaking solution, let’s shine a light on the often-overlooked pain points of traditional claims adjudication. These aren’t just minor inconveniences; they represent significant drains on resources, time, and patient trust:

Manual Data Entry: A Maze Prone to Human Error

The sheer volume of healthcare claims is staggering. Each claim, whether from a small clinic or a large hospital system, often requires manual transcription, re-keying, and cross-referencing. This reliance on human input, while diligent, is inherently prone to error. A single misplaced digit in a patient ID, an incorrect CPT code, or a missed modifier can lead to an immediate denial. What many don’t realize is that correcting these errors isn’t a quick fix; it triggers a lengthy and costly appeals process, consuming valuable administrative hours and delaying payments.

The Fragmentation of Standardization:

The healthcare space, particularly in claims, is notoriously fragmented. We operate in an ecosystem with thousands of diverse payers, each with their own proprietary rules, varying forms (even for the same service!), unique claim submission portals, and intricate adjudication logic. This absence of universal standardization makes it an almost insurmountable challenge for providers to streamline operations and for payers to achieve consistent, efficient processing. It’s like trying to speak a hundred different dialects simultaneously.

The Black Hole of Inefficient Communication:

The back-and-forth communication required for claim clarification or appeals often relies on outdated, asynchronous methods. Phone calls lead to “phone tag,” faxes get lost, and generic emails lack the structured data needed for quick resolution. This disjointed communication creates a profound lack of transparency, leaving providers in the dark about claim status and patients frustrated by the ambiguity of their financial obligations. The average number of touchpoints for a complex denied claim can easily exceed five, each adding to the delay.

The Drag of Slow Settlement Times: A Cash Flow Crisis:

The cumulative effect of these challenges is a severely protracted claims settlement process. While best-case scenarios might see a claim settled in a few weeks, it’s not uncommon for complex or denied claims to take months to resolve. For healthcare providers, particularly smaller practices, this directly translates into significant cash flow issues, impacting their ability to pay staff, invest in equipment, or even keep their doors open. For patients, it means prolonged anxiety and uncertainty about their medical bills.

The Silent Scourge of Fraud, Waste, and Abuse (FWA):

Beyond legitimate processing delays, traditional methods struggle to keep pace with the increasingly sophisticated tactics of healthcare fraud. Manual review processes are not only laborious and expensive but also inherently limited in their ability to identify subtle patterns or anomalies across vast datasets that might indicate suspicious activity. This “silent scourge” leads to billions in financial losses for insurers annually, costs that are ultimately passed on to consumers in higher premiums.

What many in the general public (and even some industry veterans) don’t fully appreciate is that these systemic inefficiencies don’t just impact the bottom line; they contribute significantly to physician and administrative burnout, divert invaluable clinical resources away from direct patient care, and ultimately diminish the overall patient experience and trust in the healthcare system.

Autonomous Agent: Your Claims Adjudication Superpower

Autonomous agents represent a paradigm shift beyond traditional automation. While Robotic Process Automation (RPA) excels at mimicking human actions in a pre-defined sequence, autonomous agents possess the inherent intelligence to learn, adapt, reason, and make decisions independently, often without explicit, step-by-step programming. They are powered by a confluence of cutting-edge technologies that enable true cognitive automation. In the context of claims adjudication, this means:

Hyper-Intelligent Data Extraction and Validation (Beyond OCR):

Autonomous agents, leveraging advanced AI models like Large Language Models (LLMs) and Optical Character Recognition (OCR) combined with Natural Language Processing (NLP), can instantly read, interpret, and contextualize complex claim documents. This includes unstructured data found in medical notes, referral letters, and even scanned handwritten physician orders – something traditional OCR alone cannot achieve. They don’t just extract; they understand the data, validate it against established medical necessity rules, payer-specific guidelines, and vast repositories of historical data. Any inconsistencies, missing details, or potential coding errors are flagged with astonishing accuracy before the claim even enters the adjudication pipeline, preventing denials proactively.

Imagine an agent instantly cross-referencing CPT (Current Procedural Terminology), HCPCS (Healthcare Common Procedure Coding System), and ICD (International Classification of Diseases) codes against the latest payer-specific guidelines, national coding standards, and even localized policy nuances. These agents don’t just follow rules; they continuously learn from new regulatory updates, industry bulletins, and the outcomes of previously adjudicated claims. This ensures dynamic compliance, drastically minimizing rejections due to outdated information or misapplication of complex rules. For example, if a specific drug requires prior authorization for a particular diagnosis, the agent will flag it automatically.

Proactive, Behavior-Based Fraud Detection:

This is where autonomous agents truly shine. Unlike human reviewers who might be overwhelmed by the sheer volume of claims or miss subtle connections, autonomous agents can analyze vast, multi-dimensional datasets in real-time. They look for complex patterns, anomalies, statistical outliers, network connections (e.g., unusual provider-patient relationships), and behavioral deviations that are indicative of fraudulent activity. This proactive, AI-driven approach significantly reduces financial losses for insurers by catching fraud at its earliest stages and strengthening the overall integrity of the claims system. They can identify everything from duplicate billing schemes to upcoding and unbundled services with far greater precision.

Seamless Integration and Intelligent Workflow Orchestration:

Autonomous agents are designed for interoperability. They don’t operate in a vacuum; they seamlessly integrate with existing Electronic Health Record (EHR) systems, practice management software, billing platforms, and payer adjudication engines. They act as intelligent conductors, orchestrating the entire claims workflow from the moment a service is rendered to the final settlement. This eliminates manual handoffs, reduces processing bottlenecks, and creates a truly end-to-end automated process that is transparent and auditable at every step.

Continuous Learning, Self-Optimization, and Predictive Analytics:

The most profound capability of autonomous agents is their ability to continuously learn and improve. Every processed claim, every successful appeal, every denial reason, and every change in regulations feeds into their machine learning models. This feedback loop makes them smarter, more accurate, and more efficient with each interaction. Furthermore, they can leverage predictive analytics to forecast potential denial hotspots, identify trends in claims, and even optimize the timing of claim submissions for faster processing based on historical payer behavior. This self-optimizing capability is a genuine game-changer in an industry characterized by constant flux.

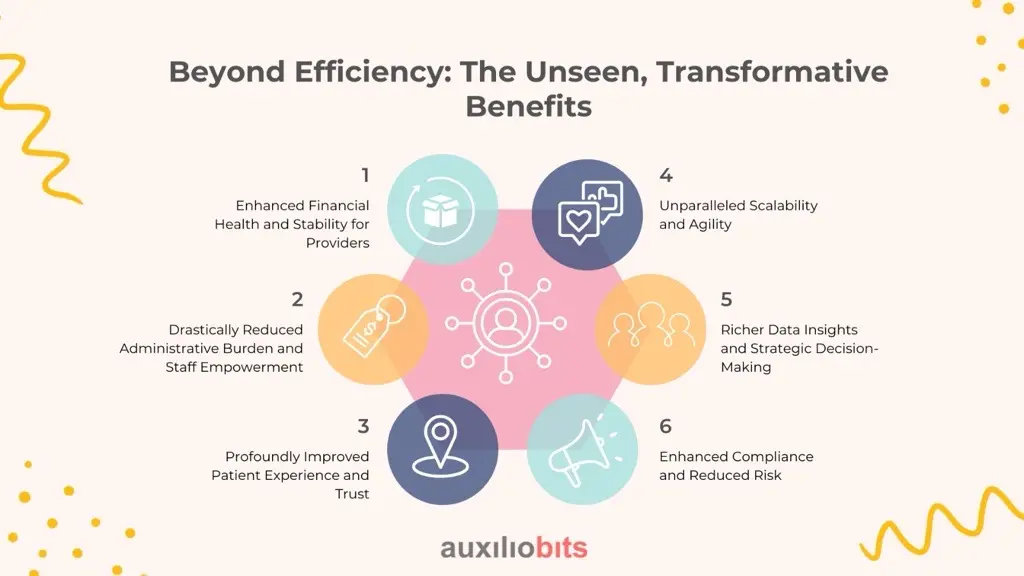

Beyond Efficiency: The Unseen, Transformative Benefits

The impact of autonomous agents extends far beyond just speeding up claims processing; they are catalysts for systemic improvement and value creation across the healthcare ecosystem:

Enhanced Financial Health and Stability for Providers:

Faster adjudication directly translates to quicker reimbursements and a significant reduction in accounts receivable days. This dramatically improves cash flow and fosters greater financial stability, allowing providers to invest more confidently in advanced medical technologies, expand services, recruit top talent, and ultimately deliver superior patient care.

By automating the mundane, repetitive, and error-prone aspects of claims processing, autonomous agents free up invaluable administrative staff. These highly skilled individuals can then shift their focus to more complex cases, patient engagement, addressing intricate billing inquiries, and strategic initiatives that add higher value to the organization. This leads to increased job satisfaction, reduced burnout, and a more engaged workforce.

Profoundly Improved Patient Experience and Trust:

Patients experience faster clarity on their claims, quicker reimbursements, and fewer billing surprises. This translates into greater financial transparency, reduced anxiety, and a significantly more positive overall healthcare experience. When billing is smooth and predictable, patients are more likely to return and recommend their providers.

Unparalleled Scalability and Agility:

As healthcare organizations grow or face seasonal fluctuations in claim volumes, autonomous agents can effortlessly scale to meet demand without requiring a proportional increase in human resources. This makes growth sustainable, cost-effective, and ensures service levels remain high even during peak periods. Furthermore, their inherent agility allows for rapid adaptation to new regulations or payer policies.

Richer Data Insights and Strategic Decision-Making:

The vast amounts of data processed and analyzed by autonomous agents provide invaluable, granular insights into claim patterns, common denial reasons, payer performance, and even patient demographics. This rich data can inform strategic decision-making for both providers (e.g., identifying areas for process improvement, negotiating better payer contracts) and payers (e.g., refining policies, detecting emerging fraud trends). This is true business intelligence at its finest.

Enhanced Compliance and Reduced Risk:

By systematically applying the latest rules and regulations, autonomous agents significantly reduce the risk of non-compliance, which can lead to hefty fines and legal repercussions. Their transparent, auditable processing pathways also provide a clear trail for regulatory reviews.

The Future is Autonomous: Are You Ready to Lead?

The transition to autonomous claims adjudication is not merely about adopting new technology; it’s about embracing a fundamental paradigm shift that redefines efficiency, accuracy, financial stability, and patient care in healthcare. For healthcare organizations looking to attract more clients, enhance their reputation, and stay competitive in an increasingly complex market, investing in robust autonomous agent solutions is no longer an option – it’s a strategic imperative.

This isn’t a distant future; it’s the present reality being embraced by forward-thinking healthcare leaders. The organizations that harness the power of autonomous agents today will be the ones that thrive tomorrow, delivering superior care with unparalleled efficiency.

Ready to transform your claims process and unlock unprecedented efficiency, financial health, and patient satisfaction? Connect with us today to explore how autonomous agents can revolutionize your healthcare operations and position you as a leader in the digital healthcare revolution.