Key Takeaways

- Multi-Agent Systems (MAS) go beyond simple automation by enabling intelligent, collaborative agents to handle complex tasks like policy renewals. This leads to hyper-personalized quotes, proactive communication, and seamless payment processing, significantly enhancing the customer experience.

- MAS extends its utility to real-time alerts for fraud detection, dynamic risk assessment, and personalized product recommendations. This proactive approach fosters deeper customer relationships and helps insurers adapt to changing customer needs and market conditions.

- By automating repetitive tasks and reducing manual errors, MAS frees up human capital, leading to a dramatic increase in operational efficiency. This, combined with improved fraud detection and higher customer retention, results in substantial cost reductions for insurance providers.

- The ability of MAS to provide smooth, proactive, and deeply personalized interactions makes policyholders feel valued and understood. This frictionless experience fosters trust, strengthens loyalty, and directly translates into higher policy renewal rates and reduced customer churn.

- Implementing MAS is not just about adopting new technology; it’s about fundamentally transforming insurance operations. Insurers leveraging MAS to offer superior service, personalized experiences, and operational efficiency will gain a significant competitive advantage and drive market leadership.

In today’s insurance sector, it has become extremely essential for everyone to stay competitive. This means they should ensure that, in addition to policies, other services are also offered to customers. These services include top-notch offerings, great customer service, understanding customer requirements, and fulfilling them. Conventional manual procedures do not function in the best possible way when it comes to fulfilling customer requirements. Therefore, Multi-agent systems have come to the rescue.

Also read: Designing Multi-Agent Systems for Enterprise Workflow Automation

What Exactly Are Multi-Agent Systems (MAS)? A Closer Look

Multi-agent systems act as a sophisticated artificial intelligence platform where several intelligent and independent agents collaborate to ensure that all the goals are fulfilled. Each agent has different responsibilities to fulfill. Some of them make decisions, while others ensure there is no human intervention needed. Others ensure the following:

- Autonomously Perform Tasks: MAS agents can perform and execute predefined actions and make decisions when needed.

- Communicate and Negotiate: MAS agents possess the ability to communicate and coordinate with one another, facilitating information sharing crucial for task completion.

- Perceive and Act on Their Environment: Agents can monitor various data sources, interpret information, and react appropriately.

- Learn and Adapt Over Time: Leveraging machine learning algorithms, agents can improve their decision-making and performance based on new data and experiences, becoming more effective with each interaction.

In the insurance context, these agents might specialize in areas like customer profiling, risk assessment, fraud detection, communication, or even payment processing, all working in concert.

The Transformative Power of MAS in Insurance Policy Renewals

The manual renewal process has long been a major pain point for both insurers and policyholders. It’s often resource-intensive, prone to human error, and can feel impersonal. MAS offers a robust solution by automating and optimizing every facet of this critical process:

Automated and Intelligent Renewal Triggers:

Instead of relying on calendar reminders, MAS can use predictive analytics. For instance, an agent might identify a policy nearing expiry, cross-reference it with the customer’s payment history and engagement level, and then decide the optimal time and method for sending a renewal offer.

Hyper-Personalized Quote Generation:

This is where MAS truly shines. Agents can delve into a policyholder’s entire profile – past claims, payment punctuality, life changes (e.g., marriage, new car, home renovation), loyalty history, and even external data like local weather patterns for property insurance. This comprehensive analysis allows them to generate highly tailored renewal quotes, potentially offering dynamic pricing, specific discounts, or updated coverage options that genuinely meet the customer’s evolving needs. This level of personalization significantly boosts the likelihood of insurance persistency.

Proactive and Multi-Channel Customer Communication:

Say goodbye to generic emails! MAS can orchestrate intelligent communication campaigns. An agent might initially send an email reminder, but if no response, follow up with an SMS, and later, a personalized notification within a mobile app. They can even adapt the tone and content based on customer segment or previous interaction history, ensuring timely, relevant, and engaging communication.

Seamless and Secure Payment Processing:

Integrated payment agents can facilitate instant, secure online payment collection. They can manage recurring payments, send reminders for outstanding premiums, and even handle payment plan adjustments, drastically reducing administrative overhead and improving cash flow.

Drastically Reduced Manual Errors:

By automating repetitive data entry and calculation tasks, MAS virtually eliminates the risk of human error. This leads to greater accuracy in policy updates, premium calculations, and compliance reporting, saving significant time and resources dedicated to corrections.

Unprecedented Enhancement of Customer Experience:

When renewals are smooth, proactive, and personalized, policyholders feel valued and understood. This frictionless experience fosters trust, strengthens loyalty, and significantly improves overall customer satisfaction, making them less likely to shop around.

Beyond Renewals: Real-time Alerts and Proactive Customer Engagement

The capabilities of Multi-Agent Systems extend far beyond streamlining renewals. They are instrumental in providing real-time, actionable alerts and fostering truly proactive customer engagement across the entire policy lifecycle:

Intelligent Fraud Detection Alerts:

MAS can continuously monitor vast streams of data, including claims submissions, transaction patterns, and even social media activity (where permissible and ethical). They can identify subtle anomalies, suspicious relationships, or unusual behavior patterns that might indicate potential fraud, flagging them instantly for human review and enabling rapid intervention, minimizing financial losses.

Dynamic Risk Assessment and Policy Adjustment Alerts:

As a policyholder’s circumstances change – a new job, moving to a different neighborhood, purchasing a new high-value asset, or even lifestyle shifts detected through anonymized data analysis (with consent) – MAS can identify these shifts in risk profiles. They can then trigger alerts for policy adjustments, ensuring coverage remains adequate and premiums are fair for both parties. This helps in underwriting accuracy.

Personalized Product Recommendations and Cross-Selling:

Imagine an agent recognizing that a customer who just renewed their car insurance also recently moved into a new home. The system could then intelligently recommend relevant home insurance products or offer bundling options. This proactive identification of needs creates genuine cross-selling and upselling opportunities, enhancing customer lifetime value.

Transparent Claim Status Notifications:

The claims process can be stressful. MAS can provide automated, real-time updates on a claim’s progress via preferred channels, from initial submission to final payout. This transparency reduces customer anxiety, minimizes inbound calls to call centers, and improves the overall claims experience.

Robust Regulatory Compliance Monitoring:

Staying abreast of evolving insurance regulations is a monumental task. MAS can be configured to continuously monitor regulatory changes and automatically ensure that all customer communications, policy terms, and operational processes adhere to the latest legal requirements. They provide an undeniable audit trail, significantly reducing compliance risks and potential penalties.

Market Trend Analysis and Competitive Alerts:

Beyond internal data, agents can scour external sources for market trends, competitor offerings, and economic indicators. This allows insurers to react swiftly to new opportunities or threats, refining their product offerings and pricing strategies.

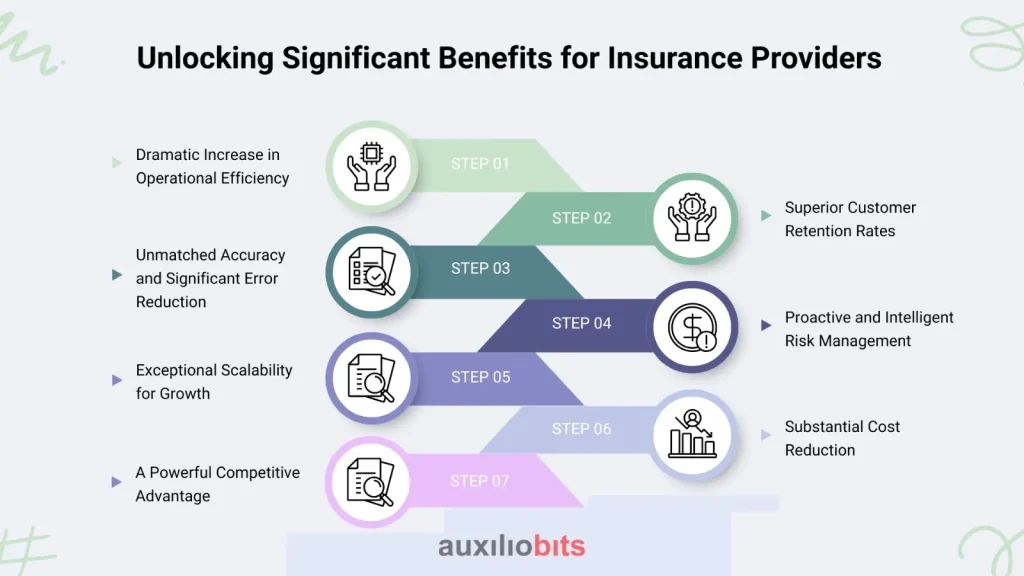

Unlocking Significant Benefits for Insurance Providers

Implementing Multi-Agent Systems isn’t just about adopting new technology; it’s about fundamentally transforming how an insurance business operates, leading to a cascade of benefits:

Dramatic Increase in Operational Efficiency:

By automating repetitive, rule-based tasks, MAS frees up valuable human capital. Agents can then focus on complex problem-solving, empathetic customer service, strategic decision-making, and fostering innovation.

Superior Customer Retention Rates:

A smooth, proactive, and deeply personalized experience is a powerful differentiator. It translates directly into higher policy renewal rates, reduced customer churn, and a stronger, more loyal customer base.

Unmatched Accuracy and Significant Error Reduction:

The precision of automated processes virtually eliminates manual errors in data entry, calculations, and policy administration, leading to fewer disputes, rework, and associated costs.

Proactive and Intelligent Risk Management:

Early detection of potential fraud and continuous monitoring of risk profiles empower insurers to mitigate financial exposures more effectively, leading to better loss ratios.

Exceptional Scalability for Growth:

As a business grows, MAS can seamlessly handle increasing volumes of policies and customer interactions without requiring a proportional increase in human agents, allowing for efficient scaling.

Substantial Cost Reduction:

The combined effect of increased efficiency, reduced errors, lower fraud rates, and improved retention translates into significant operational cost savings and improved profitability.

A Powerful Competitive Advantage:

In an increasingly crowded and digitally-driven market, insurers who leverage MAS to offer superior service, personalized experiences, and operational efficiency will stand out and attract more customers. This insurtech innovation is key to market leadership.

The Future is Intelligent, The Future is Multi-Agent

The insurance industry is not just evolving; it’s undergoing a fundamental transformation driven by technological innovation. Multi-Agent Systems are not merely tools; they are the intelligent backbone of this new era. By embracing this advanced technology, insurance providers can move beyond traditional, reactive processes to truly proactive, personalized, and predictive customer engagement. This not only optimizes every aspect of their operations but also builds deeper, more trusting relationships with policyholders, paving the way for sustained growth, enhanced profitability, and undeniable leadership in the digital age. The time to invest in intelligent automation for insurance is now.