Key Takeaways

- Time savings is the most immediate RPA win. Automating repetitive financial tasks like invoice processing can reduce task time from 30 minutes to as little as 5 minutes.

- RPA enables measurable cost reduction. By cutting down labor costs, errors, and manual interventions, finance teams can track ROI improvements directly in financial reports.

- Error rates significantly decrease with RPA. Post-implementation tracking often reveals drastic drops in data entry and reconciliation errors, from rates like 5% down to below 1%.

- Compliance and audit readiness improve. RPA ensures processes are followed consistently, while maintaining digital audit trails that support regulatory needs.

- Employee satisfaction rises when RPA is deployed smartly. By offloading mundane work, employees can focus on strategic tasks, leading to better morale and increased job fulfillment.

In today’s quickly evolving financial world, companies are looking to Robotic Process Automation (RPA) to not only simplify their operations but also to boost the efficiency of those operations. But how do you know if RPA is working? What performance indicators (PIs), key or otherwise, should you be tracking to assess the value of your RPA investment? This blog will tackle the topic of performance measurement for RPA initiatives head-on.

Also read: Best Practices for Process Discovery Before RPA Implementation

The Challenge of Measuring RPA Success

Even though increasing numbers of organizations are adopting RPA, they struggle with determining just what benefits they are receiving from it. This is particularly true in finance, where the processes are complex and haven’t always been well-defined. How do you know, for instance, if the time saved by automating the processing of invoices translates into actual savings? Or whether the reduction in manual errors is leading to improved financial reporting? These are the kinds of questions that finance departments must answer if they want to get serious about using RPA.

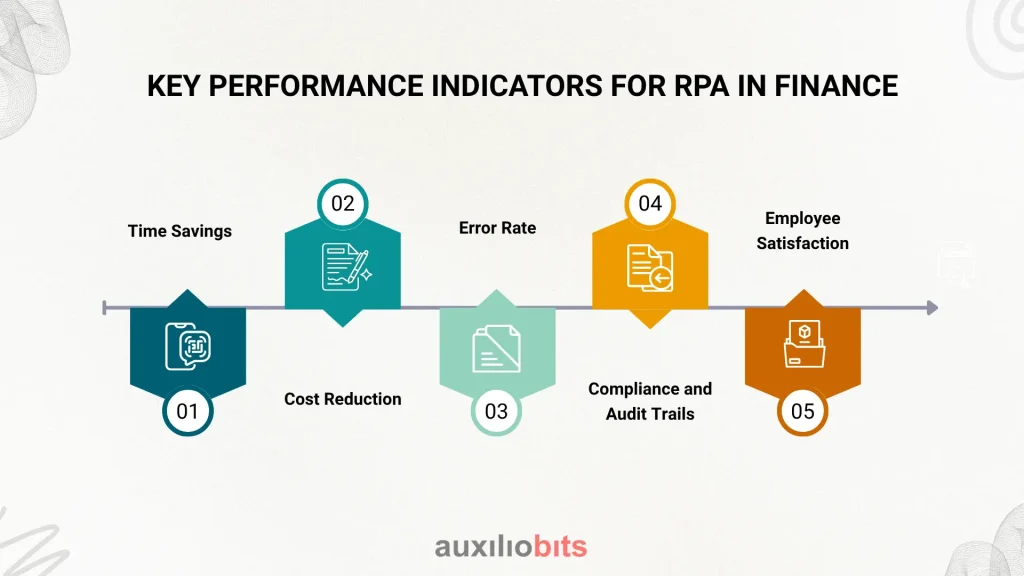

Key Performance Indicators for RPA in Finance

For the successful tracking of RPA success in finance, there are some key performance indicators that organizations should focus on. These are:

1. Time Savings:

One of the most immediate benefits of RPA is the time it saves. To measure the reduction in processing time for tasks—like invoice approvals, payroll processing, and financial reporting—that are suitable for RPA, you need to understand how much time, on average, these tasks used to take when performed by humans. For instance, the average time it took to process an invoice from start to finish was about 30 minutes. RPA, when used on an actual invoice processing task, reduced the average time to about 5 minutes per invoice. That’s a huge time savings, and it’s not the only one.

2. Cost Reduction:

A cost-saving measure is the automated finance department. By duplicating human interactions that lead to labor costs, errors, and necessary corrections, RPA can make the finance department into a cost-measuring department. That means the finance department can track RPA’s overall cost reduction for its investment, and the ROI will show up in the organization’s financial statement.

3. Error Rate:

Financial data must be accurate. Robotic Process Automation can reduce the error rate in tasks like data entry and reconciliation to a point that most people would consider acceptable. But how do we know that RPA has made things better? We can assess it by looking at error rates before and after implementation.

4. Compliance and Audit Trails:

Ensuring compliance with regulations in the finance industry is mandatory. Achieving it can be made easier with the use of RPA. Why? RPA ensures that processes are followed consistently and that audit trails are maintained. And, if processes and audit trails are handled by RPA, then it stands to reason that compliance would be something we could automate.

5. Employee Satisfaction:

Though it isn’t a classic KPI, employee satisfaction is an important metric to bring into the conversation. When you ask finance professionals about what gives them job satisfaction, they almost always say it has to do with the nature of the work they do, especially when it comes to more strategic, less tactical stuff. What tends to sap that job satisfaction is when you get bogged down in automatable, transactional-type workings.

Implementing Effective RPA Strategies

To extract the full and positive impact of RPA in finance, companies should adopt a way of working that is more than just tactical. They should think big, plan well, and work to a high standard. To make this happen, they need the right people with the right skills, working in the right way and at the right level.

Assess Current Processes:

Start with an assessment of your current processes to pinpoint those that are ripe for automation. Pay special attention to the tasks that are automated already and that require a high level of human input (that’s just a nice way of saying they need a lot of people coming together to get things done). Things that are done a lot, done in a certain way, and done with people who are prone to go off-script (or are just error-prone in general) are your best candidates for robotic automation.

Set Clear Objectives:

Articulate a vision for what success looks like for your RPA initiatives. Establish concrete, quantifiable objectives that pertain to the KPIs identified earlier.

Choose the Right Tools:

Choose robotic process automation (RPA) tools that match your organization’s requirements and harmonize with its current financial system, such as Workday Automation.

Monitor and Optimize:

Consistently assess RPA effectiveness using KPIs. Collect performance data, and use it to fine-tune the RPA; make any necessary and sensible adjustments to improve results.

Case Study: RPA Success in a Finance Department

Think about a mid-sized company that decided to harness the power of RPA. It used this technology to streamline its accounts payable process. Before RPA, there was a sizable backlog of invoices, mostly because the humans in the finance department ran out of hours in the workday. As a result, some vendors waited far too long for payment. When the company freed the finance team from the drudgery of processing invoices, it didn’t just avoid those delays. It slashed the time spent on processing by 70%. At the same time, it lowered the error rate from 5% to less than 1%. That’s not just RPA, folks. That’s RPA plus relevant KPIs.

Conclusion

To sum up, it is critical to monitor the key performance indicators that allow us to gauge the success of our RPA initiatives in finance. When we put our focus on time savings, cost reductions, and the error rates of our once-manual processes, coupled with our concerns for compliance and overall employee satisfaction, we gain some very useful insights into the effectiveness of our automation efforts.