Key Takeaways

- RPA solves volume, not ambiguity. Bots are excellent at moving data across systems, but manufacturing invoices are rarely clean enough to rely on deterministic rules alone. The real drag on AP performance lives in exceptions, not throughput.

- OCR only creates candidates—validation creates confidence. Reading invoices is table stakes. What determines success is how extracted data is evaluated against PO behavior, receipt timing, historical tolerances, and supplier patterns.

- Exception handling is an operational discipline, not a queue. Treating exceptions as workflows—rather than inboxes—reduces unnecessary human touch and prevents the same issues from resurfacing month after month.

- Touchless AP is an operating model, not a technology label. Sustainable automation emerges when OCR, validation logic, exception agents, and RPA reinforce each other—closing feedback loops instead of creating brittle handoffs.

- The biggest payoff is predictability, not headcount reduction. Faster cycle times and higher accuracy matter, but the real value shows up in calmer month-ends, fewer supplier escalations, and finance teams that can finally plan with confidence.

Accounts Payable in manufacturing has always lived in the shadow of production. When plants are running, procurement is flowing, and suppliers are shipping, AP is expected to “just keep up.” Quietly. Cheaply. Without errors.

That expectation used to be unrealistic. Now it’s just… unforgiving.

Manufacturers process invoices in volumes that don’t look dramatic on paper but become brutal in reality. Multiple plants. Thousands of suppliers. Blanket POs, partial receipts, price variances, freight add-ons, tax quirks, and invoices that rarely look alike—even from the same vendor. The idea that this could be handled manually was never sustainable. The idea that it could be handled with only RPA turned out to be optimistic.

The journey from RPA to touchless AP isn’t about replacing tools. It’s about understanding where automation actually breaks—and what needs intelligence rather than speed.

Why Invoice Processing Is Harder in Manufacturing Than Finance Likes to Admit

From the outside, invoice processing sounds linear: receive invoice, match it, post it, pay it. Anyone who’s spent time inside a manufacturing AP team knows that’s fiction.

Invoices arrive through:

- Emails sent to individual buyers

- Vendor portals no one checks daily

- EDI feeds that work until they don’t

- Scanned PDFs that were printed, signed, rescanned, and faxed (yes, still)

And once they arrive, they collide with reality:

- Goods were partially received

- Prices changed mid-contract

- Freight was added after PO approval

- Plant A received it, Plant B approved it

- GRN exists, but someone posted it two days late

This is why early RPA deployments in AP felt magical for three months… and then plateaued.

Also read: How Manufacturing Leaders Are Building Autonomous Operations

RPA’s Real Contribution—and Its Hard Ceiling

RPA earned its place in manufacturing AP. Bots don’t get tired of logging into SAP, Oracle, or legacy ERPs. They can:

- Pick up invoices from shared mailboxes

- Upload documents into AP queues

- Perform basic 2-way or 3-way matches

- Post clean invoices without human touch

In stable scenarios, RPA delivers immediate wins:

- Cycle time drops from days to hours

- Manual data entry all but disappears

- Backlogs flatten during peak periods

But RPA is brittle by design. It follows instructions, not intent.

When invoice formats change slightly, bots hesitate. When tax lines are missing or freight is rolled into unit price, bots fail silently—or worse, pass bad data downstream. Most manufacturing AP teams discover the same thing: 60–70% straight-through processing is achievable with RPA. The remaining 30–40% consumes 80% of the effort.

That remainder is where OCR, validation logic, and now exception agents matter.

OCR Was Never the Goal. Accuracy Was

OCR in AP has been oversold and misunderstood. Early implementations focused on “reading invoices.” That was the wrong metric.

Manufacturing invoices are messy. Line items wrap across pages. Part numbers look like serial codes. Units of measure vary by plant. OCR engines can read characters just fine; understanding what those characters mean in context is the real challenge.

Modern OCR works when it’s treated as signal extraction, not document conversion.

Effective OCR pipelines in manufacturing:

- Identify supplier-specific patterns instead of generic templates

- Recognize line-level structures, not just header fields

- Learn that “Total Due” might appear in five different places depending on vendor geography

- Handle multi-page invoices without losing line continuity

But OCR alone doesn’t deliver touchless AP. It only creates a candidate dataset. What happens next determines whether automation scales—or stalls.

Validation Is Where Touchless AP Is Won or Lost

Validation logic separates automation demos from production systems.

In manufacturing AP, validation isn’t a checklist. It’s a negotiation between invoice data, PO terms, receipt realities, and business tolerance.

Consider a real scenario from a multi-plant automotive supplier:

- O price: ₹100 per unit

- Invoice price: ₹101 per unit

- Quantity: 12,000 units

- Variance: ₹12,000

Is that an exception? Finance says yes. Procurement says no (annual price uplift). Plant says “we need the parts.” Legacy rules flag it. Humans override it. Every month.

Validation engines that work don’t just apply thresholds. They encode behavior:

- Accept price variances under X% for specific suppliers

- Allow freight variances if GRN exists and quantity matches

- Route tax discrepancies only when jurisdiction mismatches occur

- Ignore rounding differences that historically resolve cleanly

This is where RPA hands off to intelligence.

Exception Agents: The Missing Layer Between Rules and Humans

Most AP teams don’t drown in invoices. They drown in exceptions.

Traditional systems treat exceptions as dead ends—queues waiting for humans. Exception agents flip that model. They treat exceptions as workflows with intent.

An exception agent doesn’t just say, “Mismatch detected.” It asks:

- Is this a known pattern?

- Has this supplier behaved this way before?

- What usually resolves this exception fastest?

- Who actually needs to see this?

In one heavy-equipment manufacturer, introducing exception agents reduced manual touch on exceptions by nearly half—not by auto-approving more invoices, but by routing fewer invoices to the wrong people.

Instead of AP clerks emailing procurement, exception agents:

- Pulled historical resolutions

- Suggested approval paths

- Requested missing GRNs automatically

- Deferred non-blocking discrepancies until payment cycles

‘That nuance matters. Touchless AP isn’t about zero humans. It’s about human effort being spent where judgment is required, not where systems failed to connect dots.

OCR → Validation → Exception Agents: Why the Sequence Matters

Some implementations try to “intelligent-ize” everything at once. They fail quietly.

The sequence matters because each layer narrows uncertainty:

- OCR extracts candidate data with confidence scores

- Validation logic evaluates that data against business context

- Exception agents act only where ambiguity remains

Skipping validation and going straight from OCR to exception handling creates noise. Over-engineering validation without learning from exception outcomes creates rigidity.

The best systems close the loop:

- Exception resolutions retrain validation logic

- Validation outcomes inform OCR confidence thresholds

- OCR errors surface where document standards need supplier intervention

This is less like automation and more like operations engineering.

Where Touchless AP Delivers Measurable Value

Cycle time improvements are the obvious headline. But the deeper gains show up elsewhere.

Manufacturers running mature touchless AP models typically report:

- Invoice cycle time reduced from 7–10 days to under 24 hours for clean invoices

- First-pass accuracy exceeding 98%, even with diverse supplier bases

- Early payment discounts captured consistently rather than opportunistically

- Supplier enquiries are dropping because invoices don’t “disappear” into queues

- Audit readiness improving due to consistent validation trails

Less obvious—but more important—are organizational effects. AP stops being the bottleneck blamed for delayed payments. Procurement stops firefighting invoice issues. Finance regains predictability in cash planning.

And yes, headcount growth slows. But more importantly, stress levels drop. Anyone who’s run AP during month-end knows why that matters.

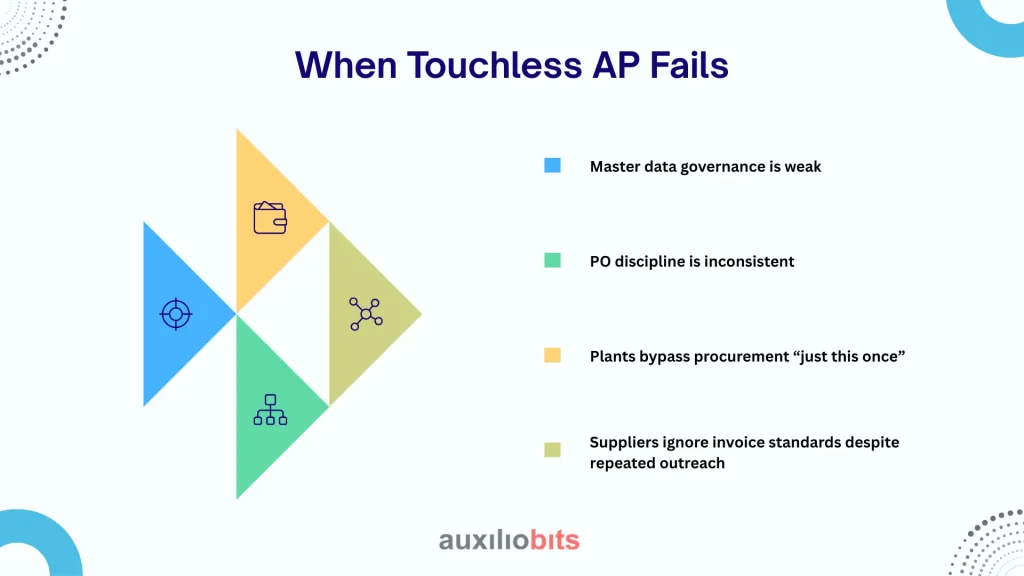

When Touchless AP Fails

Not every invoice should be touchless. Trying to force it creates risk.

Touchless AP struggles when:

- Master data governance is weak

- PO discipline is inconsistent

- Plants bypass procurement “just this once”

- Suppliers ignore invoice standards despite repeated outreach

In these environments, exception agents become the safety net—not the solution. They surface systemic issues rather than masking them. That’s uncomfortable, but necessary.

One manufacturing CFO put it bluntly: “Automation didn’t break our AP process. It exposed how broken it already was.”

That’s not a failure. That’s progress.

RPA Isn’t Going Away. It’s Just Not the Star Anymore

RPA still plays a critical role:

- System navigation

- Data posting

- Cross-application handoffs

- Legacy ERP interactions no API was built for

But RPA is infrastructure now, not strategy.

The strategic layer lives above it—in how documents are interpreted, how decisions are validated, and how exceptions are resolved without defaulting to inboxes and spreadsheets.

Touchless AP in manufacturing isn’t a single technology. It’s an operating model. One that respects the messiness of the real world while quietly removing friction where it doesn’t belong.

And if it feels less flashy than AI demos? Good. AP doesn’t need flash. It needs invoices paid correctly, on time, without waking someone up at month-end.

That’s the bar.