Key Takeaways

- The document uses AI to extract data from unstructured documents with high accuracy.

- It reduces manual errors in PO and invoices, which matches up to 90% while saving time and cost.

- AI-managed automation accelerates approval, improves cash flow, and seller increases relationships.

- Finance teams promoted changes, morale, and productivity in strategic roles from repetitive work.

- The future promises touchless AP processes with real-time matching and future analysis.

For anyone working in accounts payable (AP), the term “invoice matching” might bring a sigh of relief. Imagine piles of purchase orders (POs) and invoices—some in PDFs, some in emails, and others as hazy scans or scribbled scribbles. Each must be manually cross-checked against the other for information such as quantities, prices, and vendor IDs, sometimes within tight timeframes. A single error or mismatch can hold up payments, infuriate suppliers, or even lead to an audit. It’s a time-consuming, faulty process that’s like trudging through quicksand.

With the advent of document understanding—a potent combination of artificial intelligence (AI), machine learning (ML), and natural language processing (NLP)—AP teams are escaping this rut. They’re automating PO/invoice matching, cutting processing time by half, decreasing errors, and freeing up time for strategic work that creates business value.

This blog explores how document understanding is changing the accounts payable landscape, why it’s a game-changer, and how your team can begin to utilize it.

Why Matching POs and Invoices Feels Like a Burden

Matching POs with invoices is not a straightforward process. It’s not merely a matter of comparing figures—it’s a matter of making certain that every detail matches on documents that very seldom have a standard layout. A normal matching procedure includes the following checks:

- Item descriptions and product codes

- Quantities ordered vs. shipped

- Unit prices and totals

- Vendor information and terms

- Delivery dates and shipping terms

This information frequently arrives in disparate forms: PDFs, scanned documents, emails, or even hardcopy papers. Variations seep in because of human mistakes (e.g., typos), vendor inconsistencies (diverse nomenclature), or environment (exchange rate changes). As an example, a PO may have “50 widgets,” and the invoice states “50 units of Widget-A,” with AP teams having to be detectives.

The process is then made more complex by the number of documents. A medium-sized business may receive hundreds or thousands of invoices per month, each involving multiple touches: extracting information from ERP systems, pursuing approvals, and clearing exceptions. The outcome? Bottlenecks that have a knock-on effect on the entire procure-to-pay process. AP staff waste hours on manual data entry, with precious little time available for higher-value activities such as vendor negotiation or financial analysis.

The pressure is not just operational. Delays caused by late payments can put supplier relations under pressure, while blunders such as overpayments or missed discounts burn away profitability. It’s a high-pressure, high-stakes process that exhausts teams and exposes businesses.

The Hidden Costs of Manual Matching

Manual matching isn’t just about the hours you spend in SAP—but it also comes with hidden costs that ripple across the whole organization.

- Delayed Payment: Slow processing recalls initial payment discounts and disappoints vendors, risks stressful relationships, or supplies the disruption of the chain.

- Financial errors: Overpayments, duplicate payments, or unclaimed credits, which can cost thousands annually.

- Compliance Risk: Inconspicuous documents increase the possibility of audit or regulatory investigation.

- Team Burnout: Long, repeated tasks and prolonged low morale can lead to high turnover and training costs.

- Lost opportunities: With AP teams buried in data entry, they cannot focus on strategic functions such as cost adaptation or forecasting.

Research indicates that AP teams spend more than 70% of their time on data entry and verification, leaving only 30% for analysis or strategy. This imbalance slows down decision-making, as officials wait for accurate financial data. In industries such as retail or manufacturing, where cash flow is important, these delays can disrupt development or competitive agility.

How Document Understanding Changes the Game

Understanding the document is like giving a superpower to your AP team. Unlike traditional devices such as optical character recognition (OCR), which only scan the text, the document understands AI for “reading” and explains unnecessary documents with human understanding. This removes the major data—invoice number, date, volume, and line items—and corresponds to POS with accuracy.

- Remove the data automatically: Any document draws the relevant field from the format, whether PDF, email, or scanned image.

- Match in real time: Match discrepancies for reviews; immediately compare the invoice with the POS.

- Integrate with ERPS: Originally, reducing manual input, manual input to updated systems such as SAP or Oracle.

- Scale easily: Handles thousands of documents without slowing down.

Imagine a process that took place once a day. The document understanding acts like a tireless assistant, streamlining the workflow and allowing humans to focus on exceptions rather than regular functions. It likes to swap a manual typewriter for a modern word processor—plain and simple, everything is sharper and more accurate.

AI at the Core: Intelligent Extraction allowing

At the core of the document is AI operated by machine learning and natural language processing (NLP). The rigid, rules-based systems, which rely on predetermined templates, AI can be flexible in a flexible manner.

- Relevant understanding: “Qty: 50” vs. “volume: 50 units” or “widget” vs. “gadgets.”

- Pattern Learning: Relies on accuracy over time by learning from historical data and user feedback.

- Discrepancy detection: Flag discrepancies to prevent fraud or errors, such as unexpected value increases or duplicate invoices.

- Future stating abilities: Depending on the previous pattern, issues like missing invoices are estimated.

For example, if a supplier uses different words in documents, AI Infers coincides based on the reference or historical record. If an invoice shows a 10% higher price than the PO, it alerts the team with details, saving hours of manual probing. According to industry studies, this intelligence reduces the error rate by 90% and dramatically cuts processing time.

Real-World Use Cases

Let’s see how it works in behavior:

- High-volume invoice matching: A retail company processes about 5,000 invoices every month. Document understanding technology extracts relevant data from email and PDF, then matches the challan to purchase an order within minutes.

- Seller change resolution: In a technology company, AI analyzes historical pricing to detect unauthorized vendor changes.

- Multi-Mudra handling: A global firm is related to invoices in many currencies. Documents that understand the tools remove the challan data, automatically convert the volume using real-time exchange rates, and match them to buy orders to eliminate manual calculations.

These examples show how automation not only streamlines repetitive tasks but also empowers teams to focus on exceptions and strategic decisions.

Industry Applications

Documents for various industries make sense:

- Retail: The Inventory system matches high-volume invoices, ensures stock accuracy, and prevents overages.

- Manufacturing: Supplier reconciliation and forecasting material costs streamline and reduce supply chain risks.

- Healthcare: Complex billing codes for POS, ensuring compliance with rules like HIPAA, and handling matching claims.

- Technology: Subscription automates renewals and tracks licensing costs, important for fast-scaling firms.

- Hospitality: The process of challan for food, equipment, and services, ensuring timely payment to maintain the seller’s trust.

In some areas, the result is consistent: sharp processes, low errors, and a happy team.

Why Finance Teams Are Embracing It

Benefits are undisputed:

- Speed: Processing falls from days to minutes, causing rapid close cycles.

- Accuracy: error rate plummets, reducing financial leaks and audit risks.

- Cash flow: Unlock the initial payment discount on time and improve the seller relationship.

- Morale: Teams shift to data entry to analyze engagement and promote retention.

Finance professionals promoted morale by being freed from repeated tasks. Instead of late-night chasing mismatches, they focus on seller strategy, cost adaptation, or forecasting, which seems meaningful and aligns with their expertise.

Common Pitfalls to Avoid

Automation isn’t a magic bullet. Common missteps include:

- Dirty Data: Poor-quality inputs confuse AI, leading to inaccurate matches.

- Lack of Training: Teams ignoring alerts or misunderstanding outputs reduces efficiency.

- Weak Integration: Incompatible ERP systems cause data silos and errors.

- Security Oversights: Unprotected data risks breaches, especially with sensitive financial info.

To succeed, treat AI as a partner. Making data clean, training staff, and prioritizing secure integrations from day one.

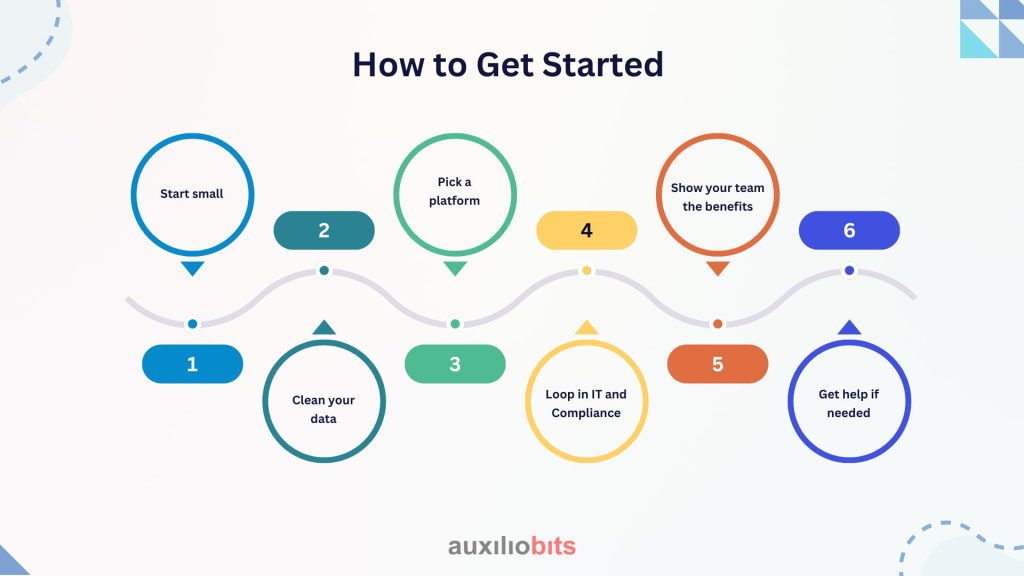

How to Get Started

You don’t need to redo everything to get started. Just take it step by step:

- Start small: Pick a process that really hurts right now—like matching invoices for a key vendor.

- Clean your data: Make sure your documents and ERP records are accurate and consistent.

- Pick a platform: Use something that works well with your ERP, like SAP or Oracle.

- Loop in IT and Compliance: It’s better to sort security and integrations early than hit problems later.

- Show your team the benefits: Automation isn’t here to replace anyone—it makes their work easier.

- Get help if needed: Companies like Auxiliobits can customize AI tools for your workflow so the transition is smooth.

The Future of Document Automation

Accounts payable is moving toward a “touchless” world—less manual work, more done automatically. Some trends to watch:

- Blockchain: Makes records tamper-proof and easy to audit.

- Predictive analytics: Helps predict cash flow and vendor behavior.

- Voice tools: Approve payments or check invoices while on the move.

- Real-time processing: No more end-of-month chaos—matching happens continuously.

Basically, AP is shifting from reactive work to proactive insight. Finance teams get info when they need it, not a week later.

Final Thoughts

Smart document matching is turning AP from a boring, repetitive task into a real business advantage. It saves time, cuts costs, and lets your team focus on things that actually matter.

Tired of the invoice headache? Auxiliobits’ AI tools can help you streamline your PO and invoice process—give them a shout and see how it works.