There is no denying that mortgage underwriting is paramount when approving a home loan. This is where loan providers evaluate borrowers’ financial condition to determine their creditworthiness. This includes monitoring many financial documents like proof of income, assets, employment status, and liabilities. Much paperwork is involved, making the procedure prone to human mistakes. Apart from this, it also takes a lot of time, resulting in delays and inconsistencies. Hence, intelligent document processing has come in handy to avoid such challenges. It has helped financial settings to automate structured and unstructured documents. By utilizing beneficial technologies like optical character recognition, IDP has worked wonders for financial settings, allowing them to improve their strategies.

Why IDP Matters in Mortgage Underwriting?

Mortgage underwriting is a documentation procedure where experts monitor an individual’s credibility to opt for a loan. It is an imperative procedure that should be followed with the set rules and regulations because it demands precision. Some of the tasks that underwriters perform are

1. Checking a credit report

2. Checking bank statements

3. Employment letters for work history

4. Credit reports

5. Tax returns

These essential documents are gathered from several sources. They are submitted to underwriters in formats like PDFs and scanned documents. The underwriters monitor all the documents and ensure no errors or unwanted overwriting. Powered by beneficial technologies like machine learning and intelligent document processing, it has the skills to do the following

1. Classify Documents

IDP can suitably classify the necessary documents, determining if a file is a bank statement, tax return proof, or employment letter. They have the experience to identify a document by simply looking at its layout or template.

2. Extract key data fields

IDP can extract key data fields such as gross income, social security number, account balances, and employment history from structured and unstructured documents.

3. Validate information

IDP also has the skills to validate details. This happens by cross-checking data points across multiple documents—for example, ensuring that the income reported on a pay stub aligns with what’s declared on the borrower’s tax return.

4. Integrate seamlessly with Loan Origination Systems (LOS)

IDP integrated loan origination systems to push cleaned, verified data directly into downstream workflows, eliminating manual data entry and enabling straight-through processing.

By automating these steps, IDP accelerates underwriting, improves accuracy, reduces compliance risks, and frees up underwriters to focus on exceptions and edge cases. In a highly competitive mortgage market, IDP is a critical enabler of faster loan approvals and better borrower experiences.

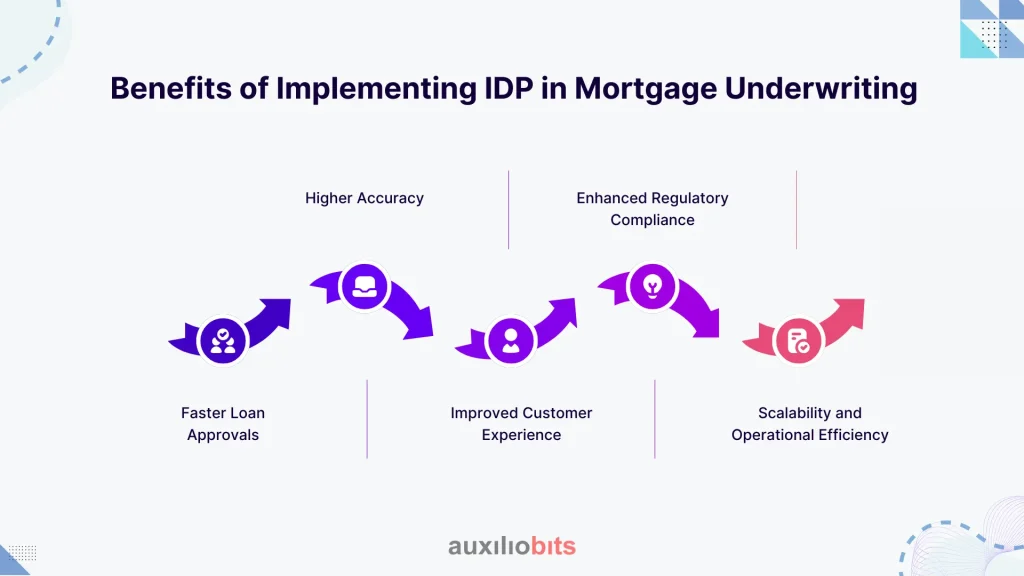

Benefits of Implementing IDP in Mortgage Underwriting

Implementing intelligent document processing in mortgage underwriting offers significant advantages across operational efficiency, risk management, and customer satisfaction. Here are the key benefits in detail:

1. Faster Loan Approvals

Traditional mortgage underwriting is time-consuming, often taking days—or even weeks—to manually review and process borrower documents. IDP automates document ingestion, classification, and data extraction, significantly reducing manual effort and speeding up processing times. This acceleration enables lenders to issue decisions faster, enhancing responsiveness in competitive markets where timing can be crucial.

2. Higher Accuracy

Manual data entry is prone to human error, especially when handling diverse, unstructured documents that borrowers submit. IDP systems use advanced OCR and machine learning models trained on financial documents to extract data with high precision. Built-in validation rules further ensure consistency and reduce discrepancies across multiple document sources. As a result, underwriters receive cleaner, more accurate data, minimizing rework and reducing the risk of approval errors.

3. Improved Customer Experience

Mortgage applicants often experience frustration with delays, redundant document requests, and a lack of visibility into loan progress. With IDP accelerating the document review process, lenders can provide quicker updates and faster decisions, improving the borrower experience. This responsiveness builds trust and positions the lender as a tech-forward, customer-centric institution.

4. Enhanced Regulatory Compliance

Mortgage underwriting must comply with stringent regulatory requirements regarding data accuracy, auditability, and customer privacy. IDP solutions can maintain comprehensive audit trails, including document versioning, processing logs, and validation steps. These capabilities support audit-readiness and traceability, helping financial institutions comply with CFPB, RESPA, and TRID regulations.

5. Scalability and Operational Efficiency

As loan volumes fluctuate, scaling traditional underwriting operations requires hiring and training more staff—a costly and time-consuming approach. IDP enables scalable automation, allowing institutions to handle growing application volumes without increasing headcount. This reduces overhead and improves consistency in document handling regardless of workload spikes.

By transforming how financial documents are processed, IDP empowers mortgage lenders to streamline underwriting, reduce risks, and deliver a superior borrower experience, making it a critical tool for digital transformation in the financial services industry.

Conclusion

IDP has redefined mortgage underwriting. If used wisely, it will provide numerous benefits. Although it may seem intricate initially, it delivers significant operational gains with a clear strategy, the right tools, and proper integration.

Are you ready to bring automation to your mortgage underwriting process? Contact us today to learn more.