Key Takeaways

- Manual insurance workflows slow down service, introduce errors, and limit broker scalability.

- End-to-end automation unifies quoting, binding, and servicing into one seamless digital flow.

- Smart portals enhance productivity, reduce admin tasks, and elevate client satisfaction.

- Automation supports effortless scaling, allowing brokers to grow without increasing costs.

- Real-time analytics empower brokers with insights to optimize operations and drive sales.

Since there are so many brokers out there, everyone is doing their level best to thrive. To thrive, client satisfaction and operational excellence are of the utmost importance. Therefore, insurance brokers who connect insurers with policyholders are always in search of innovative methods that help them minimize errors and offer a seamless experience. Hence, one cannot take a fully automated quote-to-bind procedure lightly with so many competitors out there.

In this guide, we’ll take a closer look at how insurance brokering has evolved and how modern portals are streamlining every step, from the first quote request all the way to binding the policy with confidence. We’ll also reveal the significant benefits this automation offers to both innovative brokers and their demanding clients.

Also read: Enhancing Enterprise Agility with RPA Automation in AI-driven Business Architectures

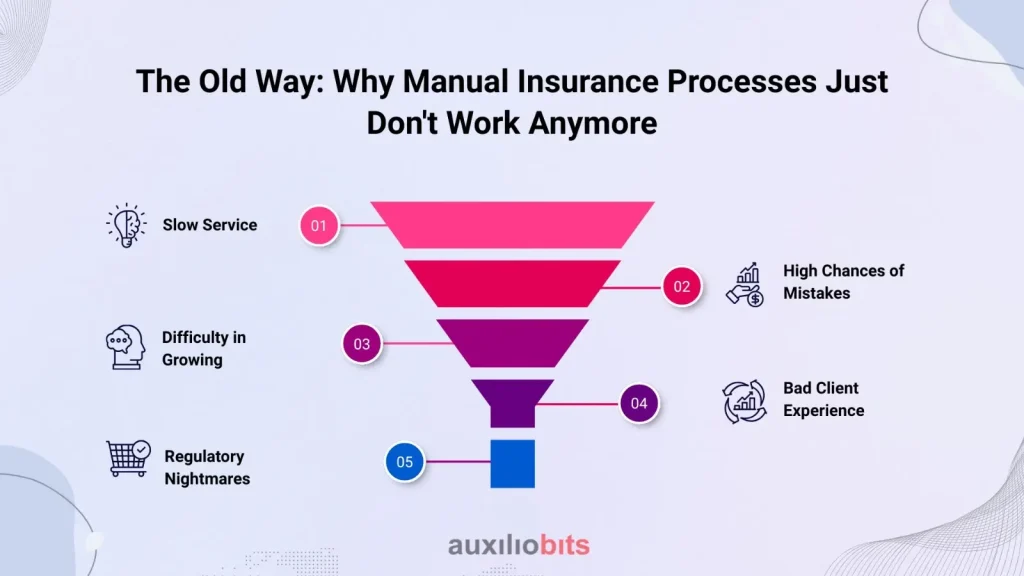

The Old Way: Why Manual Insurance Processes Just Don’t Work Anymore

It’s been a long time now that getting an insurance quote and binding a policy automatically means manual efforts with the help of several systems and spending immense time. Brokers have to deal with data entry, jump from one insurance company platform to another, and handle lots of paperwork. This old method, while once suitable, is giving rise to issues that insurers are tired of. Some of the issues are:

Slow Service:

At present, people want everything at the blink of an eye. However, the old method of gathering details and presenting them came with spending hours or even weeks. This not only made clients wait for a long time but also irritated them. On the other hand, brokers found it difficult to deal with clients in this situation, resulting in a loss in their business.

High Chances of Mistakes:

Whoever said that manual work comes with errors said it right. From typos to wrong client information and more, manual work often consumes a lot of time and energy. Minor issues often give rise to bigger ones in the future, including financial setbacks and, most importantly, a loss of client trust.

Difficulty in Growing:

When a broker wants to grow in his/her career, they tend to move into new areas, provide new services, and do everything possible to bring clients on board. They depend on manual work so much that handling things gets tough. Every new client brings information with them. With this, the administrative workload increases, and manual work cannot handle all this alone.

Bad Client Experience:

Until and unless clients get real-time updates, they are not satisfied. Clients tend to fall out of the loop and stay unhappy because there is a lack of transparency and communication in manual procedures. There is a high chance that clients won’t be happy, and they would never return to the same broker when needed.

Regulatory Nightmares:

Navigating complex regulations and compliance rules is tough enough—but when everything’s done manually, it becomes even harder. It’s a real challenge to keep proper records for audits, protect sensitive data, and show that all industry standards are being followed to the letter.”

Deconstructing End-to-End Quote-to-Bind Automation

There is no denying that automation can change the game for the better. It makes sure that everything during the insurance sales and service journey is connected and simplified into an innovative and feasible platform, including:

Smart Client Data Intake:

These portals do so much more than just gather basic form information. Therefore, they can automatically fill in the details they already have answers for. In addition to this, they keep track of errors and allow clients to upload documents in one place. Some even connect directly to existing CRM systems or approved public databases (with consent) to gather the right information faster and more accurately.”

Real-time Rating and Dynamic Quoting:

This is where the magic happens. Through sophisticated Application Programming Interfaces (APIs) and direct integrations with multiple insurance carriers, the portal can instantly pull real-time rates and generate dynamic quotes based on the client’s specific profile and requirements. This eliminates the need for brokers to log into separate carrier portals, saving immense time and ensuring the most up-to-date pricing.

Seamless Policy Comparison and Customization:

The system doesn’t just present quotes; it intelligently organizes and displays various policy options side-by-side, highlighting key differences in coverage, deductibles, premiums, and benefits. Brokers can easily customize proposals, add optional riders, or adjust coverage limits in real time, tailoring solutions precisely to client needs.

Automated Document Generation and Secure Management:

From professional proposals and detailed policy summaries to declarations pages and compliance forms, the portal automatically generates all necessary documentation. These documents are then securely stored within the client’s digital profile, accessible to both the broker and the client, eliminating physical filing and retrieval hassles.

Digital Binding and Legally Valid E-Signatures:

Once a client selects a policy, the binding process is initiated digitally. Secure electronic signature capabilities (e-signatures) allow clients to sign documents from anywhere, on any device, ensuring legal validity and eliminating the need for printing, scanning, or mailing. This significantly compresses the binding timeline.

Integrated Payment Processing:

Many portals offer direct, secure payment gateways, allowing clients to pay premiums online immediately after binding, further streamlining the process and reducing administrative overhead associated with manual payment collection.

Post-Bind Servicing & Renewals:

The automation doesn’t stop at binding. The portal can track policy expiration dates, automatically generate renewal quotes, facilitate endorsements (policy changes), and manage claims initiation, providing a truly end-to-end lifecycle management solution.

Hallmarks of an Exceptional Insurance Broker Portal

For a broker portal to genuinely deliver on its promise of end-to-end automation, it must embody a suite of robust features designed for efficiency, intelligence, and user-centricity:

Intuitive User Interface (UI) and Exceptional User Experience (UX):

A portal, however powerful, is only as good as its usability. It must be effortlessly navigable for brokers managing complex cases and simple enough for clients to interact with for self-service tasks, ensuring minimal training requirements and maximum adoption.

Deep Multi-Carrier Integration:

This is non-negotiable. The portal must offer pre-built, reliable integrations (often via APIs or web services) with a broad spectrum of insurance carriers, enabling real-time data exchange, quote retrieval, and submission across diverse product lines (e.g., personal lines, commercial lines, specialty products).

Flexible and Customizable Workflows:

No two brokerages are identical. The portal should allow for the customization of workflows to align with specific internal processes, product offerings, compliance requirements, and even individual agent preferences. This ensures the system adapts to the business, not vice versa.

Comprehensive CRM Capabilities:

Beyond basic contact management, the portal should offer integrated Customer Relationship Management (CRM) functionalities. This includes tracking client interactions, managing communication history, setting reminders for follow-ups, and segmenting client data for targeted marketing campaigns.

Powerful Analytics and Actionable Reporting:

A truly smart portal provides more than just data; it offers insights. Customizable dashboards and detailed reports on metrics like quote-to-bind ratios, average quote time, agent performance, client acquisition costs, and popular product lines empower brokers to make data-driven decisions and identify areas for optimization.

Unwavering Compliance and Ironclad Security:

Given the sensitive nature of insurance data, the portal must adhere to the highest standards of data security (e.g., encryption at rest and in transit, multi-factor authentication, and regular security audits) and regulatory compliance. It should provide robust audit trails to demonstrate adherence to industry regulations and data privacy laws.

Mobile-First Responsiveness:

In today’s mobile-driven world, the portal must be fully responsive, offering a seamless experience across desktops, laptops, tablets, and smartphones. This enables brokers to work remotely and clients to access services on the go.

Empowering Self-Service Options for Clients:

Delegating certain tasks to clients through a secure portal can significantly reduce administrative load. This includes allowing clients to view policy details, download documents, initiate simple endorsements, request certificates of insurance, and make premium payments independently.

Integration with Core Business Systems:

The portal should ideally integrate with other essential business tools, such as accounting software, marketing automation platforms, and even HR systems, creating a truly unified operational ecosystem.

Transformative Benefits for the Modern Insurance Broker

Embracing end-to-end quote-to-bind automation is not merely an upgrade; it’s a strategic overhaul that yields profound advantages for insurance brokers:

Dramatic Boost in Efficiency and Productivity:

By automating repetitive and time-consuming tasks like data entry, quoting, and document generation, brokers reclaim valuable hours. This newfound time can be redirected towards high-value activities such as prospecting, client relationship management, cross-selling, and up-selling, maximizing their output without increasing headcount.

Accelerated Quote-to-Bind Cycle:

The elimination of manual handoffs and the introduction of real-time processing mean that a policy can be quoted, approved, and bound in minutes, rather than hours or days. This rapid turnaround significantly enhances the client experience and gives brokers a crucial edge over competitors.

Impeccable Accuracy and Minimal Errors:

Automated data flows and predefined rules reduce the incidence of human error to near zero. This ensures that quotes are accurate, policies are issued correctly, and compliance requirements are met, significantly mitigating the risk of E&O claims and associated financial penalties.

Unparalleled Client Experience:

Clients benefit from instant quotes, transparent policy comparisons, 24/7 access to their policy documents, and the convenience of digital signatures and online payments. This seamless, modern journey fosters greater satisfaction, loyalty, and positive referrals.

Ignition for Sales Growth and Revenue Expansion:

Faster service and an enhanced client experience naturally lead to higher conversion rates, increased client retention, and improved referral business. The ability to handle a larger volume of quotes efficiently also directly translates to more closed deals and a healthier bottom line.

Robust Scalability for Ambitious Growth:

As the brokerage expands, the automated infrastructure effortlessly accommodates increased transaction volumes without a linear increase in operational costs. This allows for geographical expansion, diversification into new product lines, or the absorption of new client segments with minimal friction.

Empowering Data-Driven Decision Making:

With a wealth of data centrally collected and analyzed, brokers gain deep insights into market trends, client preferences, product performance, and agent effectiveness. This intelligence empowers strategic planning, targeted marketing efforts, and the ability to proactively identify and seize new opportunities.

Forge a Formidable Competitive Advantage:

In a crowded market, technology differentiation is key. Adopting end-to-end automation positions a brokerage as forward-thinking, efficient, and client-centric, attracting not only more clients but also top-tier talent looking to work with cutting-edge tools.

The Automated Horizon: Shaping the Future of Insurance Brokering

The journey towards end-to-end quote-to-bind automation is no longer a future aspiration; it is the present reality for leading insurance brokers. By strategically investing in and leveraging these advanced portal solutions, brokers are not just optimizing their operations; they are fundamentally redefining their value proposition. They are moving beyond transactional interactions to become true strategic advisors, empowered by technology to deliver speed, accuracy, and an exceptional experience. The automated future of insurance brokering is here, poised to transform the industry and empower brokers to thrive in an increasingly digital world.