Key Takeaways

- Regulatory filings are complex, data-heavy, and error-prone when done manually, making automation essential for efficiency and accuracy.

- LLMs can process unstructured insurance data, extract relevant insights, and generate standard-compliant reports in a fraction of the time.

- They help insurers stay ahead of evolving regulations by monitoring legal updates and identifying potential impacts on current policies.

- Human oversight remains critical—LLMs enhance, not replace, expert judgment in validating compliance outputs.

- Adopting LLMs positions insurers for long-term success, enabling faster reporting cycles, reduced operational risk, and stronger regulatory confidence.

The insurance sector functions within a strict set of rules and regulations. However, they continue to change and demand meticulous adherence. Manual regulatory filings consume immense time, are prone to human mistakes, and at times, resources also go to waste. However. Large language models have come to the rescue because they transform this crucial function. As an outcome, it provides automation, efficiency, and accuracy.

This blog post explores how LLMs are becoming indispensable tools for insurance companies aiming to streamline their regulatory compliance processes, enhance data integrity, and proactively adapt to new mandates.

The Challenge of Regulatory Filings in Insurance

Here are some of the most common challenges faced by insurers during regulatory filings:

Variety and Volume:

How many of you agree that insurers often struggle with numerous challenges when it comes to handling financial records, customer interactions, claims, and more? All of this data should be compiled, analyzed, and presented in several formats for various regulatory bodies (e.g., IRDAI in India, NAIC in the USA).

Evolving Regulations:

Laws and guidelines are not static. Regulators frequently introduce amendments, new standards, and reporting requirements, demanding continuous vigilance and adaptation from insurers.

Manual Processes & Human Error:

When it comes to conventional reporting, most of them depend on spreadsheets. In spreadsheets, there are higher chances that employees may enter wrong digits or information. This may give rise to penalties or even worse. At times, a company’s reputation may also be hampered.

Data Silos:

Imperative information is at times spread in several systems and departments. Without a unified view, pulling everything together for accurate regulatory reporting becomes a time-consuming and error-prone challenge.

Time and Resource Intensive:

The sheer effort involved in preparing and submitting filings consumes significant time and dedicated personnel, diverting resources from other strategic initiatives.

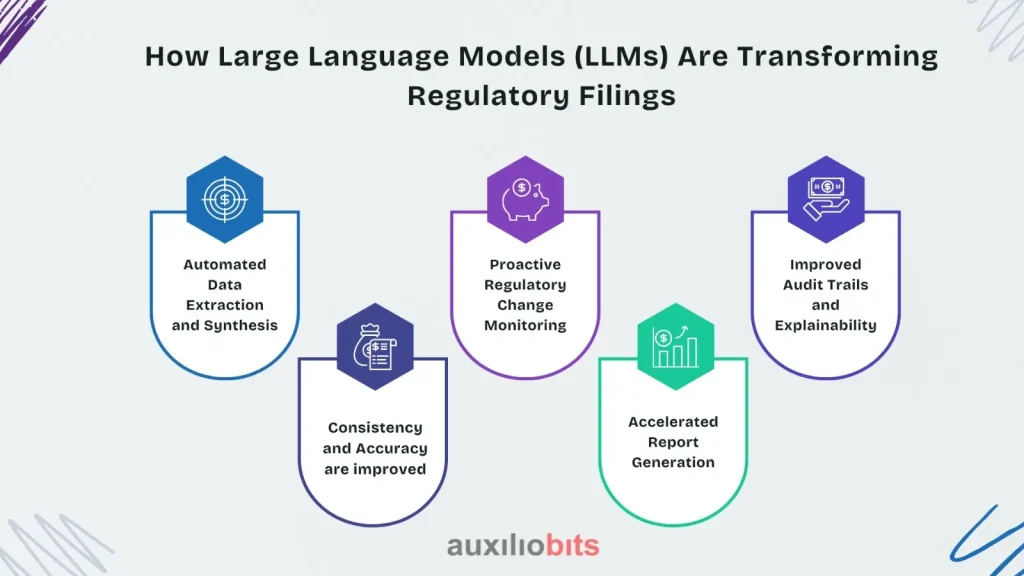

How Large Language Models (LLMs) Are Transforming Regulatory Filings

Backed by natural language processing and advanced artificial intelligence, large language models are working wonders. From managing various challenges of compliance and helping firms alter their strategies to transform their business, LLMs have not only enhanced regulatory processes but have also helped them automate.

1. Automated Data Extraction and Synthesis:

- Unstructured Data Mastery: Insurance data often exists in unstructured formats like policy documents, claims notes, emails, and legal texts. LLMs can “read” and comprehend these vast amounts of diverse documents, accurately extracting relevant information much faster than human agents.

- Intelligent Summarization: LLMs can reduce the manual effort required for examining essential data points. They help in summarizing key clauses. Apart from this, LLMs also ensure that all the claim details suitable for regulatory needs are outlined. This way, employees can focus on other tasks and also eliminate the need to sift with the help of text.

2. Consistency and Accuracy are improved.

- Error Reduction: When manual tasks are performed, there is a higher chance that they may include human errors, typos, and other issues. So what would you do to avoid these issues? Well, LLMs come in handy.

- Standardized Reporting: How many of you were aware of the fact that large language models can train themselves? Well, they make sure that when it comes to reporting standards and regulatory templates, LLMs are already trained. Therefore, they ensure that all the filings adhere to a certain format and content. This, as a result, provides consistency.

3. Proactive Regulatory Change Monitoring:

- Real-time Intelligence: LLMs can continuously monitor regulatory updates from various official sources, legal publications, and industry news feeds. They can then identify and flag new clauses, amendments, or emerging standards relevant to an insurer’s operations.

- Impact Analysis: If there is any impact of regulatory changes on current policies and procedures, large language models help in identifying them. This way, compliance staff members find out early warning signs, which prepares them for challenges.

4. Accelerated Report Generation:

- Template Population: LLMs can automatically populate pre-defined regulatory report templates with extracted and synthesized data, transforming hours or days of work into minutes.

- Customized Narratives: Large Language Models (LLMs) can quickly turn complex data into clear, well-written explanations. This helps teams speed up reporting by automatically generating the right narratives for different sections of filings or detailed data points.

5. Improved Audit Trails and Explainability:

- Data Traceability: While LLMs automate, they can also maintain robust audit trails, showing precisely where information was sourced from within documents and how it was used in a filing.

- Explainable AI (XAI) Principles: Just when large language models become up-to-date, explainability has become an integral aspect. This means that compliance teams can get a clear understanding of why artificial intelligence makes decisions. This way, teams can identify the perks of using AI and also build trust.

Practical Applications and Use Cases

Have you been wondering why LLMs are worth a try? We have listed some real-world scenarios that will help you understand how they have made a difference.

- Financial Solvency Reports: AI can automatically pull financial data from ledgers and statements, filling out solvency forms with precision. This helps ensure capital requirements are calculated accurately and saves teams from manual number-crunching.

- Market Conduct Filings: For market conduct filings, teams review customer complaints, policy details, and marketing materials to spot any possible issues and create the necessary reports.

- Product Filing Reviews: It ensures that the review of new insurance products against current regulations is ready. This way it becomes simple for the staff to find out if there are any non-compliant clauses before they make the final submission.

- Anti-Money Laundering (AML) & Know Your Customer (KYC) Reporting: This means checking all the transaction data of customers to find out if there is something suspicious. The main motive is to identify potential risks and prepare a list of the same for financial institutions and professionals.

- Claims Data Submissions: Ensuring that all the claim information, including type of loss, payout amount, etc., from unstructured claim notes is used to make sure that all the regulatory data submission prerequisites are fulfilled.

Implementing LLMs for Regulatory Filings: Key Considerations

While the benefits are clear, successful LLM integration requires careful planning.

- Data Governance and Quality: Large language models are as beneficial as the data they are trained on. Nevertheless, establishing robust data governance policies and maintaining top-notch quality is of utmost importance.

- Security and Privacy: Regulatory filings most of the time include sensitive customer information and their financial details. Therefore, it is mandatory to follow all the rules and regulations so that potential risks can be avoided.

- Human Oversight and Validation: LLMs are powerful tools, not infallible replacements. Human experts must remain in the loop to review, validate, and provide final approval for all regulatory submissions.

- Phased Implementation: Before you get started, select a project of your choice that does not have severe challenges. This will give you a chance to learn from the project and ensure that the issues are resolved. As time passes, take on more projects that have challenges, and work towards solving them.

- Vendor Selection: Get in touch with LLM solution providers who have years of experience and skills in the insurance sector. However, you can also contact financial services professionals and understand the importance of regulations.

- Continuous Learning and Adaptation: It is important to remember that regulatory environments tend to change with time. Therefore, your models will change too.

The Future of Insurance Compliance with LLMs

The integration of LLMs into regulatory filing processes is not merely about efficiency; it’s about transforming compliance from a reactive burden into a proactive, strategic advantage. By getting rid of manual effort, large language models help insurance firms to:

- Lessen operational costs connected with allocating resources.

- Allowing experts to focus on essential tasks like complex analysis and decision-making rather than spending all their time on data entry only.

- Respond quickly and smartly to all the changes in the market.

- Mitigate the risk of fines, penalties, and reputational damage due to non-compliance, strengthening market trust.

- Improve data governance and ensure consistent, reliable information across the entire organization.

As large language models are getting better with time, there is no denying that in the long run, they will be considered as a beneficial tool for enhancing and simplifying regulatory filings in insurance.