Key Takeaways

- Organizations using RPA+AI report reducing their month-end close from weeks to just a few days.

- With AI-powered IDP and ML models, companies achieve up to 98.6% transaction match accuracy and <2% unmatched items.

- Automation cuts down manual finance workloads, repurposing staff to more strategic and analytical roles.

- Automation extends beyond bank reconciliation to credit cards, intercompany, AP/AR, and multi-currency accounts.

- Self-learning agents will soon handle end-to-end reconciliation—from document ingestion to journal posting—with little or no human input.

Closing the books at the end of the month has always been an arduous experience: gathering bank statements, matching transactions, making journal entries, hunting for exceptions, preparing for audits, and the list goes on. Big finance teams often spend weeks (and days in any month with more than 28 days) in month-end reconciliation; they are rounding up all different forms of data from bank portals, ERPs, spreadsheets, and PDF statements. A lot of this manual grunt work only delays critical financial insights and exposes you to human error, compliance failure, and workforce fatigue.

Robotic Process Automation, or RPA, has become a viable solution for helping to automate repetitive manual tasks so software bots can perform those tasks just like a human would—logging in to systems, logging in and downloading files, extracting data using OCR, reconciling, and posting to ledgers. For example, one European bank reduced its reconciliation from 15 days to 4 days, a 70% reduction. First Abu Dhabi Bank reportedly went from one week to one day, approximately 840 hours saved each year. Siemens has saved 45,000 hours per year, and many companies report bots can match approximately 98% of transactions in real time.

Also read: Enhancing Enterprise Agility with RPA Automation in AI-driven Business Architectures.

Intelligent Data Ingestion & Matching

Finance teams process non-standard formats—bank PDFs, invoices from different marketplaces, exports from UPI apps, and emails. AI-driven Intelligent Document Processing (IDP) tools can interpret and normalize multiple document and record formats and pull transaction metadata at nearly 99.9% accuracy. The leading tools today essentially reduce error rates from roughly 5% down to 0.5% or less.

Once the machine learning models are onboarded, they utilize contextual clues and historical patterns to make fuzzy match suggestions when amounts or descriptions do not match perfectly. To observe the efficacy of IDP tools in a real-world application, take a scenario where a bank, or a business institution with multiple accounts (such as a governmental organization), will try to reconcile vendor payments for utilities. The typical patterns of discrepancies can result in rekindling 90% of the reconciliation tasks, which can be automated, and amount reconciliation remaining as the human touch for the 10% exceptions.

Acceleration, Accuracy, and Audit Readiness

The productivity and quality advantages of automated reconciliation span a range of areas, driving cost efficiencies in addition to improving productivity. Businesses are reporting an average reduction in labour costs of between 30 and 40 percent while repurposing their workforce to more strategic functions. The shift in focus enabled by automation is reported by 73% of finance leaders and is described as moving from manual, mundane tasks towards critical, value-adding activities.

Bank reconciliation specifically exemplifies these advantages. In 2025, companies using newer platforms (like Optimus) report:

- 85% faster month-end close

- 98.6% transaction match accuracy

- 70% reduction in manual effort

- Reallocation of 80–90% of finance staff to higher-value roles

Bank Reconciliation: A Live Use Case

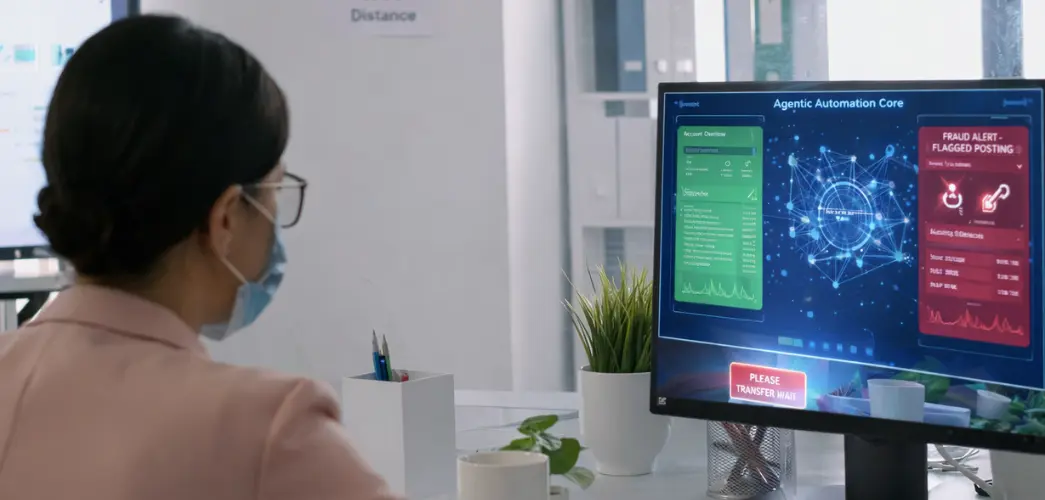

Tackling the bank reconciliation is arguably one of the most tedious, but also most important, ledger-close activities—making it a great candidate for RPA+AI. Robots take care of the routine tasks: downloading bank feeds, importing into the ERPs, executing rule-based matching, and creating journal entries. AI agents identify ambiguous data, recommend smart matching, detect fraud-like activity, and even compose reconciliation notes or narratives.

To illustrate, in one recent hybrid automation deployment, the RPA bots and AI agents in UiPath, for example, reduced a backlog of $2 million to less than $100,000 in six months. The system would execute routine items end-to-end, leaving the residual exceptions to the humans—saving as much as 90% of the manual work and enabling finance teams to concentrate on exception investigation and analysis.

Today’s AI-enabled systems support fuzzy matching, handle partial payments, can handle split transactions, and do multi-currency reconciliation. Finance teams typically reduce matched-unmatched transaction rates to less than 2% on average and can scale across payment platforms, bank accounts, intercompany entities, and geographies.

Strategic Uplift for the Finance Function

When RPA and AI take on 50-90% of the basic ledger-close work, humans do not become obsolete; they become empowered. Staffed roles transition to data analytics, surveillance trends, cash-flow forecasting, risk management, and value advisory. Numerous CFOs have indicated improved staff productivity, increased strategic alignment, and a 42% reduction in finance team turnover with the introduction of this technology base.

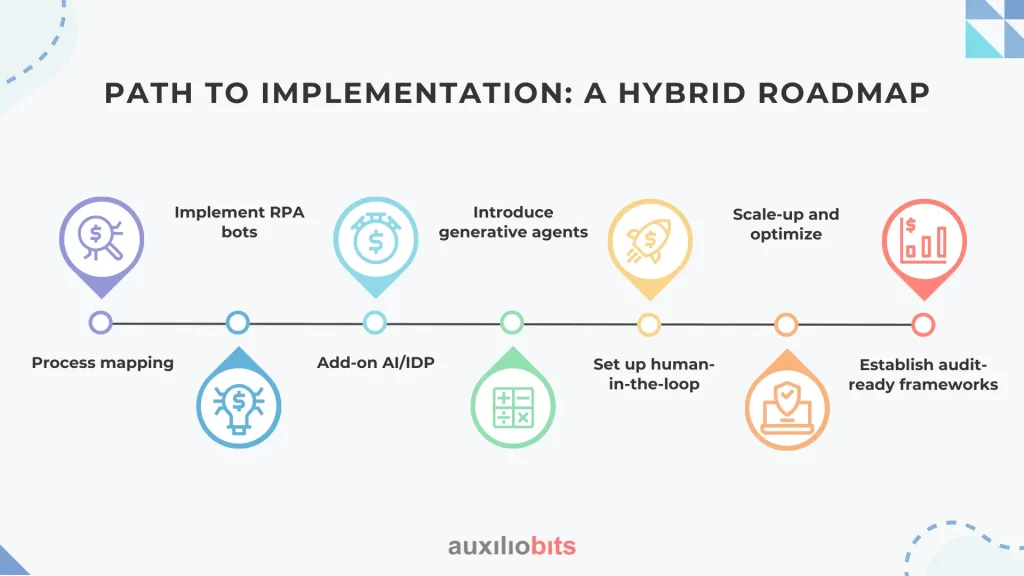

Path to Implementation: A Hybrid Roadmap

1. Process mapping:

Evaluate which of the high-volume, repeatable processes are in scope, such as bank reconciliations.

2. Implement RPA bots:

Automate data ingestion, user interface activity, and ledger imports and match posting.

3. Add-on AI/IDP:

Add document processing for unstructured data sources, fuzzy matching, and anomaly detection.

4. Introduce generative agents:

Use AI to draft reconciliation notes, recommend matching actions, and draft resolving journals.

5. Set up human-in-the-loop:

Have the analysts review AI-suggested exceptions, remodel the outputs, and develop training loops for continuous learning.

6. Scale-up and optimize:

Add more bank accounts, including intercompany, credit cards, invoice reconciliation, accounts payable, and accounts receivable reconciliations.

7. Establish audit-ready frameworks:

Enforce some type of verification process, recording all automated actions along with time-stamped and context tags for potential audits and controls.

The Future: Hyper-Automation with Self-Learning Agents

New applications merge generative AI, intelligent agents, and ERP orchestration capabilities. One example is a model dubbed “Fin Robot,” which saved processing time and added storage of documents, all while anecdotal evidence suggests decreasing error rates by 90% as well, since it uses real-time plans of three processes together, making it the most efficient. Case studies at enterprises in Korea demonstrated that generative AI+IDP agents reduced document handling time by 80% and have a human feedback loop for continual improvement.

Before long, I expect it to be a question of when finance teams will say, Hey bot, how about you reconcile all accounts for today?” and the agent fetches documents, interprets them, matches them, posts entries, flags anomalies, and records the audit log—no human directions! What may become normal is whether bookkeeping is done daily, with as-they-occur, event-driven accounting (we all know month-end spikes).