Key Takeaways

- Tactical procurement wasn’t a skills problem—it was a capacity problem. Buyers didn’t lack strategic thinking; they lacked uninterrupted space to apply it. Automation creates that space by removing constant transactional drag.

- Automation changes where humans add value, not whether they do. Once execution is handled by systems, procurement professionals are pushed toward interpretation, trade-off analysis, and upstream influence. That shift is unavoidable—and often uncomfortable.

- Intelligent sourcing fails when decision rights don’t move with insights. If alerts, analytics, and risk signals surface faster than teams are empowered to act, automation becomes noise. Strategy only emerges when authority follows information.

- The buyer role evolves from process owner to economic translator. Post-automation, strong buyers explain consequences—cost, risk, continuity—not just compliance. They connect sourcing decisions to business outcomes, not system rules.

- Category strategies only become real when behavior is visible daily. Automation exposes off-contract buying, exceptions, and drift in real time. This forces procurement to coach and influence rather than police after the fact.

For decades, procurement has lived with an identity problem.

On paper, it’s strategic. In practice, it’s reactive. Buyers spend their days chasing approvals, reconciling mismatched invoices, re-keying data between systems that were never meant to talk, and explaining to suppliers—again—why a PO was delayed. Strategy exists, but it’s squeezed into whatever time remains after the operational noise subsides.

What’s interesting is that procurement leaders have known this for years. Spend analysis tools, sourcing platforms, SRM systems—none of these were missing. What was missing was relief. Real relief. Automation didn’t just streamline procurement; it changed what the role could realistically be responsible for.

And that role shift—from tactical execution to intelligent sourcing—is the part most transformation stories gloss over.

Also read: How Agentic Automation Detects Procurement Anomalies Before Posting

Tactical procurement wasn’t a failure. It was a survival model

Before automation, procurement teams optimized for control and continuity. That made sense.

A typical buyer’s week looked something like this:

- Check requisitions manually for policy alignment

- Follow up on approvals stuck in inboxes

- Create or amend POs in ERP

- Handle supplier queries about payment status

- Flag obvious pricing errors (if they were spotted at all)

None of this was intellectually lightweight, but it was time-consuming. Judgment was applied tactically, not strategically. Decisions were reactive: fix the error, unblock the order, keep production moving.

There have been procurement teams called “non-value adding” in steering committees. That label usually came from people who never sat through a quarter-end PO cleanup or a three-day invoice backlog. The work mattered. It just didn’t scale.

And scaling is where things broke.

Automation didn’t arrive as strategy. It arrived as damage control

Most procurement automation initiatives didn’t start with grand visions of intelligent sourcing. They started with pain.

- Too many invoices to process with the same headcount

- Audit observations piling up

- Buyers acting as human middleware between ERP and email

- Suppliers escalating because “nobody responds”

RPA bots were introduced to stabilize operations. AI models were added later to classify documents, extract line items, flag obvious anomalies. At first, the goal wasn’t to rethink roles—it was to survive volume without burning out teams.

Something unexpected happened after the first six to twelve months.

Buyers had time.

This was not “free time” in a leisurely sense, but rather mental space. They weren’t context-switching every five minutes. They could look at patterns instead of transactions. That’s when the role shift quietly began.

When execution is automated, judgment moves upstream

Automation absorbs repetition first. That’s predictable.

What’s less discussed is what it pushes humans toward. Once buyers aren’t buried in execution, their attention naturally moves to decisions that can’t be fully automated.

For example:

- Why do we keep onboarding suppliers with marginal performance just because they’re cheap?

- Why does Plant A consistently buy off-contract while Plant B doesn’t?

- Why do price deviations spike right before quarter close?

These aren’t system errors. They’re behavioral and structural issues. Automation surfaces them by removing noise.

In one manufacturing client, invoice automation reduced manual touchpoints by over 60%. Within three months, the same procurement team started questioning long-standing sourcing assumptions—not because leadership asked them to, but because they finally had evidence and bandwidth.

That’s intelligent sourcing emerging organically, not through mandate.

Intelligent sourcing is not “more analytics”

This is where many transformations stall.

Procurement teams are given dashboards and told to be strategic. But analytics without agency doesn’t change behavior. Intelligent sourcing isn’t about prettier charts—it’s about decision authority shifting closer to insight.

What automation enables:

- Continuous visibility into spend drift, not quarterly snapshots

- Early signals of supplier risk before performance collapses

- Contextual alerts instead of static thresholds

- Scenario testing that doesn’t require weeks of manual modeling

What it doesn’t magically solve:

- Poor category strategies

- Political supplier relationships

- Fragmented governance across plants or regions

There have been teams drown in analytics because no one clarified who acts when a signal appears. Automation makes this painfully visible. If alerts fire daily and nothing changes, trust erodes quickly.

Intelligent sourcing only works when roles evolve alongside tools.

The buyer role doesn’t disappear. It mutates

There’s a persistent fear—sometimes unspoken—that automation “replaces” buyers. In reality, it replaces fragments of their job that no one enjoyed.

What emerges is a different skill profile.

Traditional buyer strengths

- Process compliance

- Transaction accuracy

- ERP fluency

- Supplier coordination

Post-automation strengths that matter more:

- Interpreting weak signals across categories

- Understanding trade-offs between cost, risk, and continuity

- Challenging historical sourcing logic with data

- Working cross-functionally with finance, operations, and legal

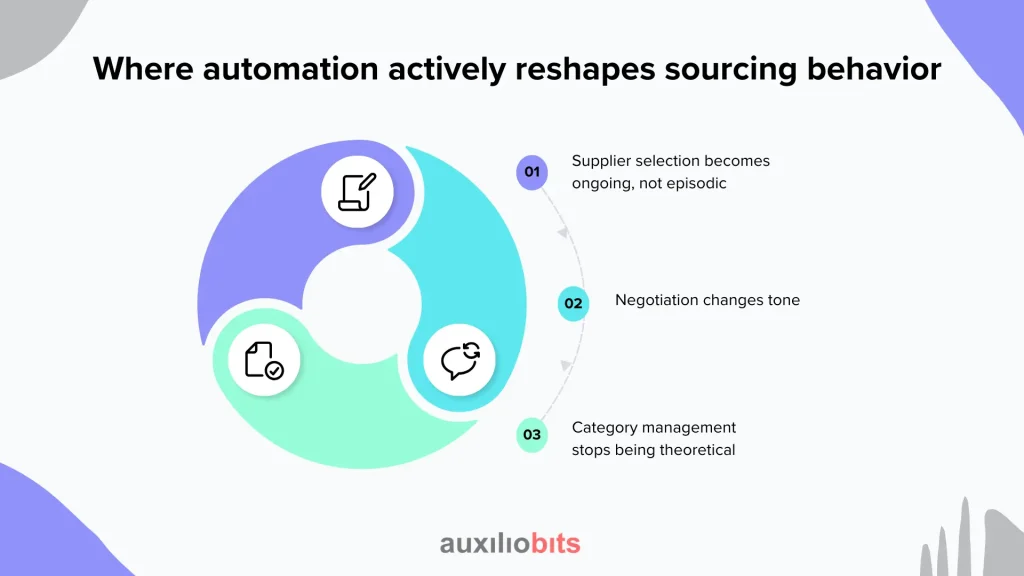

Where automation actively reshapes sourcing behavior

The most tangible role changes show up in specific sourcing activities.

1. Supplier selection becomes ongoing, not episodic

Historically, sourcing events were periodic. RFPs, evaluations, awards—then silence for years.

With automated data flows:

- Delivery performance is tracked continuously

- Price deviations are flagged transaction-by-transaction

- Compliance checks don’t stop after onboarding

This forces procurement to think in probabilities instead of snapshots. Suppliers aren’t “approved” once; they’re continuously validated.

The role shift here is subtle but real. Buyers stop being event managers and start acting like portfolio stewards.

2. Negotiation changes tone

When pricing data is fragmented and delayed, negotiations rely on leverage and anecdotes. Automation changes that dynamic.

With clean, timely data:

- Buyers know where margins actually erode

- Volume commitments can be modeled realistically

- “We’ll look into it” stops being an acceptable supplier response

Interestingly, negotiations often become less adversarial. Facts reduce theater. But they also raise expectations. Buyers must understand the numbers they bring to the table. There’s nowhere to hide behind process anymore.

3. Category management stops being theoretical

Many organizations say they have category strategies. Fewer operationalize them.

Automation connects category intent to daily behavior:

- Off-contract buys are visible immediately

- Maverick spend isn’t discovered six months later

- Exceptions require justification, not excuses

This pushes category managers into a coaching role. They explain why a contract exists, not just enforce it. That’s a very different posture.

When the shift fails

Not every automation program leads to intelligent sourcing. Some stall at “faster tactical procurement.”

Common failure modes:

- Automation layered on broken processes

- No clarity on decision rights post-automation

- Buyers measured on old KPIs (cycle time, volume processed)

- Leadership expecting strategy without removing operational accountability

There have been teams automate invoice processing, then redeploy the same buyers to handle more exceptions instead of deeper analysis. Automation becomes a treadmill—faster, but still exhausting.

The role shift only sticks when incentives change. If buyers are still rewarded for throughput, they’ll behave tactically no matter how advanced the tools are.

A quiet but important change: procurement’s credibility improves

One underappreciated effect of automation is reputational.

When procurement stops being the bottleneck:

- Business stakeholders engage earlier

- Finance trusts forecasts more

- Operations involve procurement in planning discussions

This credibility shift matters. Intelligent sourcing requires influence, not authority. Automation earns procurement a seat at the table by reducing friction first.

What this means for procurement leaders right now

The transition from tactical to intelligent sourcing isn’t a future state. It’s already unevenly underway in most enterprises.

If you’re leading procurement today, a few uncomfortable questions are worth asking:

- Which parts of my team’s work exist only because systems don’t talk?

- Where do we still rely on heroics instead of design?

- Are our best people doing the work only they can do?

The answers usually point directly to where automation should be applied next—not to eliminate roles, but to elevate them.

Final thought

Procurement didn’t become strategic because someone declared it so. It becomes strategic when the organization removes the weight that keeps it tactical.

Automation is not the strategy. It’s the release valve.

What fills the space afterward—insight, judgment, influence, or just more noise—depends entirely on how seriously the role shift is taken. And that part, inconveniently, can’t be automated.