Key Takeaways

- UiPath excels at complex, cross-platform automation. Its robust RPA capabilities and drag-and-drop interface make it ideal for automating workflows across multiple enterprise systems.

- Power Automate is cost-effective and deeply integrated with Microsoft tools. Organizations already using Microsoft 365 benefit from native integrations and AI-powered workflows at a lower cost.

- Finance departments face significant manual process challenges. Tasks like invoice processing and data entry are time-consuming and prone to human error—making them prime candidates for automation.

- Choosing the right tool depends on your tech ecosystem and automation goals. UiPath suits broader automation beyond Microsoft apps, while Power Automate is perfect for businesses embedded in the Microsoft environment.

- Automation leads to tangible business benefits. The case study demonstrated that automation reduced processing time from hours to minutes, increased accuracy, and improved employee morale.

Automation has moved beyond a luxury to a necessity in today’s fast-paced financial world. And with the onrush of digital transformation, companies are now also hurrying toward solutions around something called process automation to try and remedy that by, let’s say, 2025. But with so many choices available, how do you select the right process automation tool for your company? This blog post looks at two of the leading tools on the market—UiPath and Microsoft Power Automate—to see how they might meet the needs of your organization.

Also read: What’s New in UiPath: Features You Should Be Using Today

The Challenge of Finance Automation

The repetitive tasks of data entry, invoice processing, and report generation tend to weigh down finance departments. These activities not only eat up a lot of valuable time, but they also raise the potential for human error. For example, it might take a financial analyst many hours to pull together data from multiple sources. This could lead to decisions being made more slowly, and it could also lead to inaccuracy in the financial reporting that is being done.

Companies are confronted with the need to balance efficiency and accuracy, and at the same time, ensure they comply with the regulations they must follow. The demand for financial services that are not only fast but also reliable is growing. At the same time, those services must be accurate; they must satisfy the basic requirements of automatable processes. In this scenario, where should a decision-maker begin? Two leading contenders for delivering these outcomes are UiPath and Power Automate

Evaluating UiPath and Power Automate

Regarding finance automation, both UiPath and Power Automate offer distinct traits and capabilities.

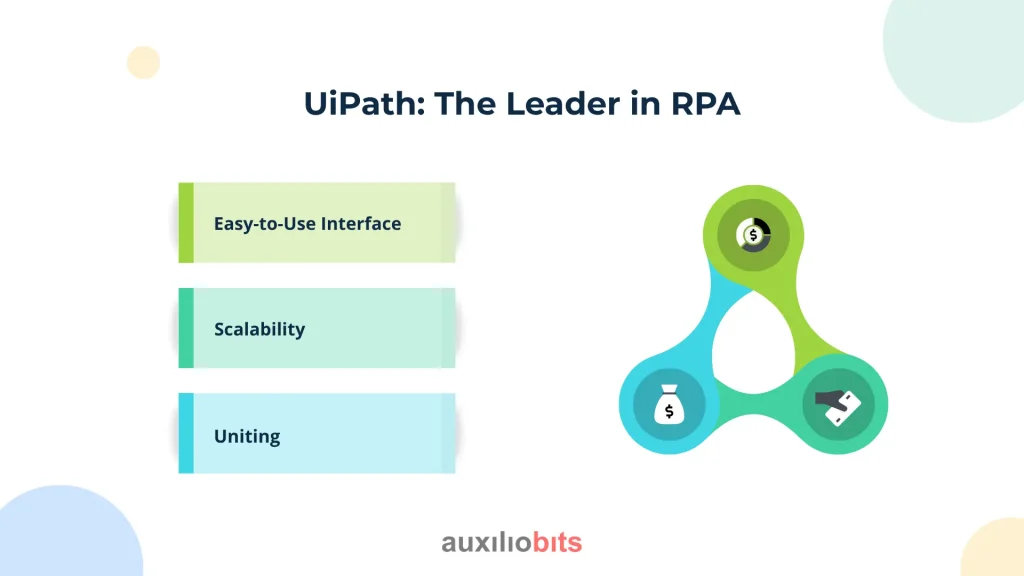

UiPath: The Leader in RPA

UiPath has a great reputation for its strong automation capabilities. It enables businesses to automate mind-numbing repetitive tasks across many applications and systems. Even better, it works well with existing platforms and applications, automating across them without any need to change those systems. Here are some of its main features:

- Easy-to-Use Interface: The drag-and-drop interface that UiPath has makes it easy to design automation workflows without having extensive knowledge in coding.

- Scalability: Companies can commence with a modest endeavor and progressively expand their automation initiatives. This makes it appropriate not just for small businesses but also for large ones.

- Uniting: UiPath unites effortlessly with abundant financial programs, increasing the potential for automating finance functions.

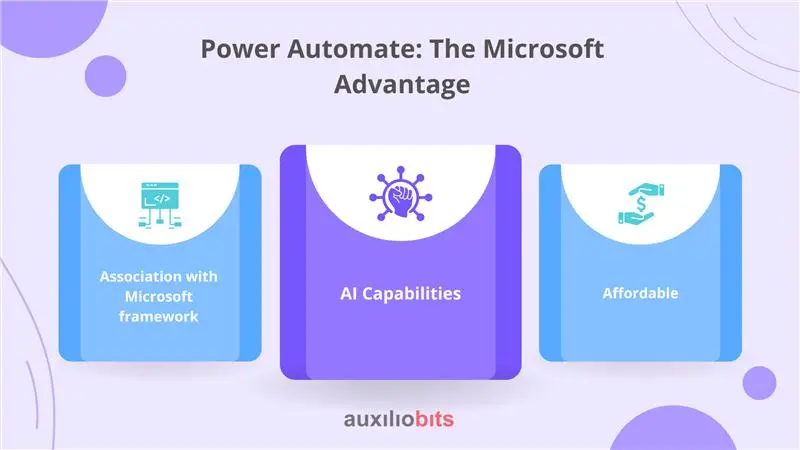

Power Automate: The Microsoft Advantage

Power Automate, which is part of the Microsoft Power Platform, takes a different route, concentrating on making workflows operate between Microsoft apps and services from other parties. Its main features are as follows:

- Association with Microsoft framework: In the event that your establishment makes intensive use of Microsoft wares such as Excel, SharePoint, or Dynamics 365, Power Automate offers a compatible interface.

- AI Capabilities: Power Automate can automate tasks and analyze data to add intelligence to your finance processes. How? With built-in AI tools.

- Affordable: For companies that have already adopted Microsoft 365, Power Automate can be a considerably more economical option since it is frequently bundled with current subscriptions.

Choosing the Right Tool for Your Business

When choosing between UiPath and Power Automate, it’s necessary to examine the particular requirements of your finance department. If you are looking to automate extremely intricate workflows that span several applications, UiPath may be more suitable. On the other hand, if your organization is essentially operating within a Microsoft environment, Power Automate might integrate more seamlessly with your other tools.

Case Study: Finance Transformation

Let’s consider a mid-sized accounting firm as a case study for automation’s impact in finance. The firm took on serious problems with its invoice processing workflow, which was very much a manual operation. It had trouble with manual data entry, which led to inefficiencies and inaccuracies in several invoices. These problems, in turn, led to some serious challenges the firm had in some financial reporting that went beyond it. The problems it had were going in the opposite direction one would want, with a sort of sending up a red flag issue using the way a signal flag is seen as a symbol of a message.

The Problem

Countless hours were spent by the accounting team to process invoices; frustration and low morale were the results. The number of errors in data entry led to payment delays and strained relationships with vendors. A solution was needed to streamline the process.

The Solution

Following the evaluation of both UiPath and Power Automate, the company decided on UiPath because of its superior RPA capabilities. They installed robots from UiPath to automate the extraction of data from invoices and to enter that data directly into their accounting software. The implementation was straightforward, thanks to the user-friendly interface of UiPath.

The Result

In a matter of weeks, the company experienced a sharp decrease in the amount of time it took to process invoices. Where it used to take several hours to process a single invoice, it now takes just minutes—if that. Of course, with less time taken came better accuracy. No one on the accounting team would be foolish enough to challenge the uptime of an RPA-enabled decision engine.

Conclusion

To sum up, UiPath and Power Automate are both excellent choices for automating finance processes. Each has its unique capabilities and advantages that make it suitable for different sorts of tasks and environments. Your ideal choice depends on what sorts of tasks you want to automate, the environments those tasks tend to run in, and the overall vision you have for the future of your finance automation initiative.

If you’d like to know how Auxiliobits can help you automate finance operations, let us know. We offer consultations. Our experts can help demystify finance automation and help identify the most suitable solution for your organization.