Key Takeaways

- Traditional self-service tools are no longer enough—AI and agentic workflows bring a new level of intelligence and responsiveness to banking portals.

- AI enables 24/7 support, fraud detection, and hyper-personalized financial services, creating a more meaningful customer experience.

- Agentic workflow routing allows autonomous, multi-step task orchestration with seamless handoff to humans when needed, ensuring efficiency and continuity.

- Building such a portal requires a robust data foundation, the right tech stack, user-first design, and a firm commitment to compliance and security.

- This transformation doesn’t just improve service—it redefines banking by freeing up human talent for higher-value tasks and strengthening long-term customer relationships.

Consumers want everything within a blink of an eye. Whether it is a service or a product, the expectations for immediate service have reached new heights. This, however, is getting very common in the financial industry. The conventional banking procedures, characterized by manual procedures and a lot of human intervention for everyday inquiries, are now struggling to fulfill the customer demands. Therefore, all these factors make the development of a self-service bank portal better with the help of agentic workflow routing and artificial intelligence.

Also read: AI Agents for Regulatory Compliance Monitoring in Banking

The Dynamic Evolution of Self-Service in Modern Banking

Well, the concept of self-service banking is not new. Automated teller machines, online banking platforms, and mobile apps have made it easy for customers to handle their finances. Whether it is about checking the bank balance or applying for a checkbook, everything is feasible.

But what if we tell you that this is not sufficient? Yes, you read it right. We are in search of innovative systems that can handle tasks that include several steps. Additionally, they should also understand complex instructions and make sure that customer demands are met.

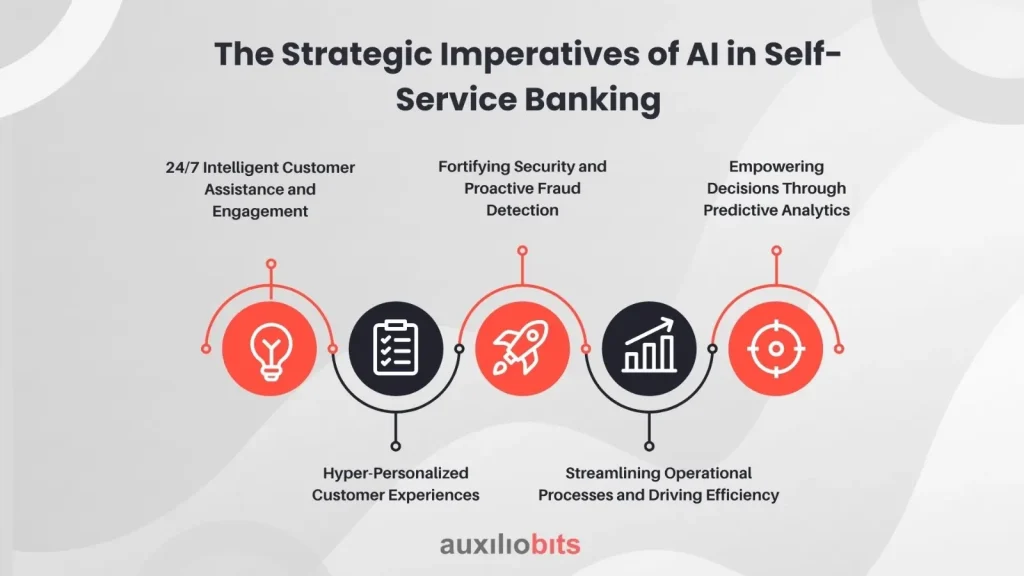

The Strategic Imperatives of AI in Self-Service Banking

By integrating AI, a conventional self-service portal changes into an efficient platform. As an outcome, this platform offers the following to the customers:

24/7 Intelligent Customer Assistance and Engagement:

Agents that are powered by artificial intelligence offer virtual assistants and chatbots that have the skills to consider and solve a plethora of customer inquiries without wasting time. From sorting out customer queries to getting their hands on essential documents and more, AI entities ensure that the waiting period is decreased.

Hyper-Personalized Customer Experiences:

With the help of top-notch machine learning algorithms, AI can understand demographic details and analyze several datasets. This provides recommendations for customers. So whether they want to opt for financial services or products, customers can now get everything customized. This strengthens the relationship between customers and financial institutions.

Fortifying Security and Proactive Fraud Detection:

AI’s unparalleled capacity to rapidly process and analyze colossal volumes of real-time transactional data empowers it to identify subtle yet suspicious patterns and anomalies that would otherwise go unnoticed by human observation. This capability is instrumental in significantly bolstering fraud detection and prevention mechanisms, including identifying unusual spending habits or potential account compromises. This proactive, AI-driven approach safeguards both the financial institution’s assets and the integrity of its customers’ accounts.

AI is adept at automating a multitude of repetitive and rule-based tasks that traditionally consume significant human resources. This includes, but is not limited to, rigorous Know Your Customer (KYC) verification procedures, the intricate processing of loan applications, and comprehensive document management. Such automation leads directly to remarkably faster turnaround times, diminishes the probability of human error, and substantially reduces operational overheads, thereby reallocating human capital to more strategic endeavors.

By meticulously analyzing extensive historical data, AI systems can accurately predict future customer needs, anticipate emerging market trends, and identify potential financial risks with remarkable foresight. This predictive capability empowers banking institutions to make more informed strategic decisions, develop proactive service offerings, and mitigate potential challenges before they escalate, ensuring a more resilient and forward-looking operational model.

The Orchestrator of Action: Understanding Agentic Workflow Routing

While AI provides the foundational intelligence and analytical power, Agentic Workflow Routing acts as the dynamic orchestrator, transforming intelligence into actionable, seamless processes. Consider AI not merely as a tool for answering static questions, but as an autonomous, goal-oriented agent capable of meticulously coordinating and executing complex tasks.

Agentic workflows are characterized by AI-driven processes where intelligent AI agents exhibit the following sophisticated capabilities:

Sophisticated Reasoning and Adaptive Planning:

These agents possess the ability to deeply comprehend the underlying intent behind a customer’s request, even when the query is nuanced, ambiguous, or initially incomplete. They can infer context and formulate a strategic plan for resolution.

Autonomous Decision-Making:

Based on their comprehensive understanding and established protocols, agentic AI agents can autonomously determine the most efficient and effective course of action required to fulfill the customer’s request. This reduces reliance on human intervention for routine decisions.

Seamless Tool Utilization and Integration:

Agentic AI agents are designed to seamlessly integrate with and leverage various internal banking systems (e.g., core banking systems, CRM platforms) and external Application Programming Interfaces (APIs). This allows them to execute diverse tasks such as initiating a financial transfer, logging a complex service request, updating customer contact information, or even fetching external data relevant to the inquiry.

For more intricate requests that necessitate multiple sequential steps, involve disparate systems, or ultimately require human intervention due to complexity or regulatory requirements, agentic workflows exhibit a remarkable ability to dynamically and intelligently route the task. They ensure the customer and all relevant context (e.g., chat history, pre-filled forms) are seamlessly transferred to the most appropriate human agent or specialized department. Crucially, these systems possess a learning mechanism, continuously optimizing future interactions based on past outcomes and feedback, refining their routing logic over time.

In essence, agentic workflow routing ensures that if an AI chatbot encounters a query beyond its immediate resolution capabilities, it doesn’t just pass the customer along. Instead, it intelligently hands over the customer and all accumulated, relevant contextual details to the most suitable human agent or specialized department, ensuring a frictionless and highly efficient escalation process. This eliminates the frustrating experience of customers having to repeatedly articulate their issues, significantly accelerating the resolution time and enhancing overall satisfaction.

Architecting Your Next-Generation Self-Service Banking Portal

The successful implementation of a transformative self-service banking portal, powered by the synergy of AI and agentic workflow routing, necessitates a structured and meticulous approach:

1. Define Granular Strategic Objectives:

Before embarking on development, precisely articulate the specific customer pain points you aim to alleviate and the quantifiable operational efficiencies you intend to achieve. Is it reducing call center volume, improving loan application completion rates, or enhancing customer satisfaction scores? Clear objectives will guide the entire project.

2. Establish a Robust and Secure Data Infrastructure:

AI models are insatiably data-hungry. It is paramount to ensure the presence of a secure, highly integrated, and meticulously governed data infrastructure. This foundational element will reliably feed clean, accurate, and real-time data to your AI models, ensuring their efficacy and trustworthiness.

3. Strategic Selection of AI and Automation Technologies:

This critical phase involves carefully evaluating and selecting the most appropriate AI platforms. This includes sophisticated Natural Language Processing (NLP) engines for understanding human language, advanced Machine Learning (ML) frameworks for predictive capabilities, and Robotic Process Automation (RPA) tools for task execution. Crucially, an overarching orchestration layer is vital for managing and integrating these technologies within the agentic workflow framework.

4. Prioritize an Unparalleled User Experience (UX):

The portal’s design must be inherently intuitive, effortlessly navigable, and universally accessible across all digital devices (desktops, tablets, smartphones). Employing simple, unambiguous language and providing clear, concise instructions are fundamental principles for ensuring a positive and productive user journey.

5. Foster Seamless Human-AI Collaboration (The “Human-in-the-Loop”):

Design the workflows meticulously to ensure that AI agents can efficiently and intelligently escalate complex, sensitive, or high-value cases to human agents. Crucially, when an escalation occurs, the human agent must be provided with complete historical context of the interaction, eliminating redundancy for the customer. This “human-in-the-loop” model is indispensable for maintaining empathy, handling edge cases, and building trust.

6. Unwavering Commitment to Security and Regulatory Compliance:

Implement multi-layered, robust security measures, including advanced encryption, access controls, and continuous monitoring, to protect sensitive customer data. Furthermore, ensure that all AI-driven processes and workflow automations adhere rigorously to stringent banking regulations, data privacy laws (e.g., GDPR, local financial regulations), and industry best practices. Compliance is non-negotiable.

7. Embrace a Culture of Continuous Improvement and Iteration:

AI models are not static; they learn, evolve, and improve through continuous feedback. Establish a robust feedback loop mechanism, coupled with comprehensive analytics, to constantly monitor the portal’s performance, identify areas for refinement, and perpetually enhance customer satisfaction and operational efficiency. This iterative approach ensures the portal remains cutting-edge.

The Future of Banking: Intelligent, Self-Directed, and Empowering

By strategically embracing the symbiotic relationship between advanced AI capabilities and intelligent agentic workflow routing, financial institutions can profoundly transform their self-service offerings. They can evolve from mere transactional platforms into truly intelligent, proactive, and profoundly personalized customer engagement hubs.

This paradigm shift not only empowers customers with immediate and effective solutions but also strategically frees up invaluable human resources. These skilled professionals can then redirect their expertise to focus on more complex, empathetic, and advisory-oriented interactions, ultimately driving superior operational efficiency, cultivating deeper and more enduring customer loyalty, and securing a decisive competitive advantage. The future of banking is not just digital; it is inherently intelligent, self-directed, and remarkably empowering.