Key Takeaways

- Manual KYC and AML processes are inefficient, error-prone, and costly, leading to compliance risks, poor customer experience, and heavy regulatory fines.

- UiPath’s intelligent automation platform leverages AI and RPA to streamline every stage of the compliance lifecycle—from document processing to transaction monitoring and SAR filing.

- Automation improves accuracy, reduces costs by up to 70%, and accelerates customer onboarding, helping banks remain compliant while enhancing agility and service quality.

- UiPath bots integrate seamlessly with existing systems, offer real-time monitoring, and generate complete audit trails, making compliance both efficient and transparent.

- Banks embracing automation for compliance gain a strategic edge, freeing up human talent, improving fraud detection, and aligning with evolving regulatory expectations.

The financial industry at present has come up with rules and regulations that every customer has to follow. This is to avoid major challenges like fraud detection and more. Currently, banks have made it mandatory for customers to adhere to KYC (Know Your Customer) and AML (Anti-Money Laundering) rules. Both of these crime measures come with paperwork, proper data verification, and monitoring of customers. However, to ensure the completion of these, banks have utilized manual procedures that have resulted in customer dissatisfaction and compliance vulnerabilities.

To help financial institutions get rid of such challenges, UiPath has emerged as a useful platform. Financial institutions can revolutionize their KYC and AML compliance conveniently by following a streamlined and efficient process. This will not only save time but will also build a compliant, resilient, and customer-centric financial institution.

Also read: What’s New in UiPath: Features You Should Be Using Today

Understanding the Compliance Imperative: KYC and AML Explained

Before diving into automation, let’s briefly clarify KYC and AML.

Know Your Customer (KYC):

This is a very important step when it comes to avoiding financial crime. KYC consists of verifying the identity of customers. This helps to identify if there is any risk. The KYC process consists of the following:

- Customer Due Diligence (CDD): Gathering and verifying basic customer information (ID, address, occupation, source of funds).

- Enhanced Due Diligence (EDD): For any customer who is considered high risk, investigations are performed by experts. This includes gaining a complete understanding of the customers’ financial activities.

- Ongoing Monitoring: Continuously monitoring customer transactions and activities for any suspicious patterns or changes in risk profile.

- Anti-Money Laundering (AML): It encompasses all regulatory procedures and frameworks designed to prevent criminals from obtaining funds illegally. AML extends beyond Know Your Customer (KYC) protocols to include:

- Transaction Monitoring: Analyzing large volumes of transactions to identify unusual patterns that could indicate money laundering or terrorist financing.

- Suspicious Activity Reporting (SARs): Filing reports with financial intelligence units when suspicious activities are detected.

- Sanctions Screening: Checking customers and transactions against global sanctions lists (e.g., OFAC) to ensure compliance with international embargoes.

The interconnectedness of KYC and AML means that robust customer identification is the bedrock of effective anti-money laundering efforts.

The Pain Points of Manual Compliance: Why Banks Struggle

For years, banks have grappled with the inherent challenges of manual KYC and AML processes:

Laborious Data Collection and Verification:

Gathering documents (IDs, utility bills, company registries) from various sources, often in different formats, and manually inputting data is incredibly time-consuming and error-prone.

High Operational Costs:

A single KYC check can cost banks upwards of $2,500, with ongoing monitoring adding to this burden. The sheer volume of checks translates to significant overheads.

Inconsistent Data and Human Error:

Manual data entry and cross-referencing across disparate systems inevitably lead to inconsistencies and mistakes, increasing compliance risk.

Slow Customer Onboarding:

Lengthy verification processes can frustrate new customers, leading to abandonment and lost business opportunities.

Regulatory Scrutiny and Hefty Fines:

Non-compliance can result in severe penalties, reputational damage, and even loss of operating licenses. Regulators are becoming increasingly vigilant.

Lack of Scalability:

During peak periods or with business growth, manual processes struggle to scale, leading to backlogs and increased risk.

Alert Fatigue:

Manual transaction monitoring often generates a high volume of “false positives,” overwhelming compliance teams and diverting attention from genuine threats.

The UiPath Solution: Intelligent Automation for Compliance Excellence

UiPath’s RPA platform empowers banks to automate a wide array of KYC and AML tasks, transforming these challenges into opportunities for efficiency and enhanced security. Here’s how:

1. Automated Customer Onboarding & KYC:

- Intelligent Document Processing (IDP): UiPath’s Document Understanding capabilities, powered by AI, can automatically extract data from various KYC documents (passports, driving licenses, utility bills, company registration documents) regardless of format. This eliminates manual data entry and drastically reduces processing time.

- What most people don’t know: UiPath’s IDP leverages pre-trained models and can be continuously trained on custom document types, making it highly adaptable to a bank’s specific needs and diverse global clientele. It’s not just OCR; it’s about understanding context and extracting meaningful data.

- Automated Verification and Validation: Bots can instantly verify customer data against internal databases, external government registries, credit bureaus, and watchlists (sanctions, PEPs – Politically Exposed Persons).

- Risk Scoring and Segmentation: Based on verified data, UiPath robots can automatically assign risk scores to customers, categorizing them into low, medium, or high risk. This ensures that resources are allocated efficiently for due diligence.

- Seamless System Integration: UiPath can seamlessly integrate with existing core banking systems, CRM, and other third-party compliance tools, ensuring data consistency and eliminating the need for costly system overhauls.

2. Streamlined AML Transaction Monitoring:

- Real-time Alert Generation: Bots can monitor transactions 24/7, flagging suspicious activities based on pre-defined rules and AI-powered anomaly detection. This significantly reduces the time to detect potential financial crime.

- Automated Alert Triage: UiPath can automate the initial investigation of alerts, gathering relevant data from multiple sources and presenting it to compliance officers in a consolidated view. This drastically reduces false positives and allows human analysts to focus on complex cases requiring judgment.

- What most people don’t know: UiPath can be integrated with advanced AI and Machine Learning models to learn from historical data and continuously improve the accuracy of anomaly detection, reducing alert fatigue even further.

- Automated SAR Filing: Once a suspicious activity is confirmed, bots can automatically populate and file Suspicious Activity Reports (SARs) with the relevant regulatory bodies, ensuring timely and accurate submissions.

3. Continuous Regulatory Compliance:

- Automated Audit Trails: Every action performed by a UiPath robot is meticulously logged, providing a comprehensive and immutable audit trail. This is invaluable for demonstrating compliance to regulators.

- What most people don’t know: UiPath’s granular logging capabilities go beyond simple timestamps; they capture every data point accessed, every decision made by the bot, and every system interaction, offering unparalleled transparency for audits.

- Rapid Adaptation to Regulatory Changes: When new regulations are introduced, RPA workflows can be quickly updated and reconfigured, ensuring rapid compliance without extensive manual retraining or system reprogramming.

- Automated Reporting: Bots can generate various compliance reports regularly, ensuring all necessary data is collated and presented in the required format for regulatory submissions.

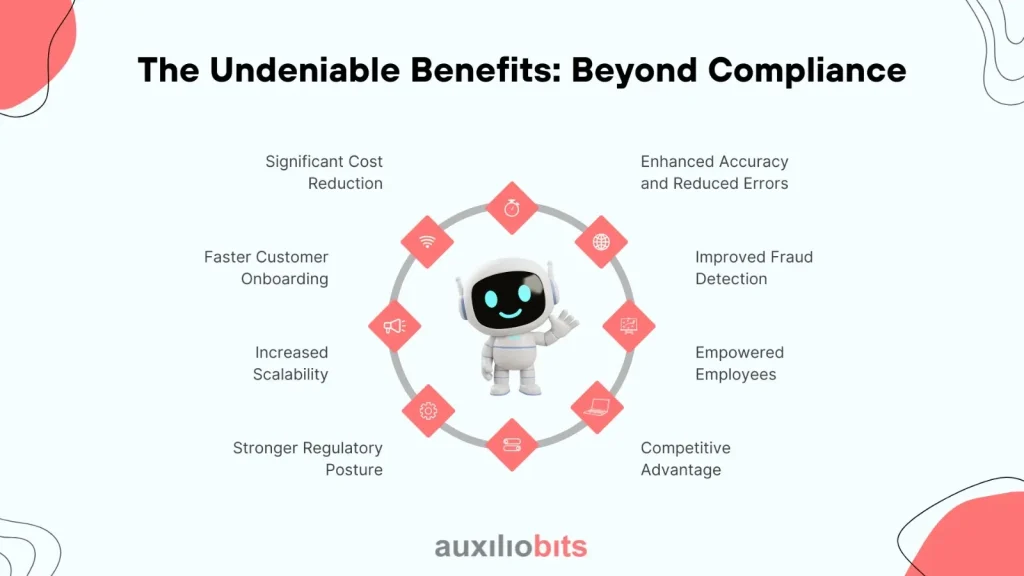

The Undeniable Benefits: Beyond Compliance

Automating KYC and AML with UiPath offers a multitude of benefits that extend far beyond simply meeting regulatory obligations:

Significant Cost Reduction:

Automating repetitive tasks can lead to a 30-70% reduction in operational costs associated with compliance. This frees up significant capital for strategic investments.

Enhanced Accuracy and Reduced Errors:

Bots eliminate human error in data entry and processing, leading to higher data integrity and fewer compliance breaches.

Faster Customer Onboarding:

By accelerating KYC checks, banks can onboard new customers in minutes, not days, significantly improving the customer experience and driving revenue growth.

Improved Fraud Detection:

Real-time monitoring and advanced analytics enable quicker identification of suspicious activities, strengthening fraud prevention efforts.

Increased Scalability:

RPA solutions can easily scale up or down to handle fluctuating workloads, ensuring consistent performance even during peak periods.

Empowered Employees:

By offloading mundane tasks to robots, human employees can focus on higher-value, more strategic activities that require critical thinking, judgment, and customer interaction. This leads to increased job satisfaction and productivity.

Stronger Regulatory Posture:

A robust, automated compliance framework minimizes the risk of fines and reputational damage, building trust with regulators and customers alike.

Competitive Advantage:

Banks that embrace intelligent automation for compliance gain a significant edge, offering faster, more secure, and more efficient services.

Real-World Impact: UiPath Success Stories

Leading financial institutions worldwide are already experiencing the transformative power of UiPath in compliance. For instance, some banks have reported:

- 88% faster processing times for customer verification.

- Thousands of man-hours saved annually, redirecting human capital to more strategic initiatives.

- 100% accuracy in automated compliance processes.

These aren’t just theoretical gains; they are tangible results demonstrating the profound impact of UiPath on banking operations.

The Future is Automated, Compliant, and Customer-Centric

The banking industry is at a crossroads. The pressures of regulatory compliance are only increasing, while customer expectations for seamless digital experiences continue to rise. Manual processes are simply no longer sustainable.

UiPath offers a proven path forward. By strategically implementing intelligent automation for KYC and AML, banks can not only mitigate risk and ensure compliance but also unlock new levels of efficiency, improve the customer journey, and position themselves for sustained growth in the digital age.

Ready to transform your bank’s compliance operations? Explore how UiPath can help you build a future where compliance is not a burden but a competitive advantage. Contact us today for a personalized demonstration and discover the power of intelligent automation for your financial institution.