When we talk about the insurance sector, customer happiness, accuracy, and efficiency are factors that cannot be taken lightly. Traditionally, claims processing has been a manual, time-consuming, and often error-prone endeavor. However, a powerful synergy of Robotic Process Automation (RPA) and Large Language Models (LLMs) is now poised to revolutionize this critical function, ushering in an era of unprecedented speed, precision, and intelligent automation.

This isn’t just about incremental improvements; it’s a fundamental shift in how insurance companies operate, leading to significant cost savings, enhanced compliance, and a superior customer experience.

Also read: How Autonomous AI Agents Are Transforming Insurance Claims?

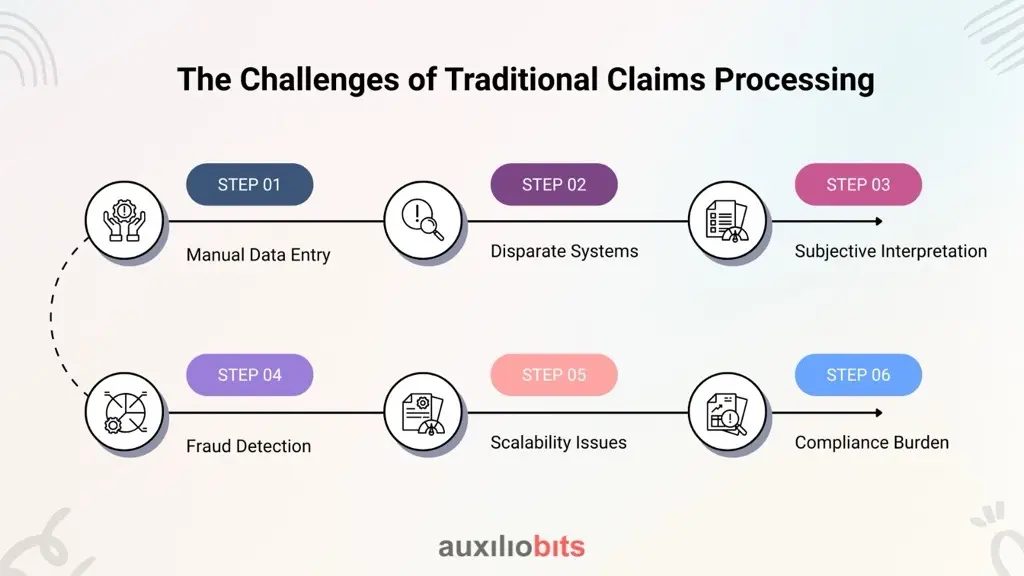

The Challenges of Traditional Claims Processing

Before we delve into the transformative power of RPA and LLMs, let’s acknowledge the common pain points in conventional claims processing:

Manual Data Entry:

A vast amount of data from various sources (emails, forms, medical reports, police reports) needs to be manually entered, leading to human errors and slow processing times.

Disparate Systems:

Legacy systems often don’t communicate effectively, creating data silos and requiring agents to navigate multiple platforms.

Subjective Interpretation :

Complex claim narratives, legal documents, and damage assessments often require subjective interpretation, leading to inconsistencies and

Fraud Detection:

Identifying fraudulent claims manually is challenging and resource-intensive.

Scalability Issues:

Surges in claims (e.g., after natural disasters) can overwhelm manual processes, leading to significant backlogs and customer dissatisfaction.

Compliance Burden:

Adhering to ever-evolving regulatory requirements demands meticulous documentation and auditing.

RPA: The Backbone of Automation

Robotic Process Automation acts as the digital workforce, automating repetitive, rule-based tasks that typically consume a large portion of an insurance agent’s time. Think of RPA bots as tireless assistants capable of:

Automated Data Extraction:

RPA can extract data from various document formats (PDFs, scanned images, emails) with high accuracy, eliminating manual data entry.

System Integration:

Bots seamlessly interact with disparate systems, including legacy platforms, CRMs, and core claims management systems, bridging data gaps without extensive API development.

Form Filling & Verification:

RPA can automatically fill out forms, cross-reference information, and validate data against predefined rules, ensuring consistency and accuracy.

Workflow Orchestration:

Bots can trigger actions, route documents to the correct department, and initiate subsequent steps in the claims process, ensuring smooth progression.

RPA can generate audit trails and compliance reports automatically, significantly reducing the burden of regulatory adherence.

By automating these foundational tasks, RPA drastically reduces processing times, minimizes human errors, and frees up human agents to focus on more complex, value-added activities

LLMs: Adding Intelligence and Understanding

While RPA excels at structured, repetitive tasks, Large Language Models (LLMs) bring a new dimension of intelligence to claims processing. These advanced AI models can understand, interpret, and generate human-like text, making them invaluable for handling unstructured data and complex narratives.

Here’s how LLMs elevate claims automation:

Intelligent Document Understanding:

LLMs go beyond simple data extraction. They can understand the context and meaning within complex documents like medical reports, adjuster notes, and legal correspondence, identifying key entities and relationships.

Natural Language Processing (NLP):

LLMs can process and analyze natural language in claim descriptions, customer communications, and incident reports, extracting critical information and identifying sentiment.

Automated Triage and Classification:

By analyzing claim details, LLMs can intelligently classify claims based on complexity, urgency, and type, and automatically route them to the most appropriate handler or automated workflow.

Enhanced Fraud Detection:

LLMs can analyze vast datasets of historical claims and identify subtle patterns, anomalies, and inconsistencies in claim narratives that might indicate potential fraud, flagging them for human review.

Personalized Communication:

LLMs can generate personalized responses to customer inquiries, explain policy coverages, and even assist in drafting follow-up communications, improving customer engagement.

For more complex claims, LLMs can synthesize information from various sources and provide claims adjusters with comprehensive insights and recommendations, supporting faster and more informed decisions.

The Powerful Synergy: RPA + LLM

The true power lies in the intelligent combination of RPA and LLMs. Imagine a claims process where:

1. Claim Submission:

A customer submits a claim via email or an online portal. RPA extracts the necessary documents and initial data.

2. Intelligent Data Ingestion:

LLMs analyze the unstructured text in the documents (e.g., incident descriptions, medical notes) to understand the context, extract relevant entities, and identify key information not explicitly structured.

3. Automated Validation & Routing:

RPA uses the LLM’s insights to validate the claim against policy details, verify customer information, and automatically route the claim to the appropriate workflow, whether it’s a fully automated straight-through process or a complex case requiring human intervention.

4. Fraud Detection:

LLMs continuously analyze claim patterns and flag suspicious activities for further investigation by human experts.

5. Decision Support & Communication:

For human-reviewed claims, LLMs can provide a concise summary of the case, highlight critical details, and even suggest potential settlement options. RPA then handles the administrative tasks of processing payments and generating official communications.

The Benefits are Clear:

Accelerated Processing:

Significantly reduce claim cycle times from days to hours, or even minutes for simple cases.

Superior Accuracy:

Minimize human error in data entry and interpretation, leading to more precise claim adjustments.

Cost Efficiency:

Drastically reduce operational costs associated with manual processing and rework.

Enhanced Customer Experience:

Provide faster resolutions, proactive communication, and a more seamless claims journey, boosting customer satisfaction and loyalty.

Improved Fraud Prevention:

Leverage intelligent analysis to detect and prevent fraudulent claims more effectively.

Scalability & Agility:

Easily scale operations up or down to meet fluctuating demand without significant hiring or training.

Enhanced Compliance:

Automate compliance checks and reporting, ensuring adherence to regulatory standards.

Empowered Workforce:

Free up insurance professionals from mundane tasks, allowing them to focus on complex problem-solving, customer relationships, and strategic initiatives.

The Future of Insurance Claims is Here

The integration of RPA and LLMs is not a distant dream; it’s a tangible reality that is already reshaping the insurance landscape. By embracing these innovative technologies, insurance companies can not only overcome historical challenges but also unlock new levels of operational efficiency, customer satisfaction, and competitive advantage. The future of insurance claims is intelligent, automated, and human-centric, driven by the powerful capabilities of RPA and LLMs.