Key Takeaways

- Traditional collateral management is fragmented, manual, and error-prone, increasing risk and operational costs.

- Automation using AI, ML, and RPA consolidates data, streamlines margin calls, and enhances real-time visibility.

- Intelligent collateral optimization reduces funding costs and improves liquidity utilization.

- Automated systems ensure auditability, scalability, and compliance with evolving regulatory requirements.

- Investment banks that adopt automation in collateral management gain a critical edge in efficiency, agility, and client service.

There is no denying that the investment banking sector is rising at a rapid pace. This is one major reason why handling collateral is not a task that should be taken lightly. Instead, the staff members should prioritize this task and understand that it is an important part when it comes to lessening risk, making more capital, and adhering to the regulations. With markets experiencing change in the blink of an eye, following old traditional methods of handling collateral is no longer recommended. Therefore, the only way to handle everything is to automate the procedures.

Also read: The CFO’s Guide to Automation Investment and Payback Periods

The Looming Challenges of Traditional Collateral Management

For years, collateral management has been considered a challenging task. It asks for research from numerous sources, as it is known to be an error-prone domain. This is why investment banks face several challenges, like:

Data Silos and Fragmentation:

Information is most of the time scattered within several systems, documents, and even spreadsheets. This is why it becomes difficult for the staff to keep track. Therefore, reconciling data across silos becomes beneficial. One can avoid errors and keep a check on everything without facing difficulty.

Manual Processes and Human Error:

From calculating margin calls and tracking collateral movements to reconciling statements and resolving disputes, many steps involve tedious manual data entry and verification. This not only introduces a high propensity for human error but also leads to delays, bottlenecks, and increased operational risk.

Lack of Real-time Visibility and Agility:

The market can experience changes every day. Therefore, it is no surprise that it becomes difficult to assess real-time collateral positions, and accurately forecasting exposures can impede the capabilities of risk management. Lagging data means the decision-making process is slow. This gives rise to missed margin calls, suboptimal collateral utilization, and credit risk breaches.

Escalating Operational Costs:

The sheer volume of manual work, the need for extensive human oversight, and the costs associated with rectifying errors and resolving disputes contribute significantly to operational overhead. These costs detract from a firm’s bottom line and limit resources for value-added activities.

Intensifying Regulatory Scrutiny:

Regulators worldwide are demanding greater transparency, robust reporting, and stricter adherence to collateral rules (e.g., UMR for non-cleared derivatives). Manual processes struggle to provide the granular audit trails and timely, accurate data required, increasing the risk of non-compliance, hefty fines, and reputational damage.

Sub-optimal Collateral Utilization:

Without an automated, holistic view, firms often pledge more expensive or less efficient collateral than necessary. This leads to increased funding costs and ties up valuable liquidity that could be deployed elsewhere.

These intertwined challenges not only erode operational efficiency but also expose financial institutions to substantial financial, reputational, and regulatory risks.

The Transformative Power of Automation: A Strategic Imperative

Embracing automation through advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), Robotic Process Automation (RPA), and sophisticated data analytics offers a paradigm shift in collateral management. By intelligently automating repetitive tasks and providing actionable insights, investment banks can achieve unprecedented levels of efficiency, accuracy, and strategic control.

Here’s how automation is fundamentally reshaping collateral management:

Consolidated, Real-time Data Aggregation:

Automated platforms seamlessly integrate data from diverse internal and external sources – trading systems, custodians, market data feeds, and more. This creates a single, golden source of truth for all collateral-related data, providing a holistic and real-time view of positions, exposures, and collateral availability. This empowers proactive risk management and significantly improves decision-making speed and quality.

Precision-Driven Margin Call Automation:

From the automated calculation of initial and variation margin requirements based on complex algorithms and market data to the intelligent generation and routing of margin calls and responses, automation drastically reduces manual intervention. This ensures timely and accurate processing, minimizes disputes, and optimizes liquidity.

Intelligent Collateral Optimization & Allocation:

AI and ML-powered algorithms can analyze available collateral across an entire portfolio, considering factors such as eligibility, haircut schedules, funding costs, counterparty agreements, and regulatory constraints. They recommend and execute the most cost-effective and capital-efficient collateral pledges, maximizing utilization and minimizing funding expenses.

Streamlined Reconciliation & Dispute Resolution:

Automated reconciliation tools can rapidly compare collateral statements and identify discrepancies with pinpoint accuracy. When disputes arise, predefined workflows and automated communication channels accelerate the resolution process, strengthening counterparty relationships and reducing operational overhead.

Robust Regulatory Compliance and Reporting:

Automated systems maintain comprehensive, immutable audit trails of all collateral activities. This ensures that every transaction is meticulously documented and readily available for regulatory reporting (e.g., ISDA SIMM, BCBS-IOSCO requirements). This significantly de-risks the compliance function and builds confidence with regulators.

Significant Reduction in Operational Costs:

By eliminating tedious manual tasks, minimizing errors, and optimizing resource allocation, firms can achieve substantial cost savings. This frees up skilled personnel to focus on higher-value activities such as strategic risk analysis, relationship management, and product innovation.

Enhanced Scalability and Agility:

Automated workflows are inherently scalable. They can effortlessly handle growing transaction volumes, expanding product offerings, and evolving market dynamics without requiring proportional increases in headcount. This provides the agility needed to adapt to rapidly changing market conditions.

Improved Client and Counterparty Experience:

Faster processing, fewer errors, and quicker dispute resolution translate directly into a superior experience for clients and counterparties, fostering stronger, more trusting relationships.

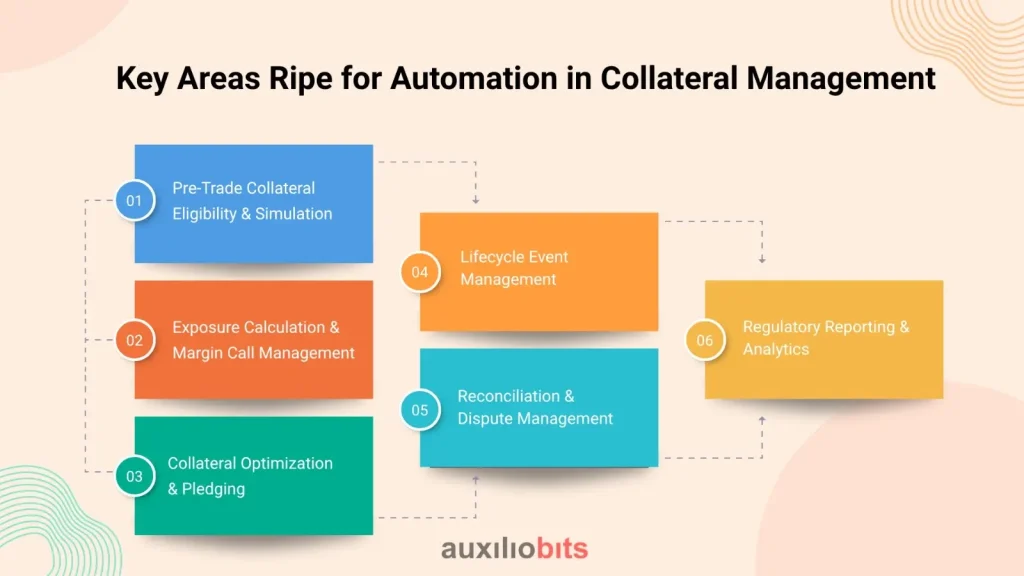

Key Areas Ripe for Automation in Collateral Management

The scope for automation in collateral management is broad, covering the entire lifecycle:

1. Pre-Trade Collateral Eligibility & Simulation:

Automating the real-time assessment of collateral eligibility based on predefined rules, legal agreements, and current market conditions, even before a trade is executed. This includes simulating the impact of new trades on collateral requirements.

2. Exposure Calculation & Margin Call Management:

Implementing sophisticated engines for accurate and real-time calculation of current and potential future exposures across all asset classes. Automating the generation, receipt, and response to margin calls, including notifications and tracking.

3. Collateral Optimization & Pledging:

Utilizing AI to identify the most efficient and cost-effective collateral to pledge, considering factors like liquidity, credit ratings, and haircuts. Automating the process of instructing custodians for collateral transfers.

4. Lifecycle Event Management:

Automatically processing corporate actions, collateral substitutions, and other lifecycle events impacting collateral positions.

5. Reconciliation & Dispute Management:

Automated matching of collateral movements and positions against internal records and counterparty statements. Providing robust workflows for identifying, tracking, and resolving discrepancies with clear audit trails.

6. Regulatory Reporting & Analytics:

Generating predefined and customizable reports for internal risk management, capital adequacy, and regulatory bodies (e.g., EMIR, Dodd-Frank, SFTR, and UMR). Providing advanced analytics to identify trends, optimize strategies, and predict future collateral needs.

Embracing the Future: A Competitive Differentiator

The strategic shift towards automated collateral management is not merely an option for investment banks; it is rapidly becoming a competitive imperative. Firms that cling to outdated manual processes will find themselves at a significant disadvantage in terms of cost, risk, and agility.

By proactively investing in and implementing comprehensive automation solutions, investment banks can not only enhance operational efficiency, significantly mitigate risk, and ensure robust regulatory compliance, but also unlock new avenues for strategic growth and profitability. The future of investment banking collateral management is intelligent, resilient, and remarkably efficient. Is your firm prepared to lead the way?