Key Takeaways

- Increased efficiency: LLM workflows cut the invoice processing time up to 75%.

- Higher accuracy: LLMS achieves 95% accuracy in data extraction and verification.

- Cost Savings: Automation reduces operating costs by 30%.

- Scalability: Handle the increasing invoice versions without additional employees.

- Smart Decisions: LLM optimizes payment and detects discrepancies.Real-time visibility: Dashboard provides immediate AP insight.

- Compliance and Safety: Regulatory follows and ensures data security.

Accounts payable are a cornerstone of economic activity and ensure that suppliers are paid on time and carry accurate items and cash flow. However, AP manual processes are usually labor-intensive, exposed to errors, and ineffective, leading to increased delays and costs. Taking the bills to pay, from invoice capture to payment approval, transforms these challenges into opportunities for efficiency and accuracy.

By integrating LLM models like GPT for intelligent automation, businesses can optimize AP processes, reduce errors, and improve decision-making. This blog examines how LLMs’ workflows revolutionize AP automation and describes each step, the technologies involved, benefits, challenges, and recommended implementation, while following SEO best practices for visibility and commitment.

Also read: Using LLM-Powered Agents for SLA Tracking Across Departments

The Need for Accounts Payable Automation

Manual AP procedures require trimming via paper or PDF challan, entering the data by hand, confirming the details, and managing complex approval workflows. These activities are not only long but also suffer from mistakes such as duplicate payments or ignored deadlines, which can endanger the sellers and affect the cash flow.

Automating accounts payable causes digitizing these problems, reducing human participation, and increasing scalability. Through the LLM workflows, companies can carry forward automation by integrating AI-related insight to handle unrestricted data and erection discrepancies and extend the payment time limit.

Why LLM Workflows?

Large language models (LLMs), such as GPT, excel at processing and understanding complex data, including text, numbers, and unstructured formats. In AP automation, LLM workflows enable intelligent data extraction, contextual validation, and dynamic decision-making, making them ideal for handling diverse invoice formats and approval scenarios. By integrating LLMs, businesses can achieve smarter, faster, and more accurate AP processes compared to traditional automation tools.

The AP Automation Process with LLM Workflows

Step 1: Invoice capture

Invoice capture is the initial step, in which invoices—paper, PDF, or electronic—are assembled and converted into a digital format. Most automation techniques use optical character recognition (OCR), but LLM workflows make up and create data from complex or poorly structured invoices and draw on them.

→ How LLMS assists:

LLM challans check the template, identify the major fields (for example, challan number, date, and amount), and identify procedure variations such as handwriting or non-standard format. They can also understand reference-based information, for example, seller-specific terminology or posture translation.

→ Technologies used:

OCR integration with LLM-based Intelligent Document Processing (IDP) guarantees accurate data extraction. Electronic Data Interchange (EDI) provides trouble-free data exchange for e-challan.

→ Benefits:

80% of manual data is saved, reducing errors and adjusting various invoices, thus enhancing efficiency.

Step 2: Data Matching and Verification

After capturing the challan, the system verifies the data and compares it to avoid procurement from the purchase orders (POS), delivery receipts, or contracts. LLM workflows are the best here, where they flag discrepancies and learn from previous data.

→ How LLMS assists:

LLM identifies and highlights approval and recommends approval. They get better over time by learning from previous reforms. For example, an LLM is trained to identify whether the price of the supplier is out of the limit and recommends tasks.

→ Technologies to be used:

Machine learning algorithms, rule-based verification, and three-way matching (challan-pO-puri) ensure accuracy and compliance.

→ Benefits:

Verification saves 60% of time, eliminates errors, and ensures compliance with vendor terms and tax regulations.

Step 3: Approval of Workflow

The acceptance of the correct stakeholders based on predetermined rules challenges. The LLM workflows streamline it by automating and providing relevant insights.

→ How LLMS helps:

LLMS analyzes invoice data and approval stories to identify optimal approval or high-risk challans (such as abnormally high volume). They can also generate a natural language summary for approval, simplifying decisions.

→ Technologies include:

Work flight automation platforms (e.g., SAP Ariba, COPA), Roll-Bed Access Control (RBAC), and cloud-based mobile integration are capable of seamless integration.

Benefits:

Approval speeds up to 50%, gives real-time visibility, and improves accountability with the audit path.

Step 4: Payment processing and approval

The final stage involves planning and paying and integrating with accurate recording. LLM workflow pays for payment stimulation and methods, cost savings, and ensures supplier satisfaction.

→ How LLM helps:

LLMS analyzes payment terms, cash flow data, and suppliers’ preferences to recommend optimal payment schemes, such as taking advantage of discounts on initial payments. They can also generate payment instructions in natural language for clarity.

→ Technologies include:

Payment ports (e.g., Stripe and PayPal) and ERP integration (e.g., SAP, QuickBooks, and new blockchain-based smart contracts) are secure and automated.

→ Benefits:

Payment processing reduces errors by 70%, adapts the cash flow, and strengthens the supplier situations through timely payment.

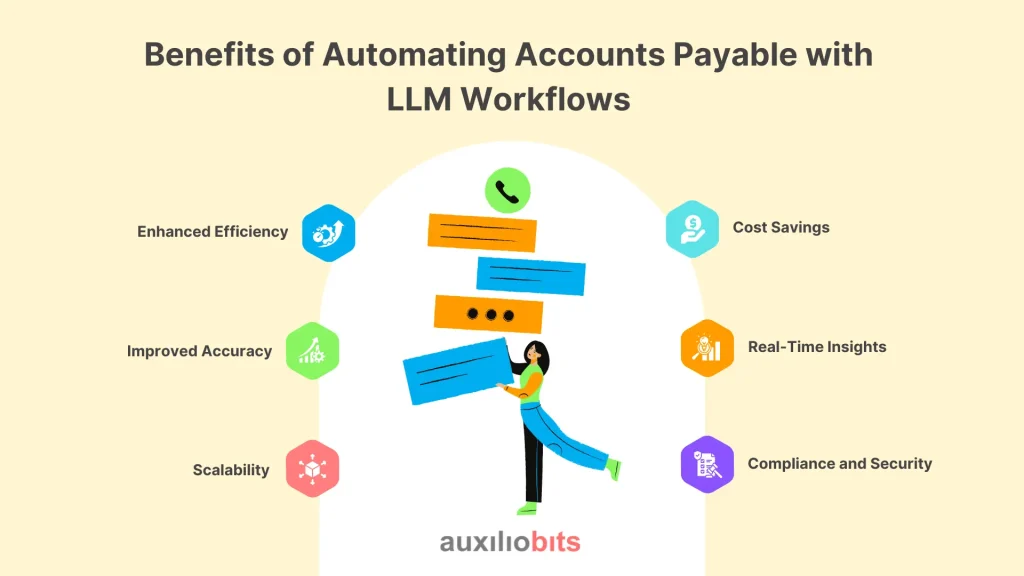

Benefits of Automating Accounts Payable with LLM Workflows

The benefits of automating accounts payable with LLM workflows are numerous. We have listed them below.

1. Enhanced Efficiency:

LLM workflows reduce invoice processing time from days to hours, freeing AP teams for strategic tasks.

2. Cost Savings:

Automation cuts labor costs and eliminates penalties for late payments, saving businesses up to 30% on AP operations.

3. Improved Accuracy:

LLMs minimize human errors by intelligently extracting and validating data, achieving up to 95% accuracy in data processing.

4. Real-Time Insights:

Dashboards powered by LLMs provide real-time visibility into AP metrics, enabling data-driven decisions.

5. Scalability:

LLM workflows handle growing invoice volumes effortlessly, supporting business expansion without additional staff.

6. Compliance and Security:

Automated systems ensure regulatory compliance (e.g., GDPR, tax laws) and protect sensitive data with encryption

Challenges of AP Automation with LLM Workflows

Despite their advantages, LLM workflows in AP automation face challenges:

High Initial Costs:

Implementing LLM-powered AP systems requires investment in software, hardware, and integration.

2. Change Management:

Staff may resist transitioning to automated workflows, necessitating training and change management strategies.

3. Vendor Adoption:

Some vendors may prefer manual invoicing, requiring coordination to adopt electronic formats.

4. Data Privacy:

Storing financial data in AI systems raises cybersecurity concerns, requiring robust protections

5. Interpretability:

LLMs can be “black boxes,” making it challenging to explain their decisions in highly regulated industries.

Best Practices for Implementing LLM Workflows in AP Automation

Some of the essential practices you should follow when implementing LLM workflows in AP automation are:

1. Conduct a Process Audit:

Analyze current AP workflows to identify inefficiencies and prioritize automation opportunities.

2. Select the Right Platform:

Choose an AP automation tool with LLM capabilities (e.g., SAP Ariba, Tipalti) that integrates with your ERP system.

3. Pilot Test:

Start with a single department or vendor group to validate the system before full-scale deployment.

4. Engage Vendors:

Encourage vendors to adopt e-invoicing and electronic payments, offering support for a smooth transition.

5. Train Teams:

Provide comprehensive training on LLM workflows to ensure staff confidence and adoption.

6. Monitor KPIs:

Track metrics like processing time, error rates, and cost savings to measure success and identify improvements.

7. Secure Data:

Implement encryption, access controls, and regular audits to protect sensitive financial data.

LLM Workflows in AP Automation

Enterprises across industries are leveraging Large Language Models (LLMs) to transform Accounts Payable (AP) workflows—driving speed, accuracy, and strategic value.

Retail industry

A large retailer adopted an AP LLM AP system to process 10,000 monthly invoices. The system used LLMs to extract data from various invoice formats and validate against POS, reducing processing time by 75% and saving US $400,000 annually in hand-in-BOA.

Manufacturing sector

A global manufacturer integrated Flows LLM with its ERP system to automate invoice validation and approvals. LLM signaled 95% of accurate decisions, reducing delays in approval by 60% and improving supplier satisfaction.

E-commerce platform

An e-commerce company used LLMS to analyze invoice data along with customer demand trends by optimizing payment schedules. This resulted in a 20% increase in early payment discounts and a 50% reduction in payment errors.

Conclusion

Automated accounts to pay using LLM’s workflows change the way businesses deal with invoices, approvals, and payments. Leveraging the strength of large language models, organizations can gain smarter, quicker, and more accurate AP processes, save time, avoid costs, and enhance supplier terms.

Although there are challenges such as initial costs and change management, the adoption of best practices—such as piloting, training, and monitoring—defines the implementation of good. As LLM –er continues to develop, its integration in AP automation promises even greater efficiency and innovation, making it a duty for future vision companies.