Key Takeaways

- Market feeds only become valuable when they’re interpreted, not aggregated. Dumping exchange prices, indices, freight data, and news into one model doesn’t create insight. AI agents work when they preserve context—what moves fast, what lags, and what procurement can actually act on.

- Predictive alerts should explain risk, not just announce movement. Alerts that say why a price change matters—and when it historically led to supplier action—get used. Alerts that just flag thresholds get muted.

- Buying recommendations earn trust when they offer options, not orders. The most effective agents frame decisions with probabilities, trade-offs, and conditions for override. Procurement leaders don’t want automation—they want decision leverage.

- AI agents are strongest in organizations with clear category strategies. When sourcing rules, risk tolerance, and negotiation levers are defined, agents amplify good practice. Without that foundation, even the smartest system produces confusing advice.

- The biggest benefit isn’t prediction—it’s earlier, calmer decisions. Teams stop reacting to supplier quotes and start acting on weak signals. The payoff shows up quietly: fewer surprises, steadier margins, and better-timed commitments.

If you work in procurement for manufacturing, you already know the uncomfortable truth: raw material prices don’t just “change.” They jump, drift, overreact, correct, and occasionally behave in ways that make no economic sense at all. Steel spikes when demand is flat. Polymers soften even though feedstock costs are rising. Copper reacts more to a rumor out of Chile than to last quarter’s consumption numbers.

Most procurement teams still monitor these movements the same way they did ten years ago—spreadsheets, supplier emails, quarterly reviews, and the occasional panic call when a quote comes in way above expectations. It’s not laziness. It’s that the signal-to-noise ratio is brutal, and humans can’t watch everything all the time.

This is where AI agents actually earn their keep—not as forecasting oracles, but as tireless market readers, pattern spotters, and recommendation engines that sit between raw data and buying decisions.

Not dashboards. Not static alerts. Active systems are designed to detect changes before individuals do, guiding procurement towards improved timing and more intelligent contracts.

Also read: AI Agents in Strategic Scenario Simulation for Executive Decisioning

Market Feeds: Where the Signal Really Comes From

Price monitoring starts with feeds, but combining them poorly is often worse than not combining them at all.

In the real world, procurement teams track a messy mix of:

- Exchange-traded prices (LME, CME, regional commodity exchanges)

- Index-based benchmarks (Platts, Argus, Fastmarkets)

- Supplier-specific quotes and escalators

- Logistics inputs—freight rates, port congestion, fuel costs

- Regional demand indicators (construction permits, auto output, PMI data)

- Unstructured signals: news, trade restrictions, strikes, weather events

An AI agent doesn’t treat these as one giant spreadsheet. It treats them as different classes of evidence, each with its own reliability and time lag.

For example, LME copper prices update constantly, but they’re speculative and forward-looking. Supplier quotes move slower but reflect contractual realities. Freight rates can turn a “cheap” raw material into an expensive landed cost overnight.

A well-designed agent keeps these distinctions intact. It doesn’t average them. It weighs them.

And yes, this is where many early attempts fail. Teams ingest everything into a lake, throw a model at it, and get outputs that look impressive but don’t match how buyers actually think. If your buyer can’t say, “I trust this because it noticed that,” the system will be ignored.

From Monitoring to Interpretation: What Agents Do All Day

AI agents don’t just watch prices tick up and down. Most of their value comes from contextual interpretation.

A few examples pulled straight from the field:

- Steel prices rise 3% week-over-week. Normally, not alarming. But the agent notices that this rise coincides with shrinking mill inventories and a sudden uptick in automotive orders in one region. That combination matters.

- Resin prices stay flat, but upstream crude volatility increases sharply. The agent flags this as latent risk, not current impact.

- Aluminum drops below a historical floor, but freight costs spike in parallel. The “cheap” price is a mirage.

This kind of reasoning is boring for humans to do repeatedly and perfectly suited to machines. The trick is not prediction yet—it’s pattern recognition anchored in procurement logic, not pure statistics.

Which raises a subtle but important point: the best agents are trained less on “predict the price” and more on “recognize situations procurement cares about.”

Predictive Alerts: Not Noise, Not Panic

Most procurement leaders have alert fatigue. If everything is “urgent,” nothing is. AI agents work best when alerts are opinionated.

Instead of: “Price increased by 2%”

You get: “Short-term upward pressure detected; historical patterns suggest a 3–5 week window before supplier quotes adjust.”

Or:

“Current dip appears speculative; similar patterns reversed within 10 trading days in 7 of the last 9 cases.”

Notice what’s happening here. The agent isn’t shouting. It’s explaining why the alert exists and how confident it is.

Good predictive alerts usually fall into a few categories:

- Early anomaly detection: Price moves that don’t align with demand, inventory, or seasonality.

- Threshold proximity: Not “price crossed X,” but “approaching a level that historically triggered renegotiations or hedging.”

- Divergence warnings: Spot prices moving away from contract benchmarks or supplier behavior.

- Latency risks: Signals that haven’t hit supplier quotes yet—but will.

And yes, sometimes the agent gets it wrong. Markets are humbling like that. The difference is that the agent learns which alerts were ignored for good reason and adjusts. Humans rarely do that systematically.

Buying Recommendations: Where Trust Is Won or Lost

This is the dangerous part. The moment an AI agent tells a buyer what to do, skepticism spikes.

Rightly so.

The best buying recommendations are not commands. They’re options with rationale.

In practice, that looks like:

- “Advance purchase recommended for 30–40% of next quarter’s volume due to rising probability of supplier quote increases.”

- “Delay spot buying for two weeks; historical reversal likelihood currently high.”

- “Lock index-linked pricing instead of fixed-rate for this material under current volatility regime.”

Each recommendation comes with assumptions, confidence bands, and—crucially—conditions under which it should be ignored.

A Real-World Scenario: Specialty Chemicals in Automotive

Consider a Tier-1 automotive supplier sourcing specialty polymers. Volumes are stable. Demand forecasts look fine. Yet prices have been creeping up in supplier quotes without a clear explanation.An AI agent monitoring:

- Crude derivatives

- Regional plant shutdowns

- Shipping lane congestion

- Trade policy chatter

Spots a pattern: a cluster of unplanned outages among second-tier producers in Southeast Asia, paired with rising insurance premiums on specific shipping routes. Spot prices haven’t moved yet, but supply elasticity is tightening.

The agent issues a medium-confidence alert and recommends pre-booking volumes for the next six weeks while negotiating flexible delivery.

Three weeks later, suppliers announce force majeure adjustments. The company absorbs less of the shock than peers.

Was this “prediction”? Not really. It was situational awareness at machine scale.

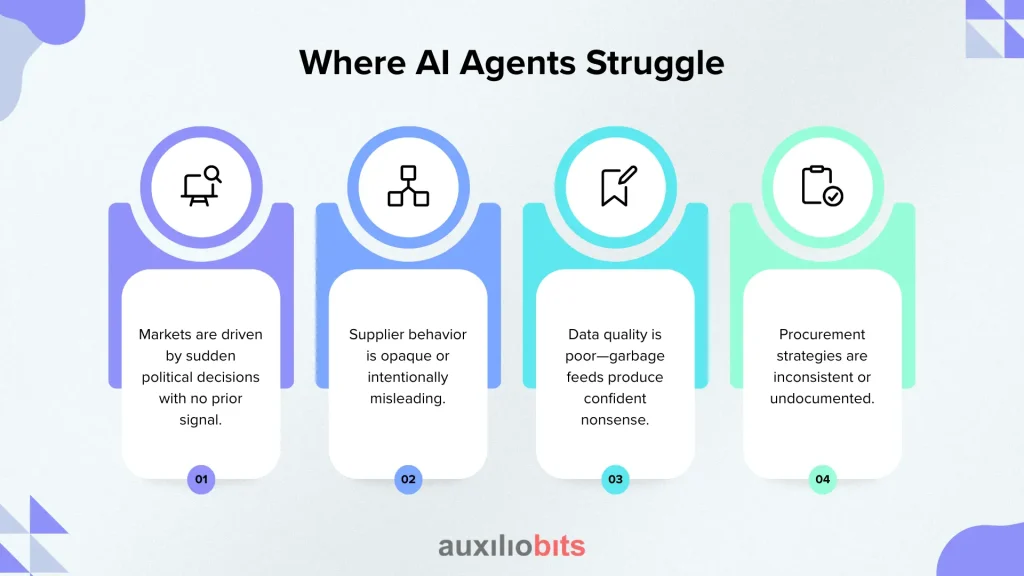

Where AI Agents Struggle

here are limits, and pretending otherwise is a good way to kill credibility.

AI agents struggle when:

- Markets are driven by sudden political decisions with no prior signal.

- Supplier behavior is opaque or intentionally misleading.

- Data quality is poor—garbage feeds produce confident nonsense.

- Procurement strategies are inconsistent or undocumented.

They also struggle when organizations expect them to replace judgment rather than support it.

Ironically, the more mature the procurement function, the more value agents deliver. Clear category strategies, defined risk tolerances, and documented buying playbooks give agents something to align with.

Without that, you’re asking software to invent a strategy. It won’t end well.

Shifts in How Teams Work

Teams that deploy these systems successfully report changes that aren’t obvious on a slide deck:

- Buyers spend less time watching markets and more time thinking about responses.

- Negotiations shift from reactive to evidence-backed.

- Fewer “why didn’t we see this coming?” post-mortems.

- More structured conversations between procurement, finance, and operations.

One side effect surprised a few leaders: junior buyers ramped faster. The agent became a silent mentor, surfacing context that usually takes years to internalize.

The Final Thoughts

AI agents won’t magically deliver savings if procurement governance is weak. They won’t fix poor supplier relationships. And they won’t eliminate volatility—markets are messy by nature.

But dismissing them as “just another analytics tool” misses the point.

This is not about smarter charts. It’s about building systems that notice weak signals, reason across fragmented inputs, and offer grounded recommendations while there’s still time to act.

If your team is only learning about price changes upon receiving supplier quotes, it may be too late.

And in raw materials, being late is expensive.

Not dramatically. Not all at once.

It happens gradually, quarter after quarter, until someone finally questions why margins continue to decline despite seemingly healthy volumes.

That’s usually when AI agents get taken seriously—right after the pain shows up.