Key Takeaways

- ROI is Layered, Not Absolute: Short-term operational gains, medium-term workflow stabilization, and long-term adaptability define agentic automation returns.

- Context Matters: High-complexity, low-volume assembly lines see higher ROI than stable, high-volume lines where traditional automation already dominates.

- Soft Benefits Are Real: Workforce focus, retention, and institutional learning provide significant, though often unquantified, returns.

- Costs Are Hidden: Integration, knowledge base setup, change management, and lifecycle maintenance are key factors that affect ROI.

- Strategic Approach Wins: Organizations treating agentic automation as a capability rather than a plug-and-play tool achieve meaningful, sustained returns.

Walk into any assembly hall today and you’ll see a strange mix. On one side, robotic arms and conveyors move parts with mechanical grace. On the other hand, shift supervisors juggle radios, whiteboards, and spreadsheets to keep things aligned. That disconnect—highly automated machinery paired with low-tech coordination—has always been manufacturing’s awkward truth.

A new generation of agentic automation systems is emerging, moving beyond simple pre-programmed routines or strict Manufacturing Execution System (MES) rules. These adaptive agents are designed to make local decisions, communicate with other agents, and react when unexpected events occur on the production line.

While the innovative nature of these systems is appealing, executives will ultimately scrutinize their return on investment (ROI). For any plant manager or CFO, ROI remains the decisive factor, and evaluating it goes beyond merely inputting figures into a payback calculator.

ROI in Manufacturing Rarely Follows Clean Formulas

Financial models thrive on certainty—NPV, IRR, and breakeven charts. Assembly lines rarely give that luxury. A welding cell can run at 98% uptime, but if upstream suppliers miss their slots, ROI shrinks. A smart scheduling algorithm can promise efficiency, but if labor shifts or compliance checks disrupt production, the model falls apart.

Agentic automation adds another twist. Unlike a fixed-asset robot arm with a neat depreciation schedule, agents evolve. A scheduling agent today might pivot into a quality inspector or a material allocator in two years. That adaptability resists tidy ROI math. It’s less about a one-off efficiency boost and more about compounding capabilities that keep paying back in unexpected ways.

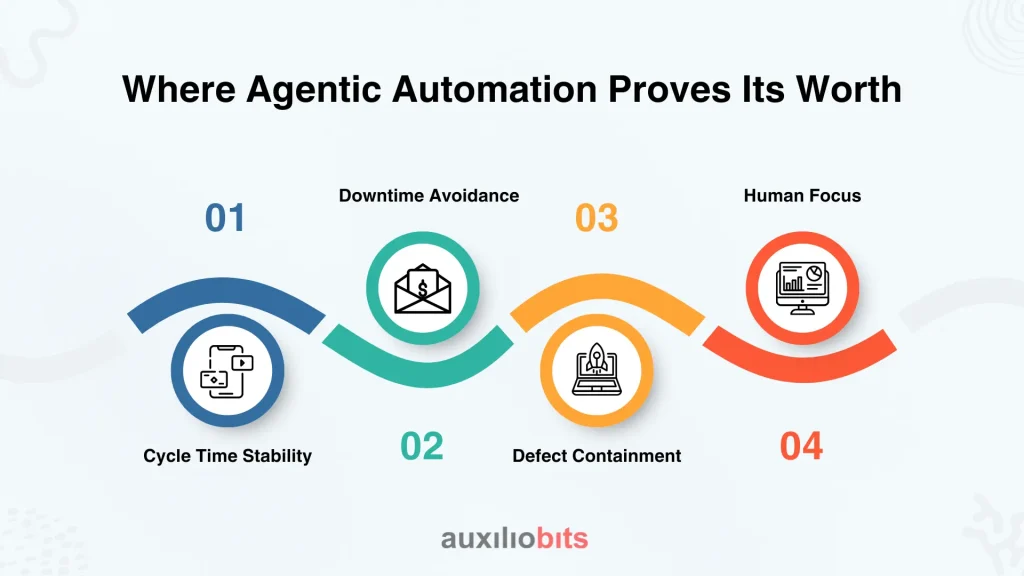

Where Agentic Automation Proves Its Worth

If you follow the money leaks inside a plant, agentic ROI starts to show itself clearly.

Cycle Time Stability

Agents smooth volatility by redistributing workloads. In one German auto plant, when Station 4 lagged, upstream agents throttled inputs while downstream buffers adjusted automatically. The outcome wasn’t record-breaking throughput, but a 15% reduction in cycle-time variance. That translated directly into fewer overtime shifts—a win that finance teams actually noticed.

Downtime Avoidance

A stamping press pulled into preventive service during a lull is better than one failing mid-shift. Predictive maintenance agents don’t just monitor; they negotiate windows with production schedulers. That’s the nuance—coordination is the real value. Plants running rigid maintenance calendars can’t touch those numbers.

Defect Containment

Vision AI is old news. What matters now is escalation logic. If a micro-fracture appears, does the line halt, reroute, or adjust tolerances until QA confirms? Agents weigh those options contextually. One prevented defective batch of gear housings covered the agent project costs for an entire quarter in a midwestern pump manufacturer.

Human Focus

Ask any line supervisor and they’ll admit: half their shift is consumed by juggling schedules, material updates, and urgent calls. When agents handle orchestration, humans focus on process improvement and training. You won’t see that on an ROI spreadsheet, but plants where this shift happened reported reduced turnover. That’s ROI—just not the kind accountants always measure.

ROI isn’t Uniform Across Industries

It’s tempting to apply a blanket ROI expectation. In practice, context dictates returns.

- High-volume, low-mix assembly (electronics, consumer goods). ROI here is primarily throughput-driven. Traditional automation already captures much of the gain. Agents add incremental stability but don’t revolutionize economics. Payback can stretch.

- Low-volume, high-complexity assembly (aerospace, specialized machinery). Here, one configuration slip can sink margins. Adaptive agents deliver ROI not just in cost savings but in error avoidance. In some aerospace contracts, one prevented rework pays back the entire system investment.

So if someone demands a universal ROI figure, the honest reply is: wrong question—the answer lies in your product mix and volatility.

The Costs That Undermine ROI

Benefits are easy to pitch. Costs creep in quietly and derail expectations.

- Integration plumbing. MES, ERP, PLCs—all must be wired together. That middleware often costs more than the agents themselves.

- Knowledge base prep. Agents don’t “know” tolerances or process flows out of the box. Feeding them specs, BOM rules, and compliance standards is time-heavy. Aerospace and medical device firms, in particular, spend months here.

- Change management. Operators who don’t trust “AI advice” override it. Result: expensive tools nobody uses.

- Lifecycle care. Unlike robots that follow a depreciation schedule, agents drift. Retraining, patching, or retiring them adds hidden OPEX.

It’s amazing how often CFOs sign off thinking software equals low upkeep. Reality begs to differ.

Real-world Examples That Clarify the Picture

- Tier-1 Automotive Supplier. Coordination agents optimized welding and painting. The result: OEE rose 14%, with a 9-month ROI. Driver: less idle time—not more hardware.

- Industrial Pump Maker. Frequent changeovers plagued throughput. Agents aligned the BOM with calibration tasks. Changeover time collapsed from 45 to 18 minutes. ROI is less about throughput, more about reclaiming hours daily.

- Consumer Electronics Plant. Tried agentic defect classification. Marginal improvement, ROI stretched past three years. Existing vision AI already handled the load. Lesson: Don’t oversell agents where processes are stable.

These aren’t fairy tales. They highlight the obvious truth: ROI isn’t about the tech itself—it’s about context.

Strategic ROI That Rarely Hits the Spreadsheet

Beyond direct cost savings, there’s a wider layer of returns that matter.

- Resilience ROI. With supply chains jittery, the ability to resequence dynamically is priceless. Finance won’t always model it, but procurement leaders see the value immediately.

- Workforce ROI. Skilled operators are leaving the industry faster than they can be replaced. Offloading coordination to agents makes work less exhausting. Retention here is ROI.

- Learning ROI. Every agent interaction logs decisions—what worked, what failed. Over the years, this forms a knowledge base. Unlike rigid automation, this institutional memory compounds quietly.

You can’t assign neat payback numbers, but these dimensions often tilt the ROI balance in practice.

Why ROI Remains Hard to Pin Down

Anyone promising neat ROI figures for agentic automation is either simplifying for a sales deck or not telling the full story.

- Attribution is messy. A 10% cycle-time gain might stem from a conveyor upgrade, not the agent.

- Timelines vary. Maintenance savings show up in weeks; workforce retention takes years.

- Soft benefits resist quantification—fewer near-misses due to balanced workloads, for example.

That’s why forward-looking plants track blended dashboards. Hard KPIs like OEE and defect rates sit alongside softer indicators like operator satisfaction and turnover. Not neat, but closer to reality.

When ROI Turns Negative

Failure cases matter.

- Plug-and-play delusion. Agents deployed without domain training generate noise.

- Workforce rejection. If operators distrust outputs, systems gather dust.

- Vendor over-reliance. Assuming the software itself delivers ROI while neglecting integration and change management.

A mid-sized electronics assembler sank $8M into agents, only to shelve them within two years. Not a technical failure—the models worked. The human side collapsed. Operators bypassed them, management lost patience, and “AI project” became a dirty phrase. Negative ROI isn’t theoretical—it happens.

So, what’s the real answer? ROI of agentic automation isn’t a static percentage. It’s a layered return that matures over time:

- Short-term: downtime avoidance, faster changeovers.

- Medium-term: smoother scheduling, better defect containment.

- Long-term: adaptability, workforce stability, institutional learning.

The trap is forcing it into a rigid 12-month payback lens. Smarter manufacturers treat it like workforce training—capabilities that accumulate and reshape economics over years, not quarters

Conclusion

The ROI of deploying agentic automation in assembly lines cannot be captured by a single percentage or a simple payback period. Its true value lies in the layered, evolving benefits these systems bring: short-term operational gains, medium-term workflow stabilization, and long-term adaptability and workforce resilience. Agentic agents do not merely replace human effort—they amplify decision-making, reduce errors, and create an institutional memory that compounds over time.

Manufacturers that approach agentic automation as a strategic capability rather than a plug-and-play solution are the ones most likely to see meaningful returns. Success requires investment in integration, change management, and ongoing lifecycle care. In the end, ROI is not just a financial metric—it is a reflection of operational maturity, workforce empowerment, and adaptive competitiveness in a dynamic manufacturing environment.