Think of a system capable of activity detection and one that learns how to outplay fraudsters in real-time fraudulently. This describes the power engineered into agentic AI. It can perform autonomously while making decisions and taking specific actions without human intervention to accomplish aims predefined by its operators. Unlike traditional AI, which frequently utilizes rules, oversight AI systems, and human supervision, agentic AI has a certain independence to function, in a way, like a human solves problems.

Fraud detection is one of the primary pain points in finance, e-commerce, healthcare, and other industries. Traditional fraud detection methods always fell behind, peaking at static rules that did not evolve along with the times. With agentic AI, the problem now has a dynamic answer that protects the organization and customers.

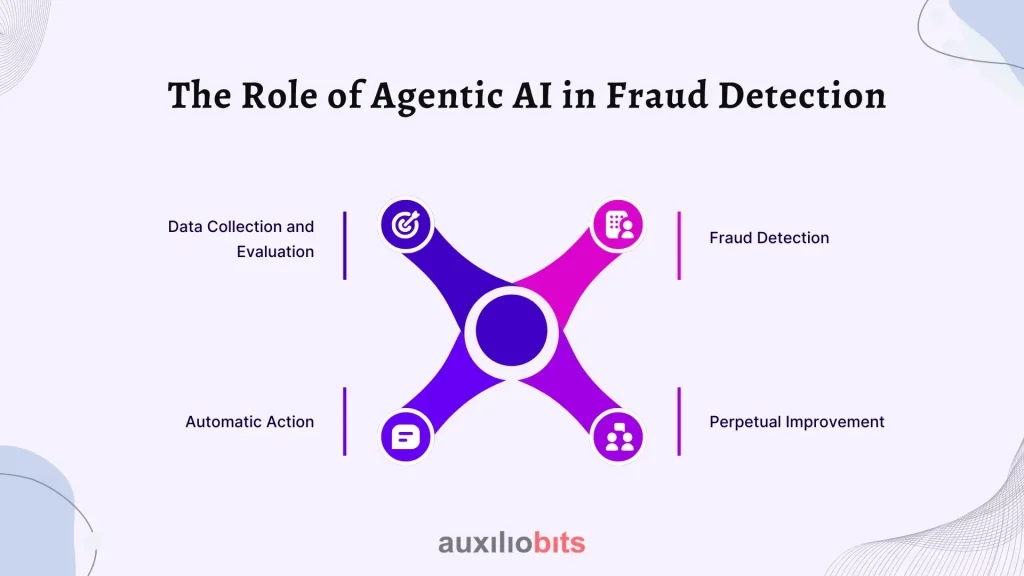

The Role of Agentic AI in Fraud Detection

Agentic AI techniques are the most recent in AI technology. They can operate as independent agents by integrating modern machine learning, analysis of real-time data, and decision-making. In the context of fraud detection, these systems can monitor user transactions, system activities, and behavior externally and internally continuously to uncover any discrepancies that could suggest fraudulent behavior.

Here is the approach:

1. Data Collection and Evaluation:

Store activity includes credit card transactions, login attempts, and insurance claims. Agentic AI analyzes data instantaneously using natural language processing techniques and pattern recognition.

2. Fraud Detection:

The AI system observes expected behaviors, flagging strange spending habits and IP addresses when not followed.

3. Automatic Action:

This differs from past systems that provision all the flagged issues for human review. Unlike traditional systems, agentic systems can block transactions without any need for human verification, freeze accounts, or request further verification instantaneously.

4. Perpetual Improvement:

Such systems learn constantly over time by evaluating new outcomes, the feedback they receive, and incorporating new evidence in conjunction with adapting to new fraud schemes. Take the banking sector as an illustrative example—an agentic AI could see a customer’s credit card being used in a foreign country just after a local transaction—for them, a flag should trigger. With automatic location data, user history, and patterns, it could assess the potential for fraud and autonomously decide to approve, decline, or flag the transaction in milliseconds.

Advantages of Agentic AI Over Traditional Methods

Attempting to detect fraud utilizing traditional practices relies on an elementary set of rules working with a fundamental form of machine learning, which has shortcomings. Agentic AI offers several key advantages:

1. Speed and Scalability:

Traditional models that agents and humans use to detect fraud can outperform human analysts, rule-based systems, and those with no systematic approach to viewing things. In 2024, a McKinsey report said AI-boosted systems lowered false positives by 40% compared to traditional anti-fraud systems.

2. Flexibility:

With agentic AI leveraging data to its full potential, it makes countering constantly changing attempts at fraud much more effective due to continually staying ahead of an ongoing battle of wits.

3. Economic Value:

Fraud claims can damage an organization. Still, the increased complexity of decision-making leads to an agentic AI-obligated diminutive need for extensive investigative teams, saving millions of dollars. Forrester estimated that companies relying on AI would experience a 25% reduction in operational costs by 2023.

Real-World Examples and Case Studies

Let’s examine how agentic AI makes a difference in the real world through powerful stories and examples.

1. PayPal:

PayPal employs agentic AI to supervise billions of transactions every year. Their AI models perform behavioral analysis, scrutinize device fingerprints, and investigate historical transactions to identify real-time fraud. PayPal claimed a 50% decrease in fraudulent transactions in 2022 after adopting newer AI systems.

2. Mastercard:

Mastercard’s Decision Intelligence platform uses agentic AI to assess transaction fraud risks using its proprietary scoring mechanism. Mastercard associates claim to handle over 75 billion transactions yearly. A 2024 company report indicated a 20 percent increase in fraud detection capabilities with the help of AI.

3. Healthcare:

Due to fraudulent activities, medical care in the United States is said to incur expenses in the range of $100 billion. Firms like Optum employ agentic AI to identify fraudulent claims by scrutinizing billing documents, patient records, and provider behaviors, thereby saving millions in warrants.

Such instances confirm how agentic AI can ease pain by limiting loss through fraud, preventing operations slowdowns, and improving efficiency.

Conclusion

The execution of Agentic AI dramatically shifts the paradigm of accuracy, adaptivity, and speed when detecting fraud. Its self-learning capabilities exceed traditional methods, allowing it to remain ahead. PayPal’s real-time transaction fraud monitoring systems and the healthcare industry for fraud prevention and agentic AI are proving their worth across multiple sectors, saving billions and concurrently improving customer trust.

Rest assured, the evolution of agentic AI with enhanced adversarial defenses and amalgamation with blockchain will further strengthen its impact. As AI advances to counter sophisticated fraud efforts, adaptable AI systems become crucial.

Are you wondering how you can turn on your fraud detection system? Learn about the latest advancements in agentic AI and connect with Auxiliobits.