Key Takeaways

- RPA reduces credit assessment time from hours to minutes by automating data collection from multiple sources, improving both speed and accuracy.

- Manual errors are minimized by up to 95%, significantly reducing the risk of inaccurate risk evaluations and enhancing compliance.

- Cost savings of 40–60% are achievable in credit processing operations through intelligent automation.

- Machine learning-enhanced RPA bots ensure consistent scoring, generate detailed audit trails, and support regulatory alignment.

- A structured implementation approach—starting with process analysis and ending with performance monitoring—ensures long-term ROI within 6–12 months

Credit risk evaluation has grown more complicated in the last financial environment, with institutions dealing with thousands of loan requests while coping with aggressive regulatory guidelines. However, outdated manual procedures are no longer adequate to satisfy the needs of contemporary lending, leading to bottlenecks that cost monetary institutions millions in missed opportunities and operational inefficiencies.

Also read: Combining Process Mining and AI for Predictive HyperAutomation in Financial Services

The Credit Risk Assessment Challenge

Meanwhile, banks must struggle with mounting demands for quicker and more accurate credit assessments while maintaining risk management procedures. Manual credit risk assessment methods, involving gathering data from various sources, are outdated and are based on obsolete processes such as laborious verification steps and institutionalized subjective scoring methodologies, and lead to uncertain results.

- Credit officers spend 60% to 70% of their time with the burden of what can only be termed as administrative busywork and not substantive risk assessment.

- Retrieval of information from credit bureaus, bank statements, records of employment, and other financial databases is particularly intimidating for multi-faceted applications.

- Manual credit applications are subjected to a 15-20% error rate, causing risk assessments and potential financial harm to be inaccurately evaluated.

- The antiquated methods are too time-consuming, which ultimately creates slower service speeds.

- The lack of standard processes and defined methods within divisions and branches creates differences in evaluation criteria that result in inconsistent scoring and decision-making.

How RPA Revolutionizes Credit Risk Management

Robotic Process Automation (RPA) revolutionizes the credit risk assessment process by utilizing repetitive, rule-based processes and providing the accuracy and consistency that financial institutions demand.

Automated Data Gathering

- RPA bots can extract sensitive data from credit bureaus, banking APIs, employment history, and even internal company databases.

- They also possess the capability to extract data from PDFs, web portals, and legacy systems.

- Such automation speeds up the data collection process, decreasing the time taken from hours to minutes.

- The bots authenticate information in real-time and verify discrepancies against data verified from multiple sources.

- Bots also possess the capability to flag omission marks for data within the documents.

Intelligent Scoring Systems

- New RPA solutions are supplied with built-in machine learning technology that enhances conventional rule-based scoring systems.

- These systems transform business processes since they operate on historical sets of data to make predictions.

- Automation ensures scoring rules will be applied consistently to all submissions.

- Scoring Models, risk assessment, and compliance algorithms established must be followed by the institutions.

- The system can automatically produce detailed reports and audit trails.

Key Benefits of RPA in Credit Scoring

Implementing robotic process automation (RPA) in credit risk assessment translates into concrete advantages across several domains.

- Enhanced processing leads to greater customer satisfaction and higher conversion rates.

- Accuracy has been enhanced just as dramatically, where computerized systems have reduced data entry errors by up to 95%.

- Cutting operational expenses for credit processing by 40-60% is yet another notable advantage.

- Credibility of businesses is improved since automated processes generate end-to-end audit trails.

Detailed Analysis and Reporting

- RPA solutions deliver detailed reports and summaries that are essential in analyzing credit risk histories.

- Automatic reporting enables financial institutions to identify trends and monitor portfolio metrics.

- Management is able to view real-time dashboards of important business metrics.

- This situational awareness improves the timely assessment of fixed and variable team efficiencies.

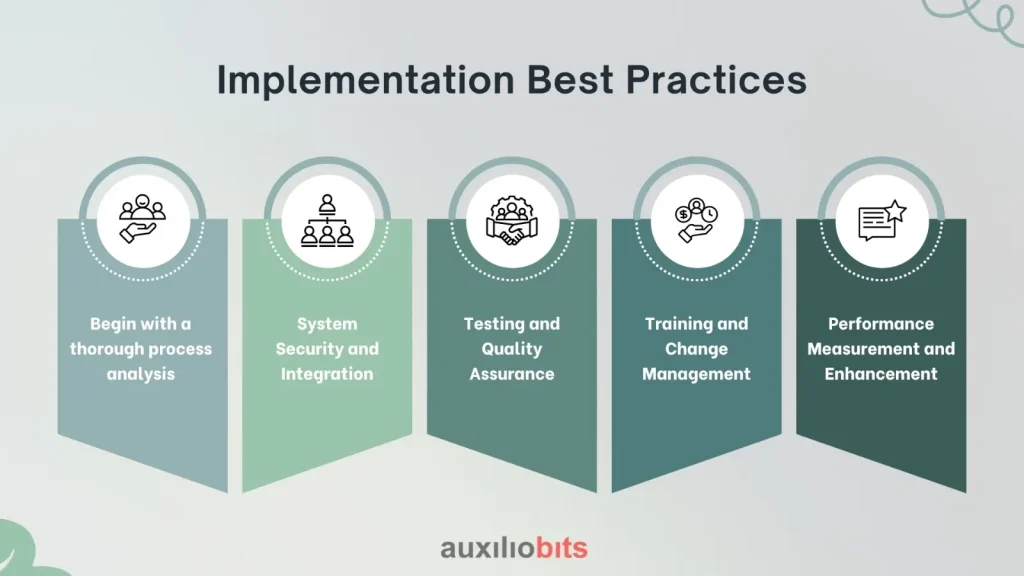

Implementation Best Practices

Effective RPA deployment for credit risk evaluation is all about proper planning and execution.

1. Begin with a thorough process analysis

- Determine opportunities for automation as well as challenges.

- Target processes that are repetitive, rule-based, and high-volume for highest effectiveness.

2. System Security and Integration

- Make it smooth to integrate with the current systems.

- Following industry standards and regulations with regard to data protection is a must.

- Use role-based access controls in conjunction with encryption methodologies.

3. Testing and Quality Assurance

- Implement automation monitoring systems for performance measurement.

- Implement resilience through the design of test cases with different types of applications.

4. Training and Change Management

- Workers need to be trained on handling exceptions that need human intervention.

5. Performance Measurement and Enhancement

- Performance measurement identifies areas to be enhanced.

- Develop and execute critical success factors and key performance factors, and maintain service level agreements.

Next Steps

Get started now and transform your credit risk analysis processes with RPA. Let our automation experts help come up with and implement solutions suited for you.